Quarterly Tax Reports Contractors

Contractors need to file Federal, State and local quarterly tax returns. How often? Most contractors file quarterly tax return every three months and most of them are due by the last day of the month following the end of the quarter.

Are You An Employee of your small business? By that I mean do you take a formal payroll and receive a W-2 at the end of the year?

Depending On Your Company Structure sole proprietor, LLC, Sub-S, or C-Corp you may or may not be an employee. Do you have any other employees? If you are anyone else in your company they need to an employee with regular payroll taxes taken out of each check and you need to send them a W-2 at the end of the year for all payroll and taxes they received from your constuction company.

Your Construction Company Payroll Taxes Are Calculated on gross wages. Federal payroll taxes are paid based on the schedule set up by the Internal Revenue Service. It is normally based on the total payroll liabilities schedule which can be semi-weekly, monthly or quarterly. The 941 quarterly tax return payroll tax reports are due on a quarterly basis, including no payroll quarter tax return. All outstanding payroll liabilities must be paid by the due date of the quarterly tax return.

The Amounts Declared on your 941 quarterly tax return and your annual 940 tax return (Federal Unemployment) and the year-end W-2’s all need to match each other. Otherwise you could send a red flag that may trigger an audit.

Things Have Changed because now the IRS has can request a copy of your QuickBooks file for an intense review. Now more than ever you need to be sure your QuickBooks setup is right and your contractors bookkeeping system is clean and easy to understand. This is one area where a Bad Bookkeeping can cost you and your company a ton of money in back taxes, fines and penalties.

Contractors Need To Be especially Careful about hiring “1099 Employees” because any "non-employees" need to be properly licensed and in a legitimate business for themselves. Otherwise they should be an employee of another company. Any Casual Labor needs can be met by using “temp service” like Madden Industrial Craftsman or Labor Ready and as part of their fees it covers the cost of their employee quarterly tax return and payroll tax filings.

Most States Have Online Databases to check on the status of a business by company name or owner’s name. You need to be aware that State and Federal government agencies talk to one another. Most states have employers fill out a “New Hire” form to notify the State of the location of new employees.

Most States Will Review their records for “Outstanding Child Support” liabilities. This database is linked to all 50 states and Tribal Agencies. It is important for business owners not to get into a position where they will be forced to assume the financial liability for some or all of your employee's children due to issues regarding payments due to the state agencies.

State Taxes every employee triggers some form of state payroll taxes. Most common State tax is “Unemployment Insurance” and “Worker’s Compensation” (Labor & Industries in Washington State). Each state determines how they handle taxes; some require an insurance policy / larger companies may “self-insure”. Each Quarterly tax report will show both gross wages and total employee hours worked. Note – Your liability insurance audit may also request these reports to determine your risk factor and calculate your company’s rate.

Washington State – Administers the state payroll taxes, sets the rates and collects the taxes. Washington State Employment Security Department is the agency for state unemployment insurance. This is mandatory if you have employees. As the owner of your company you can “OPT” out the state unemployment insurance program. All payrolls are taxed at the state level receives a credit against the 940 federal unemployment insurance. Both Federal and State unemployment insurance is based on gross wages. When you have an active employer account quarterly tax return needs to be filed quarterly (including no payroll quarterly tax return)

Washington Department of Labor & Industries (L&I) has multiple roles and it gets a little confusing for new businesses. It is commonly known as Labor & Industries or L&I. License renewals and quarterly reports can be filed and paid online. Whenever a business is paying by check, REVIEW the mailing address and send to proper location. Each department has its own mailing address; transferring between locations can take weeks. Example Contractor’s renewals and quarterly tax return reports go to different cities. At first glance Master Business License and Contractors License annual renewals can appear to be one in the same – It’s not!

Why is that a big deal? Whether it is your business license or contractor’s license clients may refuse to work with you unless your status is “Open” or “Active.” Your material supplier may cut off your credit, require cash only until corrected, refuse to sell to you, sell at retail rates (manufacturers list) and since it is at retail they are required to add local sales tax. It is worth the hassle to get it corrected?

Washington State Labor & Industries Oversees License Compliance For Contractor’s licenses and individual license tied to the construction trades like plumbers, electricians, HVAC workers that must have personal licenses with continuing education requirements. Labor & Industries makes it easy to check online the status of a business that is required to have a contractor’s license by company name or owner’s name. This is to assure the public that they are hiring a legitimate building or specialty contractor who obtained a bond and liability insurance as part of the State of Washington State contractor's licensing requirements.

Washington State Labor & Industries Oversees Worker's Compensation Insurance. To check on any other type of company to check on their work a phone call to Labor & Industries is required. Every employee job description has a risk classification code and a composite rate to be paid by the company based on employee hours worked. At the employer’s option a small portion can be deducted from employee’s payroll based on the specific rate set by Labor & Industries. The higher the rate the more likely employer will capture the deduction each payroll to offset company payroll liabilities. When you have an active employer account your labor and industries quarterly tax return needs to be filed quarterly (including no payroll quarterly tax return).

Washington Is One Of Several States where premium is based on hours and administered by the State. Other states have a rider on their liability insurance with specific language for the coverage. (Note: Not all carriers offer the approved coverage and may write a rider they “think” will work)

Many Cities Have Separate Business Licenses and may require businesses to file a quarterly tax return or annual reports and pay a Business & Occupation Tax. It may be an annual Flat Fee based on number of employee. It is common for a city to also have a quarterly tax report (business and occupation tax) based on gross sales of services (wholesale / retail / service) performed in their city. Some cities are assessing an additional flat tax based on number of Full-Time Employees (FTE).

Cities Receive Reports From The State showing the local taxes paid to the state revenue agencies. Amount reported to the city should match what was reported to the state (business and occupation / sales tax reports / quarterly tax return). Each state determines when a sale becomes income, if it is subject to sales tax, business & occupation tax and other taxes. States are always looking for ways to increase their revenue base.

If You Are You Still Using the IRS Tax Guide We recommend using a payroll subscription to properly calculate payroll, create payroll reports and quarterly tax return. Employers with multi-state payroll needs should use a dedicated payroll service. They are payroll specialists who have staff to keep track or changes and updates on a state by state basis. As more state budgets are under pressure streamline their services more forms are available online and the state agency expects you the employer to know what form you need, when you need it, where to find it, how to fill it out properly and where to send it.

Having Processed Payrolls In Washington State for over thirty years we understand their guidelines very well and I know who and where to call when the process gets “wacky”.

If You Are Interested We Offer Cloud Based Bookkeeping Services and it is a wonderful alternative to having everything on your desktop or notebook computer. Electronic tax reporting forms can be quick and easy to fill out if you know what you are doing, if not we can help.

You Still Need A Way To Prove that you sent the quarterly tax forms to the appropriate tax agencies and you need to make sure you can prove you sent it AND paid the business tax liability. I still use my printer, toner and paper as needed and suggest you do too! Have a great day!

Fill Out The Form And Get The Help You Need!

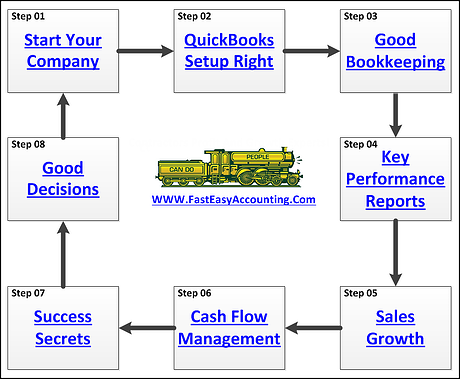

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in you QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To

Be Wealthy Because You Bring Value

To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your

Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+