We Remove Contractor's Unique Paperwork Frustrations

Why Bookkeepers Steal And Embezzle

“A recent study found that business school education not only fails to improve the moral character of the students, it weakens it. ..students were asked, if given a chance of being caught and sent to prison, they would attempt an illegal act that would net them a profit of more than $100,000; more than one-third responded ‘yes’."

Bad Bookkeeper embezzlement stems from a feeling of entitlement and the need to get even. Listed below are some of the reasons bookkeepers have used to explain why they did it:

#01 “I’m really not 100 percent sure why I did it. I’ve been thinking about that the last two-plus years.”

#02 "I hate bookkeeping, anyway."

#03 "I could use $10,000 to put a little spice in my life.'”

#04 "I am not getting a fair share at work."

#05 "They owe it to me because I am the one doing all the work around here."

#06 “I’ve made a lot of mistakes and now I’m forced to answer to them.”

#07 "I was getting a divorce and needed to amass legal fees for the divorce and the related child custody battle."

#08 "In the beginning I took a little money but when it wasn't discovered I kept doing it because I enjoyed a lavish lifestyle."

#09 "Everybody does it"

#10 "I needed a new car and in fact I deserved it!"

It is estimated the number of bookkeepers that are caught embezzling from contractors are less than one percent of the total. In most cases the ones that are caught are rarely convicted because all too often it is the contractor who has to spend thousands of dollars on forensic accountants and attorneys to prove the theft occurred.

In most cases it is near impossible to persuade the authorities to prosecute when a contractor bookkeeper embezzles because it is often viewed as a "Victimless Crime".

In most cases an in house construction bookkeeper starts out with good intentions and over a course of time they become complacent and jealous of the lifestyle the see the contractor enjoying.

Unfortunately they rarely experience life on a construction site, but are kept inside a climate controlled, clean office with good lighting, real restrooms, beverages and a relatively quiet environment.

For a small construction company there are simple steps you can take to help prevent embezzlement:

-

The Owner Signs All Checks - Nobody else ever signs any checks. It is O.K. if your bookkeeper prints the checks, just make sure the owner signs them.

-

Three Separate Checking Accounts - One for your main operating funds, one for payroll with just over enough to clear all outstanding payroll checks and one for the owner's debit card purchases.

-

The Owner Inputs The PIN - For all payroll or payroll tax deposits. Letting your contractors bookkeeper be responsible for payroll or payroll tax deposits is like giving them keys to the kingdom and saying "Take whatever you want".

-

No Company Credit Cards - Let employees make purchases as needed for company expenses and be reimbursed.

-

Every Employee Needs Time Off - Any employee that does not want to take a holiday or a vacation may appear loyal, but there could be another reason. It is wise to check each employee's work when he/she is gone.

-

Never Let Anyone Take Work Home - You could get in trouble for not paying overtime and there is too many opportunities for copying your company files, customer or client lists and selling them with your competition.

-

Make Bank Deposits Every Day - Rain or shine busy or not. Photocopy and scan all checks and bank deposit slips and upload them to your paperless server.

-

QuickBooks Backup Copy Every Day - QuickBooks has a built-in feature that will do it automatically and there are a number of other services you can use as well. Never let the bookkeeper take a backup copy of your QuickBooks out of the office for any reason. Doing so will make it easier for them to embezzle and harder for you to claim your innocence.

-

Petty Cash - If you have a cash drawer, balance it every day the same way as a bank account. Bookkeepers who develop the habit of embezzling usually start with taking small amounts, often from petty cash. Keeping track of small amounts of money can help keep large amounts of money from disappearing.

-

Keep Blank Checks In A Safe - Most office supply stores sell small safes for under $150.00 and it is money well spent. All it does is slow down and deter the bad bookkeeper.

-

Bank And Credit Card Statements - Need to be mailed to a post office box or the home of the construction company owner and opened by them. Never let the bookkeeper open any bank and credit card statements.

-

Owners Need To Verify - All check numbers, including voided ones.

-

Check References Before You Hire - And do a search on convictions (not charges).

-

Review Your Key Performance Indicators (KPI) - Every day as an internal-control check and watch for unexplained changes in the balances.

-

Don’t hesitate to call the police - If you suspect your bookkeeper is stealing. Waiting can only make it more difficult for the police and they may get the idea you are O.K. with it which could make it harder to prosecute the offender.

There is a lot of work here but it could save you thousands if not hundreds of thousands of dollars. One of the best ways to limit your exposure to bookkeeper embezzlement is to outsource your contractors bookkeeping services to us because we handle all of the construction bookkeeping services chores and WE NEVER TOUCH YOUR MONEY!

To discover how we help you limit and avoid most bookkeeper embezzlement please go to www.FastEasyAccounting.com/cbs. Just as it is impossible for you to be 100% safe all of the time in life, there is no way to eliminate 100% of the embezzlement in your contracting company. However, with the right preventative measures you can limit your losses and avoid most of it.

Learn How We Do It By Clicking HereLearn How We Do It By Clicking Here

Need A Mentor? - Someone who has been were you want to go and can guide you. We would like to be that person for you. Fill out the form on the right or call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

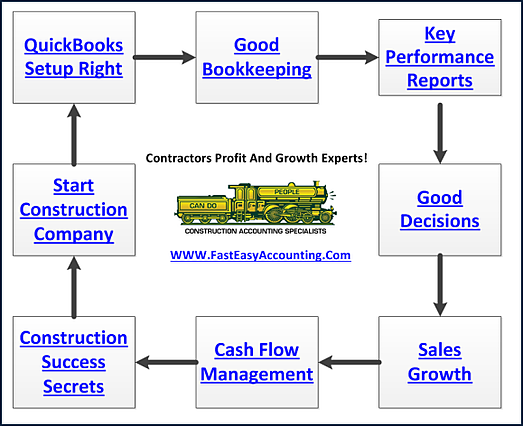

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie

206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are QuickBooks Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.