Using QuickBooks For Multiple Construction Company Files

Since The Early 2000's More Construction Company Owners Have needed two or more incomes. We have met with contractors from several groups:

Group One - Skilled Craftsman or Craftswoman is trying to grow a construction company while their spouse or significant other has a job with another company usually unrelated to construction. Today it is more common to see both partners are self-employed and operating a Construction Company.

Construction Companies And Other Businesses Owned By - Related business partners and business types can be merged into a single QuickBooks file and that always causes all kinds of trouble!

When The Individual Household Partners - File their annual tax return jointly the tax prepare who files the annual Income Tax Return looks at all the business and personal financial reports and is the final authority on what can and cannot be merged together on a single tax return.

Most Tax Returns Are Several Dozen Pages Long - With much of the information duplicated on both the personal and business returns which is why we recommend you hire someone who specializes in preparing annual tax returns NOT A Jack-Of-All-Accounting-Trades-Master-Of-None. We do not prepare annual tax returns; we do process Payroll and prepare Quarterly Tax Reports.

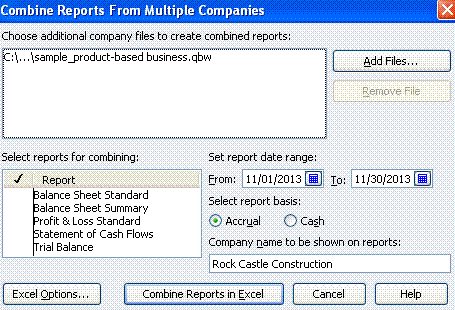

Why Do We Believe Strongly That You Need Individual QuickBooks Company Files?

Read More