How Smart Money Management Keeps Your Business Profitable and Stress-Free

When most small construction business owners think about success, they envision a steady stream of jobs, high-quality work, and satisfied clients. But there’s another side to the story that often gets ignored: the financial health of your business.

And here’s the truth we see every day as construction bookkeeping specialists: Even skilled contractors with full calendars can run into cash flow problems, tax stress, or profit shortfalls—not because of the work, but because of the numbers.

That’s where Pillar 2: Controlling the Money comes in. In this post, we’ll talk about how to take control of your finances through simple, construction-friendly accounting practices—so you can stop guessing and start growing.

Read More

Topics:

Construction Bookkeeping,

Construction Accounting,

Construction Bookkeeping And Accounting,

Systems And Processes,

MAP vs. PAM,

Accounting,

Construction Consulting For Small Contractors,

Systems

A Guide for Small Construction Business Owners (from Your Bookkeeper's Point of View)

As construction bookkeeping specialists, we spend a significant amount of time analyzing the numbers behind small construction businesses—everything from job costs to cash flow to profit margins. However, here's the truth most contractors don't hear enough: Your profitability starts before the job even begins.

Yes, it starts with the jobs you say yes to—and more importantly, the ones you should start saying no to. In this post, we'll break down what it means to attract the right jobs, how doing so can transform your business, and what practical steps you can take today to stop chasing work that doesn't serve you.

First, Why Most Contractors Struggle to Attract the Right Clients

Small contractors often accept every job that comes their way, especially when they're just starting or concerned about cash flow. But this creates several problems:

- Low-paying work that barely covers your costs

- Clients who delay payment or constantly push scope boundaries

- Traveling too far for small, unprofitable jobs

- A lack of consistency in your portfolio and referrals

Read More

Topics:

Construction Marketing,

Systems And Processes,

Accounting,

Contractor Marketing,

Systems,

handyman marketing,

Inbound Marketing For Contractors

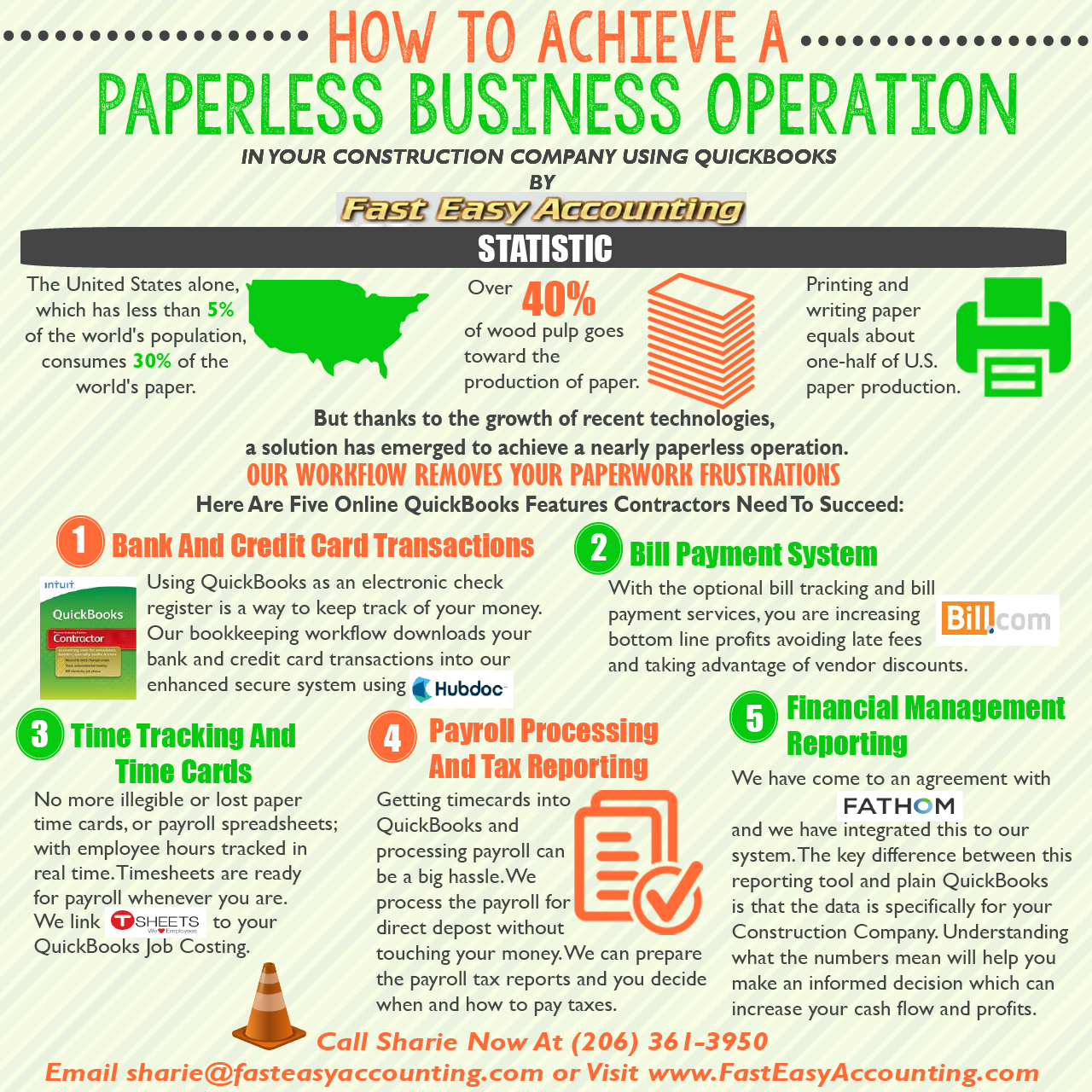

Running a small construction business is no small feat. You're on job sites one minute, sending invoices the next, and trying to line up your next project after that. It's a constant juggling act—and without the right systems, it's easy to fall behind or burn out.

As construction bookkeeping specialists, we work with small contractors who are incredibly skilled in their trade but often feel overwhelmed when it comes to running their businesses. And over the years, we've noticed a pattern: the most profitable, low-stress companies all focus on the same three areas:

1. Getting the Right Jobs (Marketing)

2. Managing the Money (Accounting)

3. Delivering Profitably (Production)

Read More

Topics:

Construction Marketing,

Systems And Processes,

MAP vs. PAM,

Accounting,

Systems,

QuickBooks Construction Accounting,

Construction Productivity

Although most construction company owners recognize the importance of careful financial management, few want to spend their time dealing with numbers. Unfortunately, not keeping a close eye on your income and expenses can be very costly for a business.

Here are five of the most common bookkeeping pitfalls, and some simple tips for getting back on track.

1. Mixing business and personal

All too often, contractors adapt a "buy now, sort later" approach to expenses, using the same credit card for personal and professional purchases. At the end of the month, they're left poring over statements, trying to sort things out. Mixing business and personal expenses cost extra hours of bookkeeping each month and muddles your overall financial picture.

Avoid this pitfall by using a separate credit card and bank account for business, and being disciplined about separating expenditures.

Read More

Topics:

Outsourced bookkeeping,

outsourced construction accounting and bookkeeping,

Accounting,

Contractor,

Contractor Tips,

Contractor Operating Tips,

Construction Systems And Processes

Contractors Are Tough Self Reliant Men And Women

Sometimes Too Self Reliant - Because we tend to become set in our ways and almost every thought, belief and action is based upon past habits and paradigms.

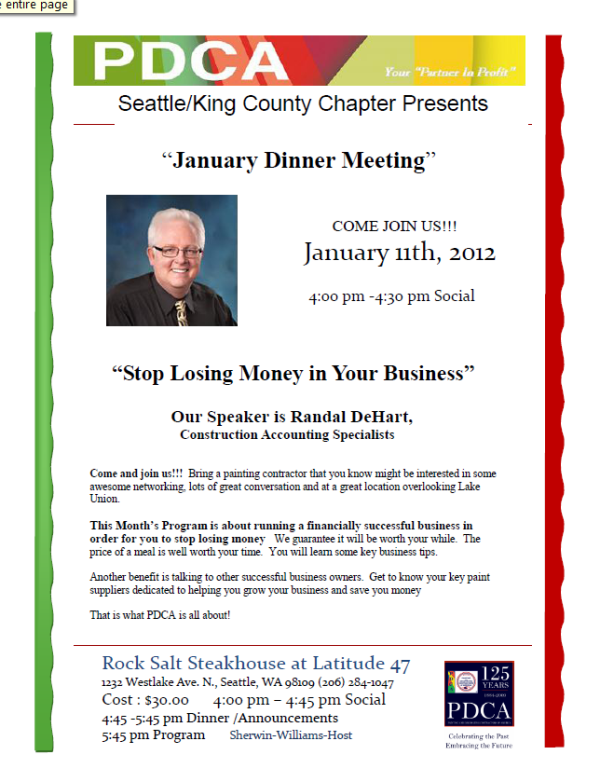

Read More

Topics:

Bookkeeping Services,

Business Process Management For Contractors,

contractors bookkeeping and accounting,

Accounting,

BPM,

contractors bookkeeping and accounting seattle

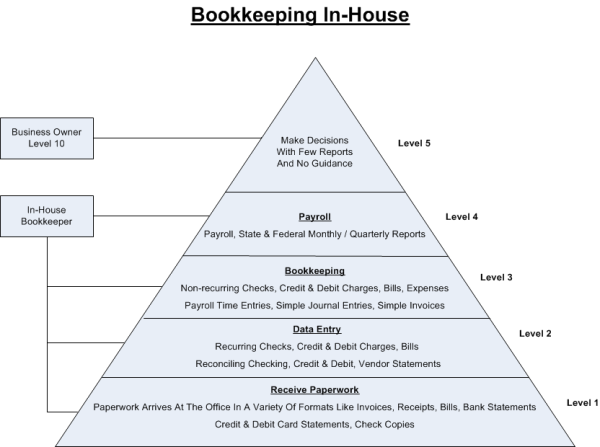

It Depends - Are You Proactive or Reactive?

- Proactive Business Owners use management reports for strategic planning to optimize profit and growth

- Reactive Business Owners wait until the taxes are filed to find out what happened and never plan ahead

- Proactive Business Owners understand the value of construction bookkeeping and accounting

- Reactive Business Owners know they can always find a cheap bookkeeper and think they are saving money.

Read More

Topics:

Construction Bookkeeping,

Outsourced bookkeeping,

Accounting

Rule #1 - Work expands to fill the time allowed for it or the outer edge of what business owner will tolerate

Read More

Topics:

Bad Bookkeepers,

Cheap Bookkeepers,

Professional Bookkeepers,

Seattle,

Bookkeeping,

Bookkeeping Services,

QuickBooks For Contractors,

Construction Accounting,

Construction Bookkeeping And Accounting,

QuickBooks,

contractors bookkeeping and accounting,

Accounting,

Bookkeeper,

QuickBooks Setup