Practical Tax Season Tips For Construction Business Owners

Posted by Sharie DeHart on Fri, Jan 12, 2024

Topics: How To Lower Your Tax Bill, Save Money On Income Taxes, Sales Tax, Tax Accountants, Reduce Taxes, Taxes, Contractor Tips

Secret To Highly Profitable Contractor Is The Construction Accountant

Posted by Sharie DeHart on Fri, Aug 11, 2017

Contractors Need Help Understanding Role of Accountants

Contractors should have two primary accountants. One is the Tax Accountant the other is your Construction Accountant. Tax Accountant who does the Annual tax return for your business and your personal tax return.

Read MoreTopics: Construction Accountant Who Listens, Tax Accountants

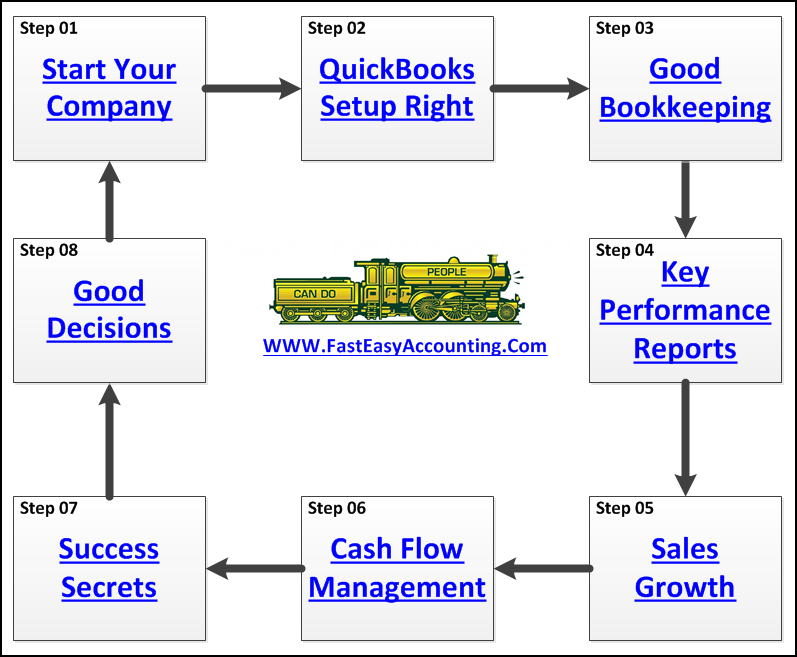

Annual Taxes And Job Costing From The View Of The Contractor

Posted by Sharie DeHart on Fri, Sep 09, 2016

The First Question You May Ask Yourself Is

Why Doesn’t My Tax Accountant Help Me With Job Costing?

They are Tax Accountants, not Construction Accountants and may not know the answers. You may think they are just keeping it a secret. Sometimes you may think they don’t know what they are doing, and maybe I need to get a new tax accountant.

My Advice is Stop, take a deep breath. Is your tax accountant doing a good job with your annual taxes? If the answer is YES. Please keep them, they are doing what they are supposed to do.

Topics: Job Costing Reports, Annual Tax Return, Tax Accountants, Taxes

Why You Need To Keep Bookkeeping And Tax Preparation Separate

Posted by Randal DeHart on Thu, Feb 23, 2012

Topics: Annual Tax Return, Tax Accountants, IRS Audit Of QuickBooks

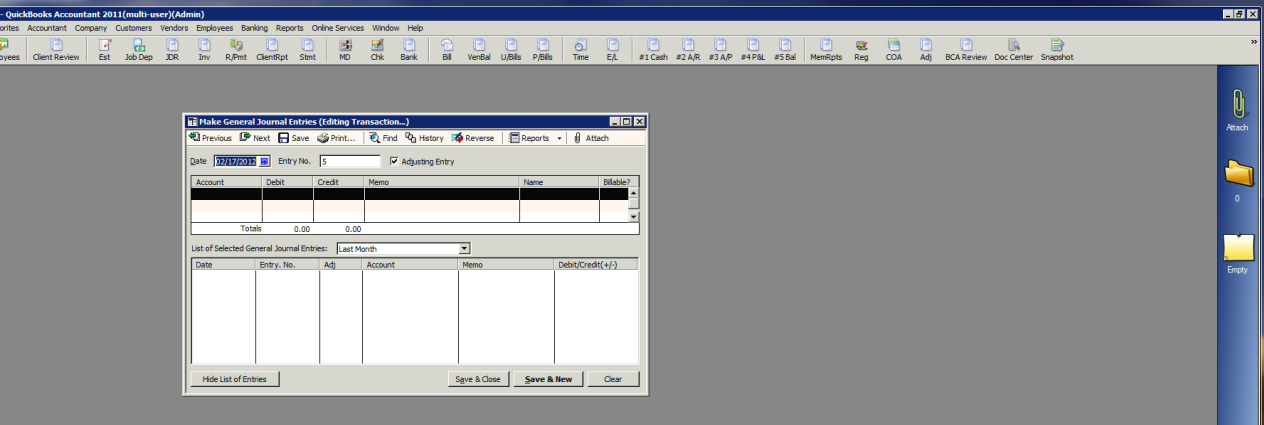

Year End QuickBooks Journal Entries From Your Tax Accountant

Posted by Randal DeHart on Fri, Feb 17, 2012

It Is Tax Time Again - And if your tax preparer sends you a bunch of "Journal Entries" for your QuickBooks call Sharie 206-361-3950 or email her Sharie@FastEasyAccounting.com and we can help you with it.

Topics: Construction Bookkeeping, contractors bookkeeping and accounting, Tax Accountants, Journal Entries