As we celebrate Independence Day and the spirit of hard work and craftsmanship that built our country, it’s the perfect time to think about strengthening your construction business, so you have the freedom to grow and succeed.

When most contractors consider why they lose clients, they often blame price competition, slow projects, or a client’s unrealistic expectations. But in my experience as a construction bookkeeper, one of the most common—and preventable—reasons contractors lose business is poor invoicing practices.

I know what you might be thinking: “My craftsmanship speaks for itself; invoicing is just paperwork.” But the truth is that invoices are often the last impression you leave on a client. That impression determines whether you get paid promptly, earn a good review, or ever hear from them again.

Read More

Topics:

Invoicing,

Construction Marketing,

Free Invoice Template,

Systems And Processes,

Systems,

finance,

invoices

If your customers owe you money, the faster you can obtain it using effective collection tactics, the better. Ideally, you want to reduce the chance of bad debts and pressure on your construction company's cash flow.

It can be easy to neglect to manage your debtors when you're busy growing your business, but intelligent credit control is important. So it's crucial to have the skills to handle the people who owe you money well, especially if you want to avoid taking them to court.

When negotiating contracts with clients, try to set payment terms that help your cash flow, such as deposits or progress payments. Dealing regular payments for contracts that take months to complete has two purposes: it gives you cash flow to match your expenses and protects you from total loss on a project if the customer goes into liquidation.

Read More

Topics:

Invoicing,

High Profit Repeat Construction Clients,

Contractor Tips,

How To Charge Clients,

Get Paid On Time

Steady, reliable cash flow is crucial for the survival of your construction business – so taking steps to ensure your customers pay promptly is a key priority.

Debtor days refer to the length of time it takes clients, on average, to pay you for the work you've done. A higher number of debtor days means clients take longer to pay you. A lower number of debtor days means clients take less time to pay you, which means there's more cash available for your business to use.

In the construction industry, debtor days can average as long as almost three months. Shortening that length can have a significant impact on your cash flow.

Read More

Topics:

Outsource,

Do What You Do Best And Outsoure The Rest,

Invoicing,

Winning Teams,

Clients,

Contractor Guidance,

contractor delegation

As a Construction Contractor, much of your world is Outside The Box. You make what seems impossible and turn it into a finished product; the whole house remodel, kitchen or bath remodel, new roof, install an attic fan, replace windows, deck, patio, hot tub, swimming pool, children's backyard playhouse.

The Handyman Contractor fixes "Things," which are very important to the clients who need them—fixing a door, hanging a closet rod, moving something, removing something. Compared to a Whole House Remodel, it may seem like you are not doing anything. The reality is that to the person who needed the work done that a few simple little things may change their whole world for the better. Your Work as a Handyman Contractor brings joy to their life. Be Proud of it. No job is insignificant, and no construction business is too small for us.

I want to be the person who says Merry Christmas! You have earned it.

Read More

Topics:

The Contractors Account,

Invoicing,

Cloud Based Bookkeeping Services,

Outsourced Accounting For Contractors,

Systems And Processes,

Construction Company Cash Flow,

QuickBooks Construction Accounting,

accounts receivable for contractors,

Contractor Guidance

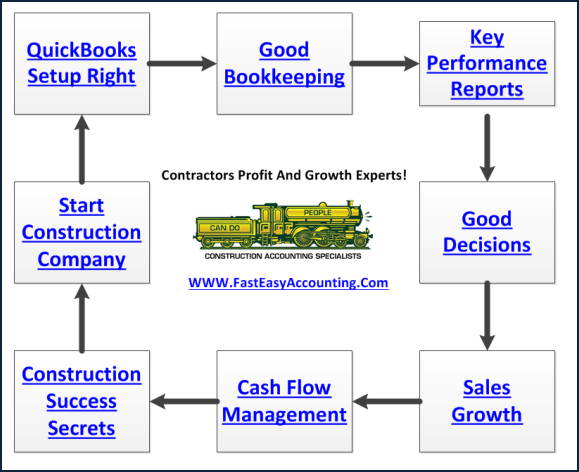

If you've been considering making a move to a cloud-based accounting system, you're not alone. Cloud technology has impacted many business functions, including efficiently managing your business's financial aspects.

Cloud-based accounting moves your accounting from being hosted on your computer's hard drive to an online platform. Cloud-based platforms like QuickBooks and Xero offer important features that save you time and money, freeing you to focus on other essential construction business activities.

Read More

Topics:

The Contractors Account,

Invoicing,

Cloud Based Bookkeeping Services,

Outsourced Accounting For Contractors,

Systems And Processes,

Construction Company Cash Flow,

QuickBooks Construction Accounting,

accounts receivable for contractors

Creating invoices and receipts is vital to successfully running a business. You need receipts to track your purchases and expenses. Your clients need invoices for their tax purposes and to manage their finances. Paper receipts and invoices have been around a long time, so many people are used to them and may even resist moving away from them.

Thanks to technology, paper receipts and invoices are becoming more a thing of the past. There are environmental reasons for the move. Paper invoices require millions of trees and billions of gallons of water to produce, and they emit carbon dioxide (CO2), so going paperless can be a good thing for the environment.

The Old Way Contractors Invoiced the jobs was sometimes just as much or more work than doing the job itself.

Read More

Topics:

The Contractors Account,

Invoicing,

Systems And Processes,

Construction Company Cash Flow,

accounts receivable for contractors

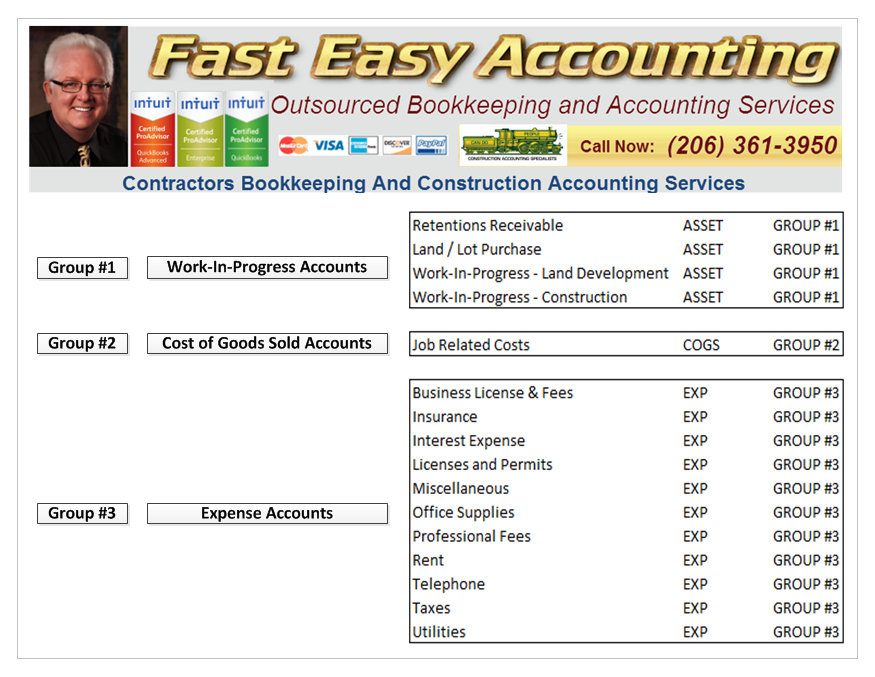

Contractors often ask us if they can buy our Chart Of Accounts with Cost of Goods Sold and import them into their QuickBooks Desktop file or their QuickBooks Online file. The answer is yes!

Click here for QuickBooks Desktop Chart of Accounts with Cost of Goods Sold

Click here for QuickBooks Online Chart of Accounts with Cost of Goods Sold

Direct Costs are tied to the jobs (field labor, material, and other cost items) Office material (pencils, paper, toner, etc. are overhead) Yes, an accountant could say these many pencils are used in the field, and that notepad is used in the truck.

The answer is the dividing line of what the DIRECT COSTS to the job and those are Cost of Goods Sold (COGS).

Read More

Topics:

Invoicing,

We Know Construction Accounting,

QuickBooks For Contractors,

Construction Bookkeeping

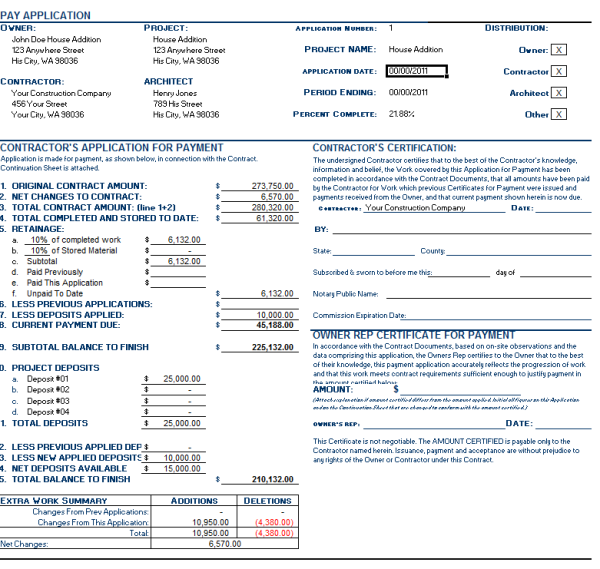

Creating an invoice for the entire project seems like it is the simplest way to track payments and have the current balance. The harsh reality is that if all of the work is NOT done, accounts receivable is reflecting a balance due that is NOT REAL. Without proper tracking and matching of income and expenses, most construction companies never know if they made a profit until the job is over.

However, due to your work’s nature, as construction contractors provide services on a per-job operation, issuing invoices make it all the more challenging and difficult than it has to be. The good news is that it doesn't have to stay that way. Consider the following invoicing errors contractors make and take actionable steps on how to avert them.

Read More

Topics:

Invoicing,

QuickBooks For Contractors,

Construction Bookkeeping,

Payment Applications

We Show You How To Get Paid The Easy Way

All construction problems are related to cash flow or communicationSome construction company owners are gung-ho about doing the work and yet are embarrassed about asking for money.

Read More

Topics:

Pay Applications,

Invoicing,

QuickBooks For Contractors,

Business Process Management For Contractors,

General Contractor,

BPM