QuickBooks Report For Tracking Employee Loans And Advances

When you have employees you sometimes find yourself in the position of needing to help them maintain their focus on doing their job. If an emergency arises between paydays they have several options and here are two of them:

The First Option Is - They get a payday loan from one of the many companies that offer that service.

-

A typical 14-day advance of $100 will cost them roughly $15 which is approximately 391 percent annual interest rate.

-

If they do it regularly it can cause your good employee to get deeper and deeper in debt which means their cash flow problem gets worse not better.

-

When do they visit the payday loan store? If they are paid for travel time to and from the jobsites they will typically do it on your time. See What Is Ten Minutes Costing Your Company and Multiply By Three! Because it will take ten minutes each way to detour to and from the payday advance company plus ten minutes inside the store.

-

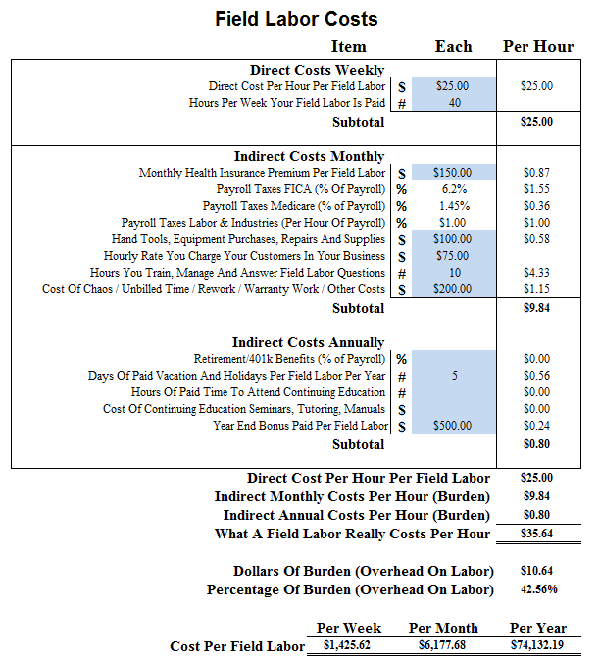

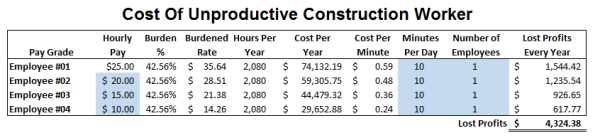

For Example: You pay your employee $25.00 per hour that means Every Ten Minutes Of Doing Personal Business On Company Time Costs You $5.94 Multiplied By Three Equals $17.82. If Your Company Earns 10% Net Profit Then You Need To Sell Another $178.20 Worth Of Work To Make Up The Loss You Suffered. See The Chart Below:

-

Every Ten Minutes Your Construction Worker Costs You $5.94

The Second Option Is - You have a process in your Business Process Management System (BPM) for employee loans or advances, whatever term you use to describe it.

-

Understand the Randalism "You can be right or rich...pick one" If providing employee loans goes against your principles don't do it. If it aligns with your principles do it. There is no right or wrong answer.

-

Never, ever charge interest on the "loan" they will not like it and they will get even.

-

Make it Fast And Easy. Give out cash and have them sign a simple I.O.U. or write a quick note on a piece of paper.

-

Understand that unlike a Promissory Note, where the borrower is in control of making repayments, the employer can control repayments of an employee loan. It is very important for you, the employer, to get written authorization to deduct money from any payroll check. You need to be specific about the reason for deduction; repay cash loan / advance.

The employee loan or debt agreement below also makes provision for the full amount to be deducted should the employee resign. The employer would therefore be wise not to extend loans greater than the weekly / monthly salary. A more extensive agreement should be drawn up for longer term or large loans.

Your labor laws may also limit deductions to a percentage of gross remuneration, so check with your local laws or your attorney before extending credit.

-

We have included a FREE Sample Employee Loan Agreement Below:

-

Check with your attorney or lawyer before using the sample loan agreement

-

Put the paper in the Petty Cash box, give it to your bookkeeper or better yet if we are doing your bookkeeping send it to us or send us an email and we will take care of the paperwork for you.

-

Give cash, do not write a check because they will simply visit the bank, check cashing store and cost you money like in the example above.

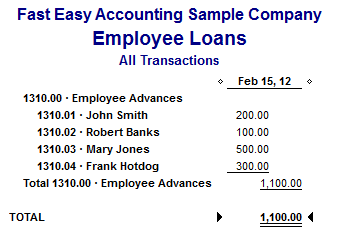

In QuickBooks Setup An Employee Loan Process and the related report to keep track of loans and repayments. The report will appear in QuickBooks as follows:

Now whenever you issue a loan record it in QuickBooks and the report will show an increase in that persons loan account. Whenever a payment is made either through payroll or if they pay it back via cash or check make the appropriate QuickBooks entry and the report will show a decrease in that persons loan account.

Now whenever you issue a loan record it in QuickBooks and the report will show an increase in that persons loan account. Whenever a payment is made either through payroll or if they pay it back via cash or check make the appropriate QuickBooks entry and the report will show a decrease in that persons loan account.

Whenever an employee loan account has a zero balance their name does not appear.

Profitable Construction Companies - Have known about and used this process for a long time and now you can too!

We Can Setup These Reports - On QuickBooks fill out the form on the right, call Sharie 206-361-3950 or email her at sharie@fasteasyaccounting.com

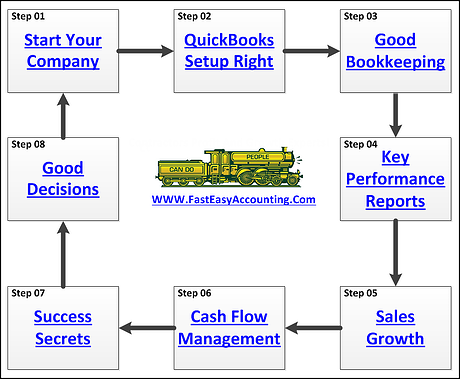

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To Be Wealthy

Because You Bring Value To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.