The First Question You May Ask Yourself Is

Why Doesn’t My Tax Accountant Help Me With Job Costing?

They are Tax Accountants, not Construction Accountants and may not know the answers. You may think they are just keeping it a secret. Sometimes you may think they don’t know what they are doing, and maybe I need to get a new tax accountant.

My Advice is Stop, take a deep breath. Is your tax accountant doing a good job with your annual taxes? If the answer is YES. Please keep them, they are doing what they are supposed to do.

Annual taxes is like the game of “Pick Up Sticks” Details are everywhere, and all need to be gently picked up and placed on your tax return in a specific order. Not all of the items on the table are actual tax deductions. Your tax accountant must be up to date on the latest changes made by Congress and implemented by the Internal Revenue Service.

Remember a few years ago when Congress made changes went they met in January. Then next the Internal Revenue Service had to determine how those changes applied to the individual pages on the tax return. Those changes then had to be sent to the software engineers to update all of the tax software.

The rule is the first two pages of the annual 1040 are the summary of your tax return. The balance of the pages is supporting documents and worksheets. Congress in a single bill can make decisions that are for the current year (today), future years (tomorrow), and yesterday (as in the example of the year changes were made in January that impacted the prior year’s taxes).

Most tax accountants are “Generalists” which means they have every combination of family structure, with and without children, elderly parents, grown children that moved back home, and friends they are helping out. Do you have health insurance, a qualified plan, non-qualified, State-run plan, or hoping for the best and will pay the No Insurance penalty.

Do you own your home, have a second home, RV or Travel Trailer that qualifies as a second home. What about IRA’s, 401k’s, changed jobs, someone was ill; had to or chose to take an early distribution. What is a tax deduction and What is Not a tax deduction?

Now add your Construction Company to the mix. Is the business a Sole Proprietor, LLC, Sub-Chapter S-Corp, C-Corp, Partnership. Did you take a payroll, Loans to Owner, Loans to Members, Loans to Shareholder (makes a difference when preparing the tax return?

If you are a Sole Prop, LLC being treated as a Sole Prop or a Partnership, then there is an additional form “Self-Employment Tax” which leads to paying quarterly estimated taxes Quarterly to the Internal Revenue Service. Tax returns are many pages long; gone are the days of the Easy File. They were the “Good Old Days” when you had a W-2 job, no house, and no to a zillion and one other questions.

Asking your tax accountant to focus on the details of your business is just TOO Much. By the time your information gets to the tax accountant; their focus in on picking up all the pickup sticks and put them in the proper order to save you money on your taxes.

Job Costing and job profitability is a question about details and good record keeping on the part of the contractor. A wife, spouse, partner, friend with the help of a construction accountant provide Job Costing reports. Without the proper tools, it is a frustrating activity for everyone involved.

The contractor, if you don’t know what job you are on and unable to unwilling to slow down long enough to put a job name on the receipt. Then expecting your others in your life to be able to EASILY (anything can be done) figure out the Job Costing with limited information is unreasonable.

CONCLUSION:

So when the tax accountant tries to keep their expression blank, without rolling their eyes, and gently fobs off your wife, spouse, partner, friend off; they think they have it easy. Tax accountant rolls the numbers all up.

Did you make a profit, Yes or No; determine your depreciation, review your travel, meals and entertainment, other misc. items. Move the numbers over to the personal side which can be much messy. Complete your return and thank you for coming in.

The smart Tax Preparers send you back to your Construction Accountant for more Job Costing details. Hoping you have a better year and a little cleaner, tidier records the next time you meet.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

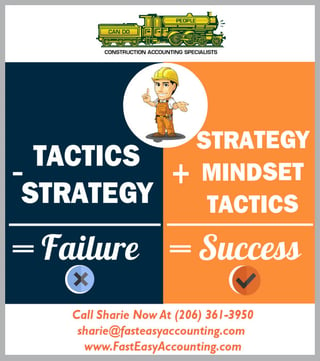

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

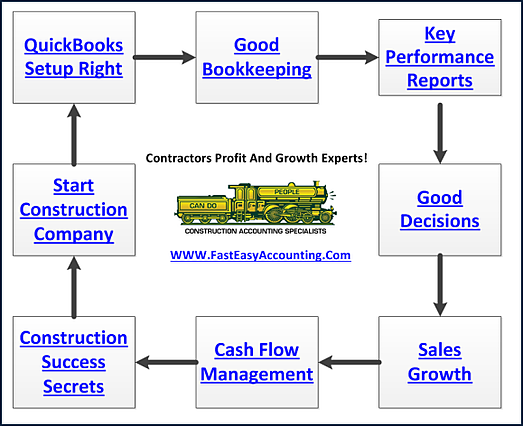

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com