Construction companies need short-term liquid working capital such as cash, lines of credits, loans, owner financing, credit cards, supplier accounts, and other forms of money to conduct daily operations. Small construction companies with annual sales volume less than $10,000,000 and other requirements enjoy some benefits that are not always available to larger firms. Likewise, larger firms can leverage economies of scale.

The larger your construction business grows, the more likely you could end up operating as a bank without the hundreds of ways to generate revenues from fee income and interest calculation that banks use. The most popular method designed by investors and developers and shrewd business people who understand the concept of divide and conquer is for contractors to get little or no down payment for a construction project, do all the work, including change orders and then try to collect their money.

What often happens is that contractors hate paperwork preferring to keep everything in their head. Then when it comes the time to collect their money, they find themselves having to re-sell the job and talk their customer into parting with their money. It's been said: "The value of services rapidly diminish after the services have been performed," which is why highly profitable companies like McDonald's gets your money before they deliver your meal. Compare the success and profitability of a McDonald's franchise to most restaurants.

The least popular method is getting work orders and contracts signed, and deposit checks before starting the project, because most of us were conditioned from childhood through adulthood and beyond not to ask for money. Some construction company owners are gung-ho about doing the work and yet are embarrassed about asking for money.

Here are the 10 most popular excuses for not asking for money:

1. The customer just signed the contract, and I haven't done any work yet

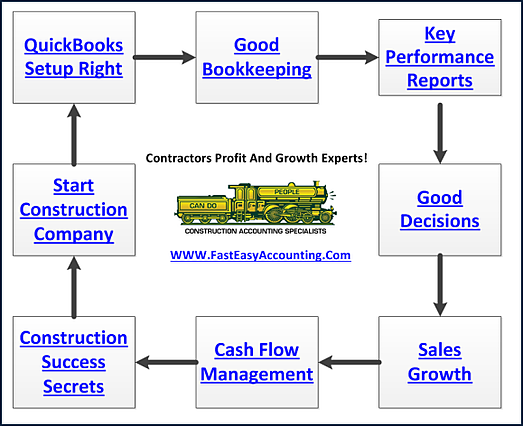

2. As soon as I need money I will ask for it (see Cash Flow Diagram)

3. I don't want to look bad in front of my customer by appearing needy

4. I don't want to appear financially weak in front of my staff

5. My wife is good at managing what little money I bring in, so I don't need any just yet

6. I have personal and business credit cards to finance the work

7. I have many charge accounts at suppliers everywhere

8. My sub-contractors don't bill me until the end of the month

9. I have a little cash in savings I can use for a while

10. I have a line of credit on my house (wives hate and FEAR this one)

Solution: Offer payment options

Financing - Get set up at a bank and/or credit union that will offer to loan your construction client money for small projects under $25,000. They sign paperwork with the lender; you do the work and get paid.

Accepting Credit And Debit Cards - It's like having an "Electronic Armored Car" on standby 24 hours a day, seven days a week ready to take your money to your bank automatically. If your QuickBooks is set up correctly, an invoice can be emailed to your client, and when they open it, there is an option for them to pay by credit card immediately.

When is a good time for you to ask for payment?

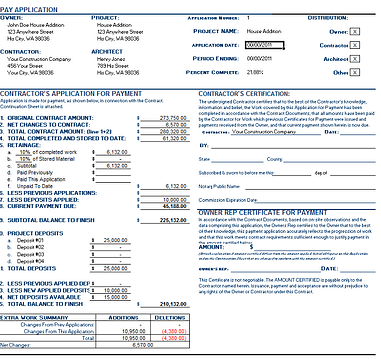

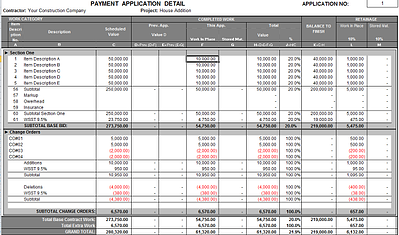

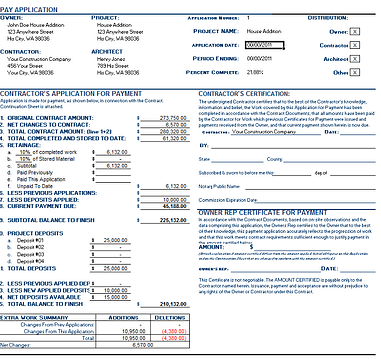

When the contract is signed - Ask for a deposit and record it in QuickBooks and on the Pay Application. We recommend one week of work as a fair deposit. To calculate it, take the contract amount and divide it by the estimated number of weeks to complete. For example: Contract $50,000 / 5 weeks = $10,000. Use this money for working capital and stop financing somebody else's dream.

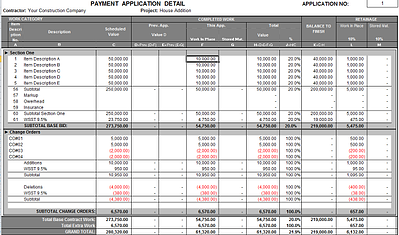

Progress Payments - Every week, perhaps on Monday, you could review the work that was completed the week before, issue a simple invoice or better yet give your customer a full payment application and get paid.

Change Orders - Every change order has a clear scope of work and pre-determined price, which needs to be documented IN ADVANCE OF THE WORK BEING DONE and paid in advance. Sound strong, doesn't it? Well, change orders have a short-short shelf life...the value of the work and the motivation to pay for the work on all Change Orders rapidly diminishes after the work has been performed. This happens a lot because some of your customers think you should have read their mind and have known in advance they were going to want the change. Keep change orders paid early and often or Christmas may come early for your customer and not at all for you and your family.

Final Payment - When the work is done, when you prepare the final invoice, you will credit back the deposit and either issue a small refund check or collect a small check.

If you did everything right, you did not put any of your money into the project.

How many projects can you support?

Your money - Make a list of all your cash and anything you can turn into cash: checking + savings accounts + credit cards + suppliers credit limit + home equity line of credit + other lines of credit + kids college fund + Christmas fund + vacation fund + loose change + gold + silver + jewelry + any other cash or anything that can be converted to cash. Add it all up and that is how much construction work you can do and hope to get paid.

Your client's money - If you operate on your client's money, your limits are now determined by your soft assets, business systems, and your hard assets including equipment and employees.

In conclusion:

The right mindset and method will help you avoid client payment problems. Having owned and operated several construction businesses, I know how vital cash flow is to the success or failure of any business and especially construction companies like yours. Don’t ever finance your customer or client’s project by providing substantial amounts of labor, material, subcontractors, and rental equipment hoping to get paid later down the road. Get enough Job Deposits and progress payments so that you are always using “Other People’s Money” (O.P.M.) to pay for your construction projects.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes.

The Information Shown Below Is From Fast Easy Accounting

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations