Accounting has two sides:

Internal Accounting (Management Accounting) - for making money. Its purpose is to help you operate and grow your business profitability.

External Accounting (Tax Accounting) - for paying taxes. Its purpose is to prepare tax forms, report your income, and make sure you pay your fair share of taxes.

Understanding the difference will impact your company's financial health and wealth. Both groups of accountants must know the relationship between your internal bookkeeping and the Internal Revenue Service, and the importance of paying the right amount of taxes. There are a lot of professional bookkeepers, accountants, and tax preparers and they all serve a different role in your business.

In-House Bookkeeping

Contractors who do not earn a lot of money see bookkeeping as overhead which costs money and therefore is a drain on profits so they get a cheap computer, tiny monitor, garbage printer, small desk and broken down chair that even the dog would not sit in and tell the bookkeeper this is all the company can afford. In an effort to get their money's worth the contractor assigns all kinds of additional tasks to the bookkeeper like running business and personal errands; delivering materials, supplies, and paperwork to the job site, make coffee, answer the phones, take out the trash and clean the bathroom. Anything and everything to get "value" out of the time and money that is being wasted on bookkeeping.

One of the biggest challenges construction company owners have with an in-house bookkeeper is training them to work for your best interest, not theirs, and deliver consistent results and the reports you can trust day after day, year after year. Do you suspect your bookkeeper is overwhelmed trying to figure out how to do construction accounting? They cost you more than they are worth in salary, fees, and profits. If you cannot get accurate financial reports, chances are you're overpaying your taxes.

Outsourced Bookkeeping

The other option would be to outsource your bookkeeping. However, there are red flags that you need to watch out for when going this route. You need someone who specializes in your industry that can guide and mentor you. Today more than ever, remote access to your QuickBooks or bookkeeping file is essential to monitor your business profitability, any outsourced bookkeeping service who cannot provide you with access to a cloud-based environment is doing you a disservice unless you don't want to see your financial documents. Furthermore, remember the value of your security; the cost of proper bookkeeping combined with secured cyber information is priceless. Trust but verify - consider this when looking for an accounting and bookkeeping company.

My thirty years of experience in the construction industry as a contractor, a construction accountant, and a profit and growth coach enabled me to identify these opportunities that you can seize to help with your business process and lower your tax bills:

My thirty years of experience in the construction industry as a contractor, a construction accountant, and a profit and growth coach enabled me to identify these opportunities that you can seize to help with your business process and lower your tax bills:

Use The Right Accounting Method

Construction bookkeeping and accounting are entirely different from standard accounting systems primarily because contractors take their entire business inside trucks and vans to people's homes and perform their services, deliver, or install products. Finding the right bookkeeping and accounting solution that will do "all I need it to do" is a challenge for construction contractors like you. It all depends on how you get paid, the type of work your company does, and if you need financial reporting (such as Job Costing for instance).

Hire A Professional Construction Bookkeeper

According to Malcolm Gladwell, author of the book "Outliers", it takes 10,000 hours of practice to master a skill. That is what your professional construction bookkeeper should have invested in practicing and learning to become competent and efficient in what they do. They continue to learn and supplement their knowledge with formal and informal classroom training, seminars, webinars, and related software applications - all related to construction bookkeeping and accounting.

If your bookkeeper is untrained, who attended a one day seminar, watched some videos, took an online class, spent a few months working in an accounting firm, or is self-taught and believes in learning by experience (this means when they make a mistake you get to pay for it), then you almost certainly are spending a whole lot more in taxes than you should.

Separate Bookkeeping And Taxes

A good rule of the thumb is to understand that Financial Accounting, which is what needed for annual tax return preparation is not the same as Management Accounting which is what you need for Job Costing, Job Profitability, Budgeting, Forecasting, and Business Process Management (BPM).

Income tax preparers earn money by filling out tax forms, not cleaning up QuickBooks or whatever bookkeeping software you are using. Most of them are not even familiar with QuickBooks let alone clean it up. Which means they could not care less if you are paying too much in taxes or if your QuickBooks file is a mess.

If you think your tax preparer will catch the bookkeeping errors, think again. This is not what they are paid to do so they will not spend time and effort to review the details (of hundreds or thousands) of transactions to make sure they're all entered in the right accounts. Be sure to clean up your bookkeeping file before taking it to your tax preparer.

In conclusion:

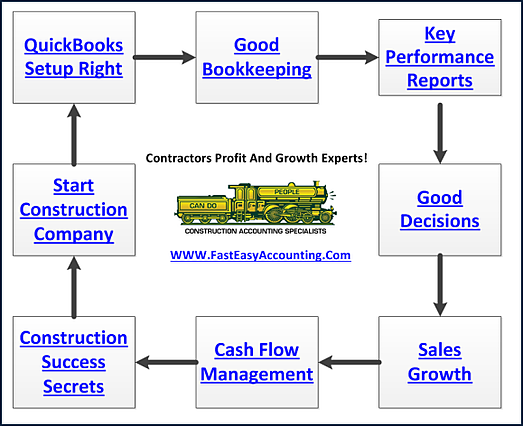

Your tax bill is based on reports produced from your accounting system which is managed by your professional construction bookkeeper. The only way to do it right is to start right. Understand the value of a proper bookkeeping setup for construction. Putting receipts in your bookkeeping software is easy. Entering them in the right account, so the reports are reliable is where the professional bookkeepers excel the most. You worked hard for your money, don't let somebody waste it. If you are having cash flow problems, you could be paying too much in state, federal and local taxes and we may be able to help. Remember, if you are a contractor, you deserve to be wealthy because you bring value to other people's lives.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes.

The Information Shown Below Is From Fast Easy Accounting

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations