Contractors Struggle Between The Cost Of Having A Bookkeeper And The Value Received Because All Contractors Want To Have Is Peace Of Mind

Number 1 Frustration is discovering the contractor knows more about Construction Bookkeeping And Accounting than the bookkeeper they hired to do the job. Contractors end up trying to teach The Bookkeeper to do the job thinking every little bit helps.

Number 2 Frustration is the Construction Bookkeeper asks “Is that part of my job description?”

Number 3 Frustration is the Construction Bookkeeper will “Go beyond their duties and authority."

General frustration towards all employees who feel that no matter what pay rate, benefits and number of hours worked there is “No Appreciation” for what the Contractor is doing for them.

When times are slow, or there is a lag between jobs The Contractor goes to great lengths to keep the employee working.

The Employee is guaranteed to receive pay based on Hours Worked.

Productivity on the part of the employee is optional. The Contractor has no guaranteed profit, or to even break even on the job. Contractors do not have the luxury of going home at the end of 4 hours, 8 hours, at 5:00 PM, taking off the weekend and forgetting about everything until Monday morning.

They would like to; but instead, the Contractor is planning, making phone calls, sending emails, meeting clients, ordering material, deliver the material or supplies, so the Office Staff and Field Employees have the tools and equipment needed to do their job.

The Contractor is researching apps and software to make the job easier for themselves and their employees. Time tracking software has the added benefit of GPS. Dispatch software has the added benefit of choosing the best route and the most efficient order in which to schedule the jobs.

The Contractor Does Not Need An App To Know Where To Go And What To Do When He Gets There.

The Contractor is squeezing Time to get the most out of every minute. In addition to their own job which includes “Pick Up Work”; completing the jobs left undone by employees to stay schedule and GET PAID!

Common Complaints Contractors Have About Field Employees

- Chasing Timecards and receipts

- Messy Paperwork or none at all

- Mistreatment of Tools and Equipment

- Not being proactive and getting fuel in the vehicle

- Cleaning up the job, vehicle, dealing with the trash

- Being polite and respectful to clients, fellow employees, management

The Contractor Is Exhausted Long Before It Is Time To Begin Working On Their Paperwork

The Last Thing You Need Is One More Problem, One More Task, One More Anything

- Frustration is Looking at the QuickBooks and finding the reports do not make sense.

- The Contractor does not know why the reports look off; they just do. (maybe showing different numbers)

- Why is there are a Ton of Bills To Pay after the job is over?

- How can there be so much profit on the report; yet there is No Money In The Bank

- Why Am I Not Getting Ahead?

The Bookkeeper (who might be the spouse) can only put in the information provided.

- Bank Statement and Credit Card statements can be reconciled.

- Reconciling Statements are important but will not tell the

- The Contractor wants to know what jobs are profitable.

- Only tying the receipts (COGS) to the jobs and properly entering in the income will produce job profitability reports.

Advice For Better Cash Flow

- Get The Money, Get The Money, Get The Money!

- Immediately Get Change Orders Signed (and paid)

- Be Sure To Charge Sales Tax (if it applies)

- Take Advantage of Supplier Discounts

When I am looking at a QuickBooks File there are some common issues that I find:

#1 Cash Is Off (How Much Money Is On Hand)

- Bank account(s) is not reconciled

- Why is this important? Because when the bank account has been reconciled you the checks that have cleared.

- Uncleared checks may also not be in the QuickBooks file.

- Are you using Carbonless Wallet Checks to be able to see what checks you have written?

- Are checks being written at the Supplier’s order desk?

- Paying subcontractors without having an invoice to match your records?

- Are you using a “Lot of Cash” without any receipts?

- Is the nearest ATM one of your regular stops?

#2 Accounts Receivable (Who Owes You Money)

- Customer Invoices are not in QuickBooks

- Why is this important? It is impossible to have Job Costing without customer invoices.

- It is impossible to properly keep track of outstanding Customer balances unless the invoice is in QuickBooks

- Customer Payments are entered in as deposits directly into the checking account.

- This means without the Customer Invoices in QuickBooks – the Sales By Customer Summary is not there.

- This means that there are no Job Profitability Reports

- Forgotten Invoices To The Customer is the Largest Cause of a Financial Problems

- Change Orders are often Forgotten to be billed by the Contractor

- Change Orders to be “Dealt With Later” are considered “Part of The Original Contract” by the customer.

- Change Orders not signed by the Customer are then not considered valid in the event of a dispute.

#3 Accounts Payable

- Just writing the check to a supplier or subcontractor and entering payment directly into check register

- When a bill has been entered into QuickBooks; unless the bill is paid from Accounts Payable is continues to show as an unpaid bill.

- When credit card balances or monthly payments are put into Accounts Payable instead as a credit card it distorts the financial statements

- When Owner’s Draws, Federal Tax Payments or IRS Payment Plans are put into QuickBooks as an Accounts Payable, it

- helps the Contractor to remember to pay the bill. Distorts the financial statements.

- Credit Cards are not entered into the Bookkeeping as Accounts Payable or lump sum numbers.

- Every transaction should go into QuickBooks.

#4 Profit And Loss

- Missing Income will reflect a Loss that is not true

- Missing COGS or Expenses will reflect a Profit that is not true

#5 Balance Sheet

- The summary of everything that happened in the business.

- Assets which includes Cash, Accounts Receivables, Job Deposits, Tools, Office Equipment, Vehicles, Inventory.

- Liabilities which includes all forms of Debt; Credit Cards, Accounts Payable, Taxes, Long and Short Loans, Vehicle Loans.

- Equity which is the value of the company. It becomes a simple math problem.

- No equity you are not in business.

- Some equity are you just starting out or have a hobby.

- Lots of equity you are “Green and Growing.”

Everyone can have a bad year or several years. What are you trying to do make it be better?

Good Accounting can help you plan and make the proper decisions that are right for you.

- Do-It-Yourself Bookkeeping (you or your spouse does the bookkeeping)

- Hire An Employee or in-House Bookkeeper (larger firms this may be your only answer)

- Outsource Your Accounting to Fast Easy Accounting. (We know what to do)

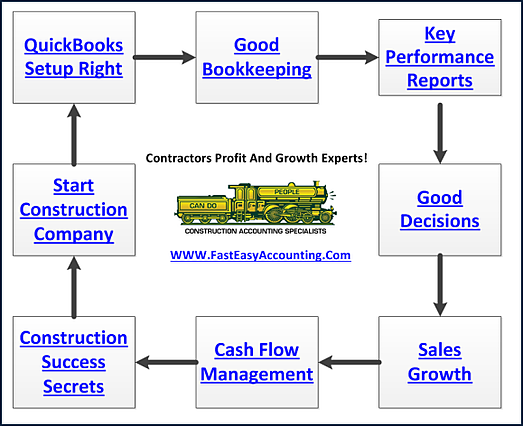

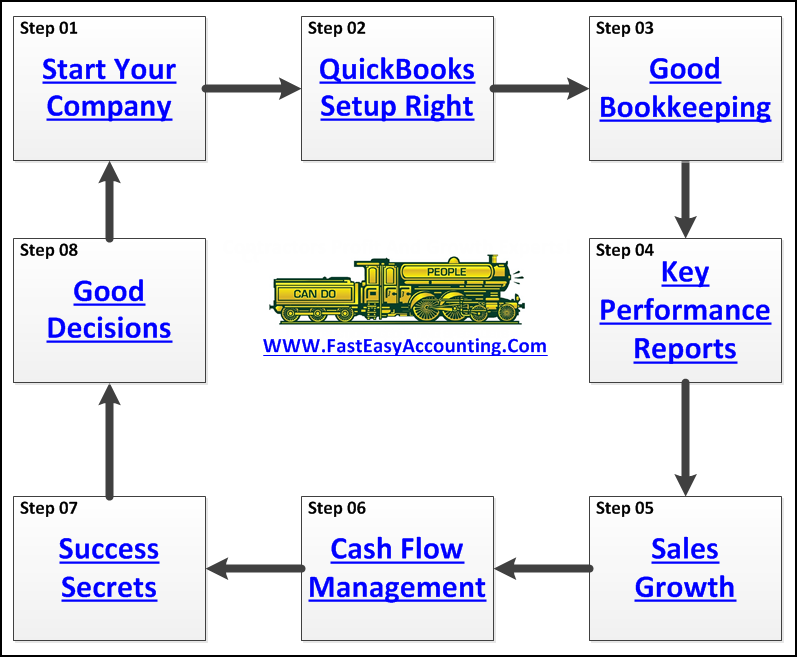

- Fast Easy Accounting in the most simplistic form is a “Production Shop” who has to manage processes to keep costs fair

- for both sides (Fast Easy Accounting and The Contractor). It’s a moving Train (see our logo)

- As much as we would like to – We cannot help everyone. Sometimes it is not a “Good Fit” for one or both sides.

- Without processes, the contractor bookkeeping and accounting are in chaos.

- As it is the Bookkeeping can be a little messy as we work through it.

- What We Need vs. What We Receive and When We Receive It.

- The Bookkeeping Department shouldn’t be the last to know. No benefit to missing documents.

- The Bookkeeping Department should NOT have check writing authority (owners need to be involved)

- Without Good Bookkeeping (Construction Accounting) you The Contractor are driving behind a Semi Truck that just ran

- through a Big Mud Puddle in a Snow Storm, and your windshield wipers aren’t working fast enough.

- Wouldn’t it be better to be in a nice clean Car Wash instead?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

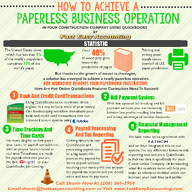

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company