Building On Solid Ground: Your Construction Bookkeeping Foundation

Posted by Sharie DeHart on Fri, Jul 05, 2024

Topics: Bookkeeping For Electrical Contractors, Bookkeeping For Commercial Tenant Improvement Cont, Bookkeeping For Custom Home Builders, Bookkeeping For Remodel Contractors, Bookkeeping Needs, Bookkeeping For Plumbing Contractors, Bookkeeping, Construction Bookkeeping, Systems, Construction Systems And Processes

Why Banks Won't Lend Money To Your Construction Business

Posted by Sharie DeHart on Fri, Oct 06, 2023

Getting approved for a business loan or line of credit is more complicated than qualifying for a personal loan. Small construction business owners must be adequately prepared to meet with a lender to present their business in the best possible light and ready for the money they need.

Think of all the times:

- You loaned money to a friend or relative

- Provided labor and materials for somebody's home or business without a deposit check

- Did change order work that you never got paid for doing and never will

- Gave a subcontractor/employee an advance on their paycheck, and you never got paid back

Multiply that by 100,000, and you will understand why banks seem so tight-fisted about loaning money.

Topics: Cash Flow, Bookkeeping, Contractor Cash Flow Problems, Financing Secrets Revealed, Banking

Better Practices For Managing And Maintaining Your Business Cash Flow

Posted by Sharie DeHart on Fri, Sep 29, 2023

Topics: Cash Flow, Bookkeeping, Contractor Cash Flow Problems, QuickBooks Construction Accounting, Improve Construction Cash Flow

What Is A Fractional CFO And How Can It Help Your Construction Business?

Posted by Sharie DeHart on Fri, Sep 22, 2023

Topics: Bookkeeping, Outsourced Accounting, QuickBooks Construction Accounting, Fractional Construction CFO, Construction Chief Financial Officer

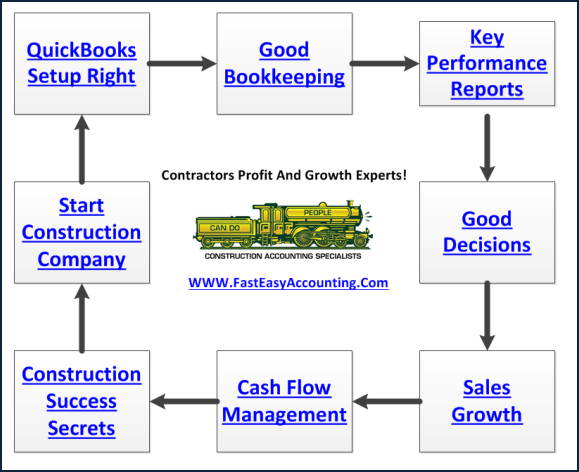

The Value Of Documenting Effective Construction Business Systems

Posted by Sharie DeHart on Fri, Sep 15, 2023

Topics: Bookkeeping, Outsourced Accounting, QuickBooks Construction Accounting, QuickBooks Do-It-Yourself construction Bookkeeping, Construction Accounting Academy

Topics: Bookkeeping, Outsourced Accounting, QuickBooks Construction Accounting, QuickBooks Do-It-Yourself construction Bookkeeping, Construction Accounting Academy

Bad Bookkeepers Have 38 Traits In Common

It is important to understand the difference between Professional Bookkeepers, Regular Bookkeepers and Bad Bookkeepers.

- Professional Bookkeepers invested the minimum of 10,000 hours that it takes to master the profession. And they continue to learn, and educate themselves with formal and informal class room training, seminars, webinars and related tools

- Regular Bookkeepers learned most if not everything they know about bookkeeping by experience and by letting you pay for their education in the form of excess taxes, fines, penalties, un-invoiced work, overpaying bills and late fees. It is painful for them and you. They have good intentions and do not want to cause contractors any grief and they are sincere with their apologies. Of the thousands of Regular Bookkeepers I have met they all have good hearts and really do mean well.

- Bad Bookkeepers also learned most if not everything they know about bookkeeping by experience and by letting you pay for their education in the form of excess taxes, fines, penalties, un-invoiced work, overpaying bills and late fees. It is painful for you but not for them. They have bad intentions and will cause contractors as much grief as possible and are quick to blame everyone else when something goes wrong. Of the dozens of Bad Bookkeepers I have met they all have a bad opinion of contractors and business in general.

On to the 38 traits

Read MoreTopics: Bad Bookkeepers, Professional Bookkeepers, Bookkeeping, Construction Bookkeeping, Bookkeeper

Topics: Meet Your New Bookkeeper, Professional Bookkeeper, Contractors Bookkeeping, Bookkeeping, Bookkeeping Services, QuickBooks For Contractors, Construction Bookkeeping, QuickBooks, Desktop QuickBooks Online, Bookkeeper

Topics: Construction, Construction Strategy, Bookkeeping, Bookkeeping Services, Strategic Planning, Construction Accounting, Systems And Processes, MAP vs. PAM, General Contractor, 80 20 Rule

Why Professional Bookkeepers Cost Less Than Bad Bookkeepers

Posted by Randal DeHart on Wed, Sep 14, 2011

The First Thing You Need To Know Is Bad Bookkeepers Have A Code Of Misconduct:

Rule #1 - Work expands to fill the time allowed for it or the outer edge of what business owner will tolerate

Topics: Bad Bookkeepers, Cheap Bookkeepers, Professional Bookkeepers, Seattle, Bookkeeping, Bookkeeping Services, QuickBooks For Contractors, Construction Accounting, Construction Bookkeeping And Accounting, QuickBooks, contractors bookkeeping and accounting, Accounting, Bookkeeper, QuickBooks Setup