![]()

![]()

![]() The year has almost come to an end. Just a handful of things left to do. The term “Burning The Midnight Oil” comes to mind. Some things need to be done and date stamped on or before December 31 of each year or it does not count for the current year.

The year has almost come to an end. Just a handful of things left to do. The term “Burning The Midnight Oil” comes to mind. Some things need to be done and date stamped on or before December 31 of each year or it does not count for the current year.

![]()

![]()

![]() Payroll – Did you take any personal payroll (S-Corp) If not, it may impact your personal deductions.

Payroll – Did you take any personal payroll (S-Corp) If not, it may impact your personal deductions.

IRA – 401K Making those final payments before midnight on December 31. (Do not wait until 11:59 PM)

Some plans allow you to make payments until April 15th (double check the dates– do not assume)

![]()

![]()

![]() End of the year income - Getting one last customer invoice out and receiving the payment

End of the year income - Getting one last customer invoice out and receiving the payment

Last minute purchases to count on 2017 taxes (expenses or larger item which qualifies for depreciation)

January 1 – is the time that the reset button on company financials, payroll tax threshold, expenses, and income start over at Zero. Do you have deductibles that reset or annual caps?

Tax Accountants will be demand explaining how the new changes will impact of and every one of us.

Many changes are coming at the Federal level with the new tax plan passes. Reading the highlights of the new tax plan, we can expect the IRS to be busy in the next few weeks rolling out the new tax rates and how it is applied to the Federal Withholding on your paychecks. Within the pages of the various tax codes that might cause changes in the 2017 tax software. Congress picks whether any tax increase or decrease impacts yesterday, today or tomorrow. Tax accountants keep on top of changes.

Do not expect to be able to file your annual taxes on January 1, 2018.

![]()

![]()

![]() IRS Statement on 2018 Filing Season Start Date. The IRS has released a statement regarding the first official day to file taxes in 2018. “The IRS Statement on 2018 Filing Season Start Date is basically that there is still no official date. Due to all of the current legislature going on regarding tax laws, there is no official start date for 2017 Tax Season.”

IRS Statement on 2018 Filing Season Start Date. The IRS has released a statement regarding the first official day to file taxes in 2018. “The IRS Statement on 2018 Filing Season Start Date is basically that there is still no official date. Due to all of the current legislature going on regarding tax laws, there is no official start date for 2017 Tax Season.”

Most common State changes are tied to minimum wage rates and employee benefits (example PTO, Sick Pay, Vacation Pay, other employee benefits). Individual cities can be different than the rest of the state (Seattle). Recommend using a 3rd Party Payroll Service with an HR Component to keep in compliance.

Hint For a Pre-New Year’s Day Activity

This is one of the Not So Fun aspects of running a business. You Are The Boss! Buck Stops Here! In addition to doing all the Fun Stuff (meeting your clients). Employees in general (maybe not yours) will start asking for their W2 on January 1st (or before) thinking that they can immediately file.

Some employees might be planning to use a service to file their tax return and receive a “tax refund loan” so they will have their money instantly. To avoid hearing employees ask over and over – it will be less time consuming to send out the W-2 forms sooner rather than later.

Create W-2 and Pass Them Out As Soon As Possible – Remember To Keep A Copy

W-2’s and 1099’s have a deadline of January 31st to be mailed out to your employees and 1099 contractors. Be proactive and send out W-9’s now; thereby asking for Federal Tax ID or Social Security Number now. IRS Form W-9 https://www.irs.gov/pub/irs-pdf/fw9.pdf. Check the IRS site for 2018 W4.

Some employees will move and forget to notify you of their new address change until after they have made the appointment to see their Tax Accountant and discovered their W-2 has not arrived.

Think About Your Company Tax Filing Status

I recommend changing from a Sole Prop to an S-Corp. Setting up an S-Corp is done with the Secretary of State in your state. Note, a few states only accept forms from a third party service.

If you are currently an LLC – my recommendation is still to become an S-Corp. If not, change your tax filing status to be treated as an S-Corp. The form needed from the IRS is a Form 2553. https://www.irs.gov/pub/irs-pdf/f2553.pdf

Unlike many State Agencies, the IRS does not charge to file their forms. You are asking the IRS to change how your company is being treated. Why is this important? Because the IRS will only accept the form for the current year in January – February (pushing the deadline to March 15th is risky) otherwise the approval will be for the next year (meaning starting in January 2019) instead of January 2018.

Quick Tip: Late Penalties to State and Federal Government Agencies are increasing, and they are looking back at filing dates of past returns for additional fees. Very expensive to borrow money from the government. In case you need it; it never hurts to ask for a payment plan.

Rule of Thumb When Asking: Be Nice, Be Polite, Ask for a payment plan to be extended for as long as possible and with payments as low as possible. Sometimes no matter how you ask – the person you are talking is not helpful, but usually, if it is within the rules they will. Cash Flow - Every little bit helps!

For many contractors the last few years has been a challenge just to stay in business. For Construction Contractors – the margins are so thin trying that trying to be competitive and to be profitable at the same time, and contractors have felt like they are acting as a Non-Profit without any of the tax benefits.

![]() Every business has challenges; it comes with being in business. Think Positive – Tomorrow will be better.

Every business has challenges; it comes with being in business. Think Positive – Tomorrow will be better.

- Now you are ready to have fun and create your New Year’s Resolution

- Pat Yourself On The Back – Job Well Done

- Stash Your Magic Wand In The Closet

- Put Your Feet Up On The Couch

- Spoil Yourself With Lot of Food

- Buy Your Favorite Ice Cream

- Eat More Chocolate

- Read The Paper

- Take A Nap

- Watch TV

- Be Happy

- Laugh

- Live

![]()

![]()

![]() Yes – I know you also have a list of Business Resolutions.

Yes – I know you also have a list of Business Resolutions.

Construction Accounting and Bookkeeping issues will not go away all by themselves.

Check out FastEasyAccountingStore.com or Chat with me about a Customized Proposal.

Now is the perfect time to clean up your Accounting for 2017, make changes for a better 2018.

New Year’s Resolution – One tiny change in your process that will help you grow your Construction Contracting Company.

We are ready to help “A Little or A Lot” with any of those accounting issues when you are ready.

Tomorrow is a new day, and once you, me, we have rested, the challenges will be easier to manage.

![]()

![]()

![]() Again, Best Wishes To Everyone.

Again, Best Wishes To Everyone.

Have a Very Happy New Year

Welcome 2018

Sharie

In Conclusion:

![]()

![]()

![]() Helping Contractors around the world is one of the reasons we added the FastEasyAccountingStore.com

Helping Contractors around the world is one of the reasons we added the FastEasyAccountingStore.com

Follow our blogs, listen to Contractor Success M.A.P. Podcast. We Appreciate Our Visitors, Listeners, and Subscribers. – Thank You!!

![]()

![]()

![]() Please feel free to download all the Free Forms and Resources that you find useful for your business.

Please feel free to download all the Free Forms and Resources that you find useful for your business.

We are here to Help “A Little or A Lot” depending on your needs.

About The Author:

![]()

![]()

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

![]()

![]()

![]() When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

-

Speed1x

-

Quality1080p

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

![]()

![]()

![]() For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

![]()

![]()

![]() This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

![]()

![]()

![]() Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

![]()

![]()

![]() Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

![]()

![]()

![]() We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

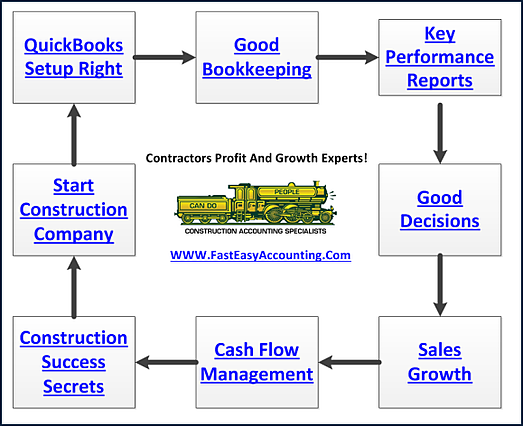

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]()

![]()

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar