How Smart Money Management Keeps Your Business Profitable and Stress-Free

When most small construction business owners think about success, they envision a steady stream of jobs, high-quality work, and satisfied clients. But there’s another side to the story that often gets ignored: the financial health of your business.

And here’s the truth we see every day as construction bookkeeping specialists: Even skilled contractors with full calendars can run into cash flow problems, tax stress, or profit shortfalls—not because of the work, but because of the numbers.

That’s where Pillar 2: Controlling the Money comes in. In this post, we’ll talk about how to take control of your finances through simple, construction-friendly accounting practices—so you can stop guessing and start growing.

Read More

Topics:

Construction Bookkeeping,

Construction Accounting,

Construction Bookkeeping And Accounting,

Systems And Processes,

MAP vs. PAM,

Accounting,

Construction Consulting For Small Contractors,

Systems

Change is inevitable in any business, but it's rarely easy—especially when managing morale. Significant transitions can leave employees feeling uncertain, disengaged, or even overwhelmed, whether you're restructuring your team, implementing new processes, or pivoting your business strategy.

As a small business owner, you probably ask yourself, "How can I guide my team through this while maintaining morale?" You're in the right place. Maintaining high morale within a construction team is crucial for productivity and overall job satisfaction. The construction industry can be challenging, with tight deadlines, physical demands, and unpredictable work environments. Supporting and motivating your team is essential.

Read More

Topics:

Construction Bookkeeping,

Systems And Processes,

Winning Teams,

Construction Systems And Processes,

Boost Construction Profitability,

Construction Team

Did you know that 39% of projects fail due to budget issues? For small businesses and entrepreneurs, the stakes couldn’t be higher. Managing a project budget is not just about numbers; it’s about ensuring your business is profitable. By understanding the essential steps of project budgeting, you can turn potential pitfalls into opportunities for success. Whether launching a new service or expanding your services, mastering project budgeting is invaluable for achieving your construction business goals.

Understanding Project Budgeting

Project budgeting is a crucial component of successful project management. At its core, a project budget is the total estimated cost of all the tasks, activities, and materials associated with a project. It serves as a roadmap for project managers, offering a framework for allocating resources and tracking expenses throughout the project lifecycle.

Budgeting is essential for several reasons. A well-prepared budget helps control costs, ensuring that project expenditures don’t exceed available funds. It also improves resource allocation by identifying potential bottlenecks and enabling more informed decision-making. Additionally, effective budgeting aids in risk management by setting aside contingency funds to cover unforeseen expenses, thereby reducing the likelihood of project failure.

Read More

Topics:

Construction Bookkeeping,

Systems And Processes,

Construction Project Managment,

Bookkeeper,

Project Management,

Construction Systems And Processes,

Construction Bookkeeper,

Project Budgeting

If you ask 100 business owners what they like least about running a business, bookkeeping will likely rank high. It's an annoying and frustrating chore that takes up much time and is easy to put off until tomorrow.

Avoiding your bookkeeping is dangerous, however. Not knowing your construction company's financial situation can result in missteps that could ultimately cost you your business.

When starting bookkeeping as a construction business owner is challenging, a good first step is to break the process down into manageable tasks.

Read More

Topics:

10000 Hours of Bookkeeping Practice,

Construction Bookkeeping,

Systems And Processes,

Bookkeeper,

Construction Systems And Processes,

Construction Bookkeeper

It's amazing how some books stand the test of time. We usually refer to one of our most recommended, Stephen Covey's The 7 Habits of Highly Effective People, when we mentor our contractor clients and employees. Although it was first published three decades ago, its lessons are still incredibly relevant for business owners. You might wonder – how these habits fit into today's landscape of changing trends, tight deadlines, and constant distractions. The short answer is that they're timeless because they focus on principles that help you stay grounded while growing your construction business.

Below, we'll break down some of Covey's key habits and explore how you can bring them to life in your business today. Think of this as your blueprint for thriving in the chaos, not just surviving it.

Read More

Topics:

Construction Bookkeeping,

Systems And Processes,

Reading List,

Construction Systems And Processes,

contractor habits,

Good Construction Business Owner Habits

As a construction business owner, you must stay informed about your finances and financial situation. You do this through bookkeeping, the process of recording transactions in your business. This includes transactions, credit card charges, and any other economic activity within your company.

Financial management can easily be overlooked when managing projects, dealing with subcontractors, and ensuring customer satisfaction. However, neglecting proper bookkeeping can significantly impact the growth and success of your construction business.

Read More

Topics:

Bookkeeping For Electrical Contractors,

Bookkeeping For Commercial Tenant Improvement Cont,

Bookkeeping For Custom Home Builders,

Bookkeeping For Remodel Contractors,

Bookkeeping Needs,

Bookkeeping For Plumbing Contractors,

Bookkeeping,

Construction Bookkeeping,

Systems,

Construction Systems And Processes

Managing a hectic schedule and complex projects can be challenging if you're a contractor. You must also ensure that your paperwork, documents, and contracts are in order. It's essential to keep a paper trail of your work and practice due diligence.

Keeping all your working documents in order shows that you treat your business, customers, and subcontractors responsibly. This is a mark of professionalism and can also help if you have an insurance or legal claim.

Contractor paperwork documentation and procedures

You should develop documentation and record-keeping procedures appropriate for your contracting operation or service if necessary. Once procedures are in place, it is equally important to ensure everyone understands and follows them.

Read More

Topics:

Construction Bookkeeping,

Construction Bookkeeping And Accounting,

Bookkeeper,

contractor bookeeping services,

Contractor Guidance

As a small business owner, you know that managing your finances is crucial to the success of your business. But with so many accounting principles and practices, it can be challenging to know where to start. That's where we come in! This guide will break down the essential accounting principles that every small construction business owner should know. We'll discuss how these principles can help you keep track of financial transactions, create accurate financial statements, and make informed decisions for your business. So, let's dive in, shall we?

Why Are Accounting Principles Important for Construction Businesses?

Accounting principles are the foundation for any successful business. They provide a uniform framework for recording and reporting financial transactions, ensuring consistency and accuracy in your financial records. By adhering to these principles, you'll be able to:

- Make better financial decisions based on accurate and reliable data

- Monitor your business's performance and identify areas for improvement

- Meet legal and regulatory requirements for financial reporting

- Build trust with investors, lenders, and other stakeholders

Read More

Topics:

Construction Bookkeeping,

Construction Accounting,

outsourced construction accounting and bookkeeping,

Cost of Goods Sold Vs. Expense,

Job Costing,

COGS

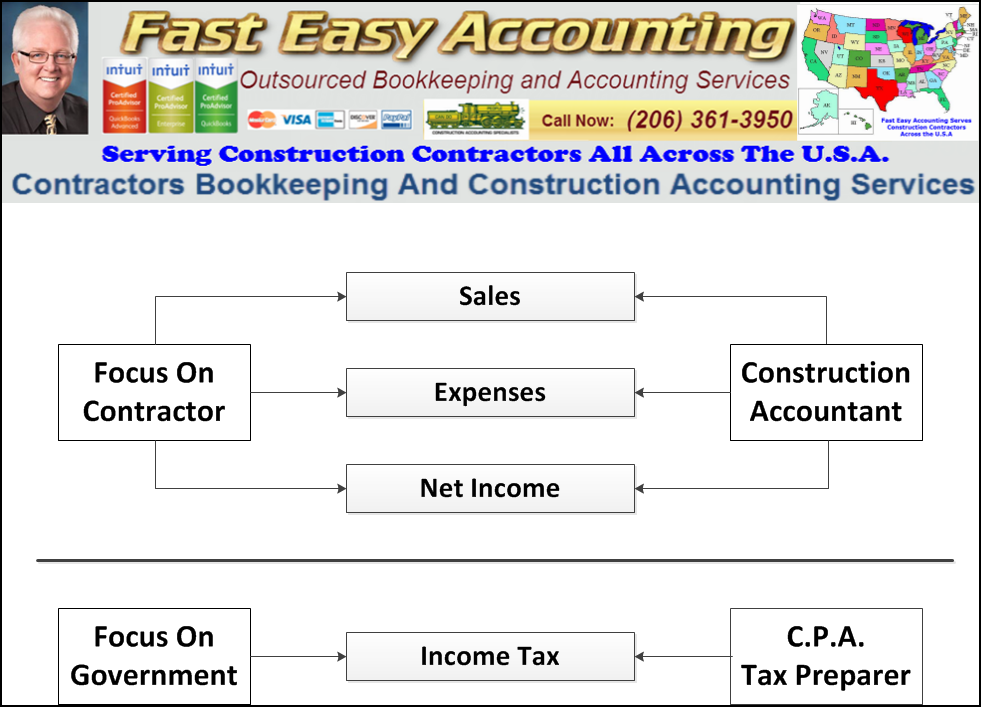

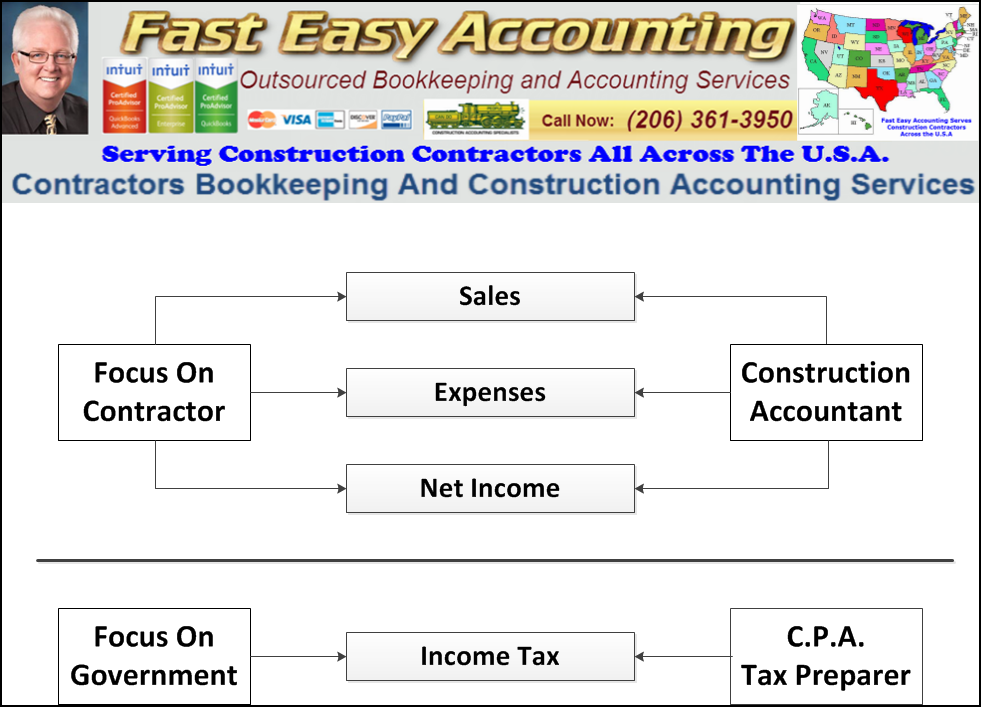

How often have you hired someone with the expectation that they know how construction works, and then you found out they did not know about it? You are a master in the construction industry, so you recognize what to look for in your particular field and quickly observe if someone has the skillsets, and you proceed accordingly.

You know what happens when you send your best Rough Carpenter that you pay piece work for framing spec from the ground up in all kinds of weather and working conditions to install some custom-made cherry wood cabinets with gold plated pulls and knobs in the home of your best client (who happens to be in the wealthiest neighborhood in your town). It is not a pretty sight.

Have you pictured a crew with muddy work gear and boots stepping onto your client's pristine floors? The dirty secret is that Tax Accountants operate like Rough Carpenters because they work fast and furious, and they are paid piece work. The main difference is that they earn the bulk of their annual income in three and a half months. This means they do not waste any time going through your receipts to ensure you get all the deductions you are entitled to.

Read More

Topics:

CPA Vs Construction Accountant,

When Contractors Need A CPA,

Construction Bookkeeping,

Construction Bookkeeping And Accounting,

Construction Accountant Who Listens,

CPA,

Contractor Tips

Small business owners spend an average of eight hours monthly performing payroll functions. That's 12 business days a year that could be spent generating sales, prospecting new business opportunities, improving products or services, or servicing customers.

Upgrading or changing your payroll system comes with a ton of attractive benefits. Saving time and money, making everyone's account more manageable, and better integration are all excellent reasons to consider a change.

But if the switch is mishandled, the results can be catastrophic and lead to long-lasting problems. Read on for tips on avoiding a disastrous payroll system migration.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

Business Process Management For Contractors,

Construction Project Managers,

Construction Project Managment,

Project Management,

Project Management For Construction