You are a small contractor who needs an Admin Assistant to answer your phone, so you hire someone for your contracting company office.

Calls come in, and your Admin Assistant has some free time between calls, so you want to make use of that famous Standby Time, and you ask them to do a little more. Being nice; you give a new title of Office Manager.

As the Office Manager; that person is in control of the bookkeeping, customer invoices, vendor payments and more. As the contractor, you are excited because you are handing off the responsibility for the day to day activities.

From your side; you have checked off the box called Office Manger DONE, phones DONE, bookkeeping DONE and material pickup and delivery person DONE. Everything is solved. Good now you can go back to work and start doing the work which is the part you are good at and like to do.

Are you expecting Too Much from your Office Manager?

-

Does the Office Manager understand Bookkeeping or is just trying to keep the checkbook balanced?

-

Now add employees; are you expecting the Office Manager to understand the payroll?

- How about the differences between Construction Accounting and Regular Accounting?

Have you ever heard your Office Manager say: Don’t worry about it. I have everything under control.

Great everything is working, and you go back to work. Life is good, and I am making money now.

Surprise Now it’s November!

Did you remember to pay The Quarterly Payroll Taxes were due on Halloween? It’s another form of Trick or Treat. If they have been paid and you have money left over it is a treat. The Trick is if you forgot, or didn’t know about them – Do you have enough money to pay?

Even the best of bookkeepers are not comfortable writing checks that they know will not clear the bank.

Everything is going smoothly. Business is good and growing. More and more jobs are coming in. Office Manager is handling everything until you ask. How much money did I make on the “XYZ” Job?

Then you discover that the accounting reports are missing details.

Is the Problem, the person, sitting in the Chair? Office Manager | Bookkeeper | Delivery Person. Do they have enough time to do everything? What is the priority? Delivery of Material because it’s needed on the job RIGHT NOW - DROP Everything and go get “stuff” from the supplier and take it to the job.

Is the Problem the receipts turned in and are not marked with the job name or never turned in at all?

Is the Problem that the timecards are not real timecards for filled out with fiction and guess word days after the fact.

Are the timecards holding up payroll, billing customers (time and material) generally unreadable and show up five minutes before the employees expects their paycheck. Perhaps you would like a simple, contractor proven solution to your timecard mess.

In other words – the Office Manager needs to STOP EVERYTHING to fix, chase down, find something or solve an issue FIRST before the next thing on their list can happen. The list is always longer than the time allowed.

Is the Problem that the phone rings in the middle of something else, and the Office Manager can only do two things at once but has ten things to be completed before going home. Ever heard of the old fashion phrase “Just Give It A Lick and A Promise” In other words a quick wipe versus a deep clean edge to edge.

The Solution Every Overworked Bookkeeper Chooses Is To Let Something Else Slip

Usually, it begins with something that not critical, but then it is. The first to go is Job Costing. After all, the Job Costing is impacting a report that the owner never looks at. Extra work for when the Office Manager is wearing the Bookkeeper hat. Just get the transaction into QuickBooks and get the bill paid. After all, that’s what is important.

Now is the slide into what I call the Office Manager | Bookkeeper is in full control of your construction office.

At this stage the Office Manager | Bookkeeper will settle into a routine on that works best for them. Office Manager is deciding what is the most important thing to do, how to do it, and when to do it.

You, the Contractor come up for air and you want reports

Unhappiness is when you the Contractor come up for air and asks questions, senses there is a problem but cannot put your finger on what the problem might be.

When you look at QuickBooks you are frustrated and agitated because you are not a Construction Accountant and you do not know exactly what is wrong; you just know intuitively something besides the bank balance is off, but you don’t know what is wrong.

Your next step is to call an outsider and ask questions. I suggest a review of QuickBooks file. After the review; I discuss issues with the Contractor about their QuickBooks file.

Contractors want for their Office Manager | Bookkeeper to continue doing the books just make it easier for them to do their job. Contractors want for their Employees to be able to easily fill out their time card.

Question – Is there a PROBLEM? Is it the same PROBLEM?

Many Office Manager | Bookkeeper | Field Employees do not see the same problem or issues that the Contractor sees. Is the Problem fixable?

Is the employee on the defensive? What exactly am I doing wrong? A favorite phrase of employees is “If I only had “XYZ” – I know what to do. If they had “XYZ” would they do something additional or something different? When will they do something additional or different?

A classic statement from an employee. “I know How To Do that?” Ok, If you know “How To Do It” then let’s address why it is not being done. (The excuses begin) Is the tasks not being done really important or not important at all. Who is it important for? Why is it important? Are you sure? Is it worth the cost to fix?

As the Contractor – Owner only you make that decision. Otherwise, the Office Manager | Bookkeeper | or Other Employees are really in control, and you are working for them. Is that why you are in business?

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

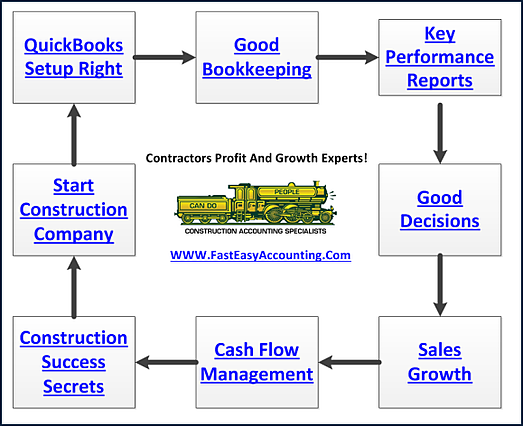

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com