Profit Drain #1 In-House Bookkeeper Until a construction company reaches at least $5 million in annual sales it cannot afford to hire a qualified construction bookkeeper or construction accountant.

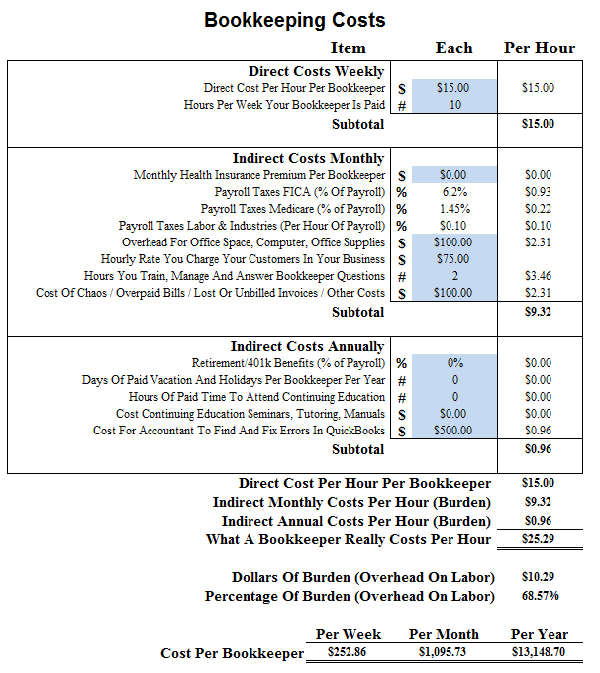

The owner Hires A Cheap Bookkeeper part-time for $15.00 an hour 10 hours a week in an attempt to save money without understanding the actual cost is $25.29 per hour. See the chart below:

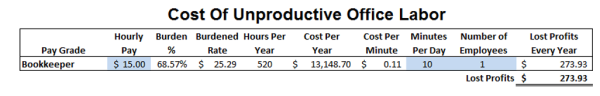

Every 10 Minutes A Day Of Unproductive Office Labor:

Cost The Company $273.93 Each Year

At 10% Profit You Need To Sell $2,739.30 More To Maintain The Same Profit Margin

In Some Cases we can do more work for less money by providing you with construction bookkeeping and accounting + payroll processing + monthly and quarterly tax reports + year end W-2, W-3 + profit and growth management consulting + financial and job costing reports + paperless data storage and more. As an added bonus we can show you how to use simple strategies to make more money faster!

Profit Drain #2 Cheap Tools And Equipment Invest in the best tools and equipment you can afford because in the short run you will save money. Construction workers who take pride in their work and will produce better results faster with fewer repairs if they have quality tools and equipment.

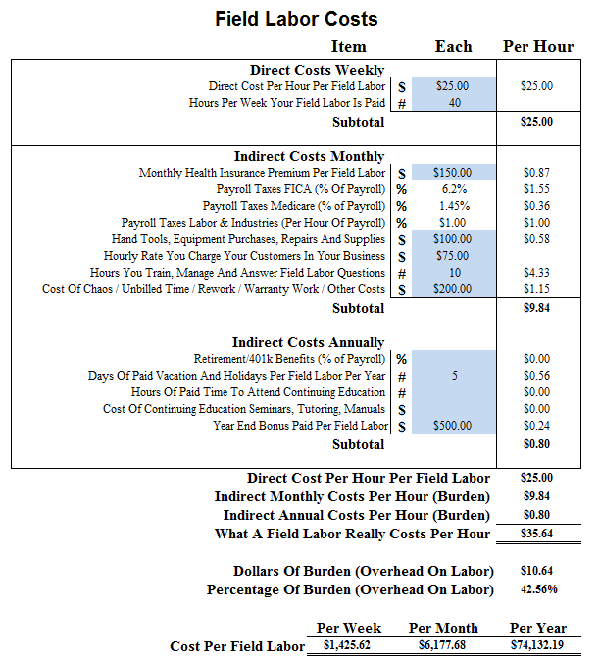

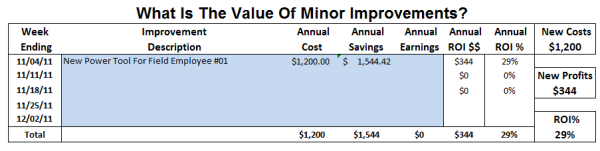

Make More Money Faster with productivity gains. See the chart below:

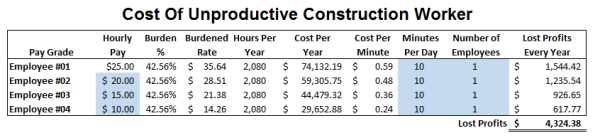

Every 10 Minutes A Day Of Unproductive Construction Worker Labor:

For Employee #01 Cost The Company $1,544.42 Each Year

At 10% Profit You Need To Sell 15,544.20 More To Maintain The Same Profit Margin

For Example your best construction worker asks for a tool that costs $1,200.00 and will last 3 years. The standard response is the we can't afford it!

Highly Profitable construction company owner's will ask their construction accountant to calculate the projected the Return on Investment (ROI) is and then consult their Strategic Business Plan to make an informed decision.

In This Example it may make sense to finance the purchase even if it means using a credit card with a 12% interest charge because the Return on Investment (ROI) is $3,289.36 or 245% ROI. See the chart below:

Two Contractors Doing Similar Work for similar customers with the similar direct and indirect construction costs will have massively different net profits for the year. Their KPI Reports will be more favorable which means a more stable construction company. Size matters when it comes to piles of money and bigger profits!

Construction Success is a few simple disciplines practiced everyday

Construction Failure is a few errors in judgment repeated everyday

Click Here To Learn More About Building Your Construction Company Strategy

Outsourced Construction Accounting Services

Outsourced Construction Bookkeeping Services

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.