The power of effective bookkeeping using QuickBooks Desktop - plus an Important Update from Intuit.

Keeping track of sales, earnings, expenses, and purchases is fundamental to your construction business's overall health and sustainability. Effective bookkeeping produces the data you need to evaluate your current practices, anticipate challenges, and set attainable future goals.

Many business owners dread bookkeeping and accounting tasks despite their proven importance. In fact, 40% of surveyed entrepreneurs claim that bookkeeping is one of the worst parts of running a business!

Is it worth the aggravation?

Read More

Topics:

QuickBooks For Contractors,

QuickBooks Desktop Cloud,

quickboooks setup, QuickBooks Features Contractors,

quicbooks,

Contractor Guidance

Small business owners spend an average of eight hours monthly performing payroll functions. That's 12 business days a year that could be spent generating sales, prospecting new business opportunities, improving products or services, or servicing customers.

Upgrading or changing your payroll system comes with a ton of attractive benefits. Saving time and money, making everyone's account more manageable, and better integration are all excellent reasons to consider a change.

But if the switch is mishandled, the results can be catastrophic and lead to long-lasting problems. Read on for tips on avoiding a disastrous payroll system migration.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

Business Process Management For Contractors,

Construction Project Managers,

Construction Project Managment,

Project Management,

Project Management For Construction

In the past, Construction Project Managers were laborers or served an apprenticeship in one of the skilled construction trades and were promoted to foreman. This meant many people were more comfortable in manual labor without management skills. And when "things" were put in charge of "people," the results were not usually favorable.

Because of this, many construction companies failed and went out of business due to the Cost of Chaos in their businesses. And it is still happening today.

In the late 20th century, construction and construction management were separated into individual disciplines, each with its methodologies, terms, and definitions.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

Business Process Management For Contractors,

Construction Project Managers,

Construction Project Managment,

Project Management,

Project Management For Construction

Employees need to fill out timecards. The most practical reason is that all employees want to get paid, early, often, and regularly.

For those of you that are parents, do you remember when you brought home your newborn baby? They need food, water and diaper changed. You learned all about "Goldilocks and the Three Bears" Some children who are born on a HOT summer day seem to get "overheated" quickly and do not suffer quietly.

If you have employees, you may notice in some similarities to raising children because in some cases you the contractor take over where your employee's parents left off. They want their paychecks (allowance) on a regular basis, and it had better not bounce at the bank due to insufficient funds.

If any of your construction worker's paychecks do happen to bounce or they are not able to cash it at the bank because your construction company does not have enough money in the payroll account then most likely you will find whatever tools and equipment they have easy access to at the nearest pawn shop.

Read More

Topics:

Time Cards,

Contractors Bookkeeping Paperwork,

Time Card Issues,

QuickBooks For Contractors,

Construction Bookkeeping,

Painless Paperless Contractor Bookkeeping Services

Running a business for general contractors like you is an overwhelming yet fulfilling task because there are so many things only the company owner can and should do. In most cases, when the owner's spouse contacts us, it is because they are trying to help with the business, but they know they need outside assistance, so there is more quality time with the family.

Most contractors, and small business owners, in general, haven’t realized that what you don’t know can keep you up at night. Instead of focusing your efforts in maintaining your relationship with your past clients and building a new one, you were up wondering whether you’re making or losing money. Today more than ever, it is necessary to have a properly set-up accounting and bookkeeping file and maintain it. Someone with the knowledge and training combined with an understanding of construction to Set-Up, Clean-Up, Tidy-Up, and manage your bookkeeping system.

Read More

Topics:

Contractors Bookkeeping Paperwork,

QuickBooks For Contractors,

Construction Bookkeeping,

QuickBooks Setup Do It Yourself,

QuickBooks Construction Accounting,

Assisted Do-It-Yourself Contractor Bookkeeping,

Painless Paperless Contractor Bookkeeping Services

In Construction, hiring Independent Contractors can get very expensive, very fast!

The Internal Revenue has a defined set of rules on what is the difference between an "Independent Contractor" and "Employee". With all the documentation in place, a person could still be classified in the eyes of the Internal Revenue Service as an "Employee."

When you hire 1099 contractors

You need to know that their state contractor's license, bond, and insurance are active. During audits, state agencies are now looking to check the bond and insurance. Anytime a contractor's license is suspended, the State may reclassify that person as an employee on your job.

Because all fifty states are working with other agencies looking to be sure employee rights are covered, and the state, local and federal payroll taxes are paid. As an employer among your responsibilities are these:

-

Pay workers’ compensation

-

Meet wage and hour requirements

-

Pay unemployment tax

-

Maintain a safe workplace

Read More

Topics:

Contractors Bookkeeping Paperwork,

Subcontractor 1099,

QuickBooks For Contractors,

Construction Bookkeeping,

QuickBooks Construction Accounting,

Taxes

The calls, emails, messages, and walk-ins that our company deal with every day come from construction contractors, spouses or significant other, construction bookkeepers, advisors, students, and financial planners among others. I do my best to offer support even if it does not lead to an immediate request for our services.

The pressures of running a construction company are tremendous. Incoming money is usually unknown, but expenses and bills are due now. You are not alone; many contractors feel the same way. Owning a construction company is so much different from just working for another construction contractor, and in most cases, new contractors had no idea what is involved in the business end of the operation before they started.

Read More

Topics:

Contractors Bookkeeping Paperwork,

QuickBooks For Contractors,

Construction Bookkeeping,

QuickBooks Setup Do It Yourself,

QuickBooks Construction Accounting,

Assisted Do-It-Yourself Contractor Bookkeeping,

Painless Paperless Contractor Bookkeeping Services

One of the biggest struggles contracting business owners deal with is the overwhelming amount of paper they have to organize as part of their everyday tasks. Invoices, receipts, bills, contracts, client records, pay applications, insurances, licenses - are just a few that seem to be never-ending "etc". Keeping important documents is necessary. Most contractors go from one extreme to the other. One extreme saves everything for decades, and the other tosses everything out.

What to save? What to toss out? At Fast Easy Accounting, we no longer need to print and save every document in file folders and keep adding new file cabinets. Our paperwork processes ensure your happiness and peace of mind knowing that your papers can be retrieved electronically at any time in the future.

Read More

Topics:

Contractors Bookkeeping Paperwork,

QuickBooks For Contractors,

Construction Bookkeeping,

QuickBooks Setup Do It Yourself,

QuickBooks Construction Accounting,

Assisted Do-It-Yourself Contractor Bookkeeping,

Painless Paperless Contractor Bookkeeping Services

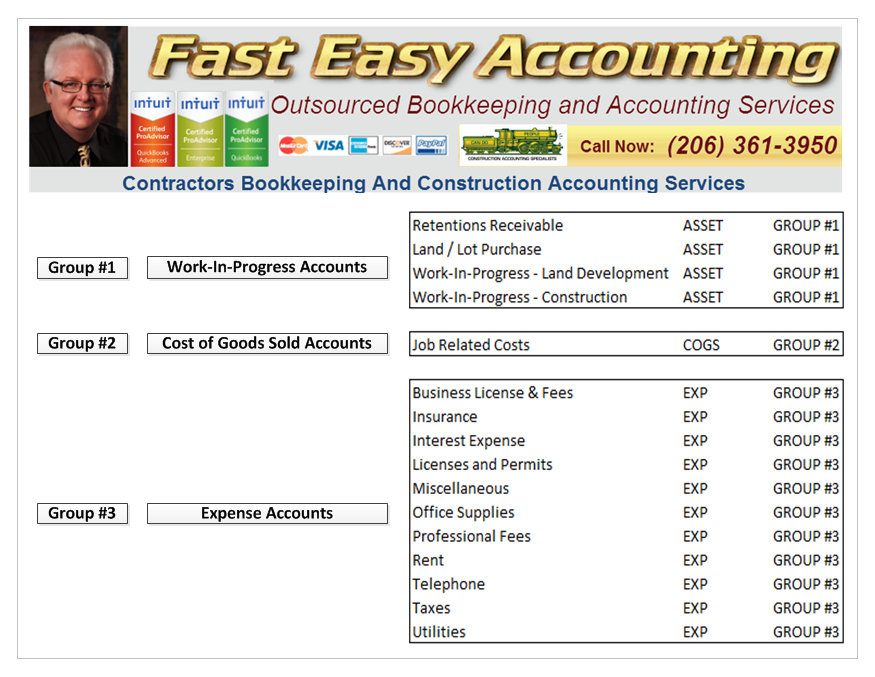

Contractors often ask us if they can buy our Chart Of Accounts with Cost of Goods Sold and import them into their QuickBooks Desktop file or their QuickBooks Online file. The answer is yes!

Click here for QuickBooks Desktop Chart of Accounts with Cost of Goods Sold

Click here for QuickBooks Online Chart of Accounts with Cost of Goods Sold

Direct Costs are tied to the jobs (field labor, material, and other cost items) Office material (pencils, paper, toner, etc. are overhead) Yes, an accountant could say these many pencils are used in the field, and that notepad is used in the truck.

The answer is the dividing line of what the DIRECT COSTS to the job and those are Cost of Goods Sold (COGS).

Read More

Topics:

Invoicing,

We Know Construction Accounting,

QuickBooks For Contractors,

Construction Bookkeeping

I would like to start my blog post by asking you to reflect on your WHY. Pause for a while and think about the reason or reasons why you started your business. I highly doubt that your answer is rooted in accounting tasks or involved any type of bookkeeping project at the slightest. It is apparent that you’re passionate about what you do and you love working in the construction industry, be your own boss, and have the freedom you’ve dreamed of.

I admit, small business owners - like myself, have learned to make the most of the resources we have. And as an entrepreneur, tend to take on the challenge of wearing multiple hats. Marketing your business, answering phone calls, responding to emails, scheduling appointments – to name a few. However, I am reminding you now that being a company owner and doing your accounting and bookkeeping requires a totally different skill set from being a construction expert in your field. When it comes to your financials, it would be wise to take a step back and let someone who specializes in bookkeeping do it for you. Not just any accountant or bookkeeper, but see to it that they are Construction Bookkeeping and Accounting Professionals.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

QuickBooks Setup Do It Yourself,

QuickBooks Construction Accounting,

Assisted Do-It-Yourself Contractor Bookkeeping