Starting Or Re-Starting A Construction Company Is Easy

If You Know Exactly What To Do

There are a number of people who pass out advice on how to start a profitable construction company; however, very few have actually done it and fewer still had a clear understanding of where they were making or losing money and fewer yet have ever gotten past the point of owning a J.O.B. (Just Over Broke) into a real company with employees who actually generated more money than they cost.

I trust this article will be of service to you There are links to other resources included in this article and it is put together in the order of importance. 99% of your success will depend on whether you follow directions or try to re-invent the wheel. Are you open to a Paradigm Shift?

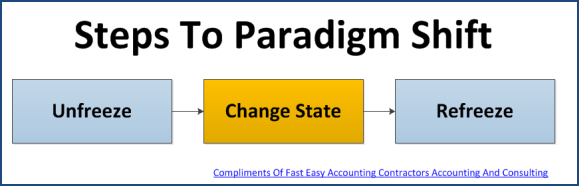

Three Steps To A Paradigm Shift:

#1 Unfreeze - Being open to a new idea that is in agreement with your core values

#2 Change State - Arriving at a new understanding about something. Education is the foundation for shifting paradigm. In ancient Greece, Socrates argued that education was about drawing out what was already within the student. "I cannot teach anybody anything; I can only make them think."

#3 Refreeze - Closing the portals of your mind for now.

Secret #01 Decide What You Want From Your Construction Company

Do you want to get rid of the boss? Do you want to work in a more structured enviornment? Are you sick and tired of working for the boss's son or daughter? Do you want to make a lot of money? Do you just want to make enough money to pay the bills and enjoy a vacation now and then? There are no wrong answers, whatever is right for you is the right answer; however, you need a reason to do it otherwise when the going gets tough, and it will you will either win or lose depending on your reason. With a big enough reason you will find a way to win.

Johann Wolfgang von Goethe is credited with saying "Until one is committed, there is hesitancy, the chance to draw back-- Concerning all acts of initiative (and creation), there is one elementary truth that ignorance of which kills countless ideas and splendid plans: that the moment one definitely commits oneself, then Providence moves too. All sorts of things occur to help one that would never otherwise have occurred. A whole stream of events issues from the decision, raising in one's favor all manner of unforeseen incidents and meetings and material assistance, which no man could have dreamed would have come his way. Whatever you can do, or dream you can do, begin it. Boldness has genius, power, and magic in it. Begin it now."

Action Step - 01: On a peice of paper type and print or hand write a description of what you want from your construction company and put it into a three ring binder. It does not have to be perfect or complete, one or two sentences for now.

Secret #02 Put Together Your Board of Advisors

Most of them are FREE or very low cost while you are just getting started. They are from the Five Key Areas of Business Success. Follow This Step-By-Step Process:

#1 Find A Commercial Banker You Can Work With

Go to your bank and ask to speak with the commercial banker. Every bank has one and they can be one of your most powerful allies and mentors. The really good news they are on the banks payroll.

Tell them you are working with a construction accountant that is involved with the bookkeeping and accounting and that you have a totally separate firm that prepares your Annual Federal Tax Return.

Bankers like to know you are using tried and true method of "Trust But Verify" to help limit fraud and errors. We recommend you have different companies doing your bookkeeping and your Annual Federal Tax Return because that will provide you with checks and balances in your system. In addition if you need to replace one or the other it will be a lot simpler.

Plan on meeting with them on a monthly, quarterly, semi-annual basis whatever works for both of you and bring two printed copies of your Profit & Loss and Balance Sheet for them to review with you. Always, always keep your commercial banker updated about any major changes that may affect your business or personal finances. NEVER SURPRISE YOUR BANKER!

Ask Your Commercial Banker These Questions:

1. Is there anything on the financial reports I should pay closer attention too?

2. How can you and the bank help me run my business more profitably?

3. Who is your target customer and how can I refer new customers to you?

No matter what size your construction business is now, whether you need a loan or line of credit or not, you need to understand that lending money is only part of what banks offer to help your business succeed. Lots of people need all construction services and some of them will ask their banker for referrals.

Do not catch the dreaded disease I call "Yellow Fever". This Randalism occurs when Caterpillar, the world's leading manufacturer of construction equipment begins to promote their brand new shiny yellow colored backhoe or grader or heavy equipment with all the latest whistles, bells and gadgets.

My advice is "Wait for it" and let your commercial banker know you are interested in some new equipment, keep developing the relationship and whamo! You could get THE CALL...

"Hi Bob... how are things going? Hey we haven't met for a while and I was wondering if we could meet for coffee because we are about to REPOSSES a piece of heavy equipment that you may be interested in? I showed the last Profit & Loss and Balance Sheet you gave me with some folks at the bank and they thought we may be able to work something out if you are interested..."

The bank is does not like storing equipment, they would rather it would go from the repo man to somebody else without stopping if possible. The price and terms are very fair so it is important to remember this Randalism "The Pig Gets Fed, The Hog Gets Slaughtered!" Negotiate a fair deal that allows the bank to get something and you get something, a win-win and you will find more great deals coming your way in the future.

Action Step - 02: Call or visit the bank where your construction company will be depositing money and writing checks and follow the steps outlined above. Make notes from your meeting and put the notes in your three ring binder.

#2 Connect With A QuickBooks Expert In Construction Accounting Services

You may not need one in the beginning but don't wait until you have big problems to find one. A construction bookkeeping and accounting firm and outsource as much of your construction bookkeeping, payroll processing, complex invoicing and monthly and quarterly tax reports as you can afford. It will free up time to do what you do best and the books will be kept in order.

We would like to be your QuickBooks expert in construction accounting and help you with QuickBooks Setup for Construction and as much of the day to day contractors bookkeeping services as you need.

Choose someone that specializes in your industry because the days of the one-size-fits-all accounting practice has gone the way of the dinosaurs.

Make certain they have current technology which means they have equipment in a secure server farm that allows you remote access to your QuickBooks desktop version on the internet. You do not want the QuickBooks Lite Online Version because you need to see the same QuickBooks software you have on your desktop now. The only difference is you have remote access anywhere you have internet connection and your construction bookkeeper can get to it from their office. No construction bookkeeping service needs to ever be in your office unless you invite them.

Your outsourced accountant needs to provide an easy way to get the paperwork to them with fax, scanning, email, and in person. Make certain they are in an office building, not their home. A more professional environment attracts a better class of professional bookkeepers. And the building needs to have a secure lock box that allows you to drop paperwork off 24/7/365 when it is convenient for you, not just during business hours.

Obviously scanning all your paperwork into a paperless secured server and link source documents to the transactions in QuickBooks for easy retrieval later is a given. This makes it easy for you to get to it remotely, see it, print it or email it without having to dig through a file cabinet or pile of papers.

Finally they need to be available to meet with in person to discuss how your business is doing. And they need to be able to explain in easy to understand language what your Financial Statements, Profit & Loss and Balance Sheet mean.

Action Step - 03: Click the button below Contractors Bookkeeping Services Guide to download it. Read it and make notes then put the notes in your three ring binder.

#3 Your Income Tax Return Preparer

If your bookkeeping is solid you can use any qualified tax preparer to fill in the blanks and generate the return. I used to believe only a C.P.A. could fill out a tax return. Now with the advances in technology and properly setup QuickBooks I no longer feel you need a C.P.A. for this.

Action Step - 04: Ask your construction accounting services and your banker for referrals of tax preparers in your area.

#4 Your Commercial Attorney

If you own and operate a business you absolutely positively need a commercial attorney to:

-

Setup your business entity, LLC, Inc. or whatever is best

-

Review contracts you will ask your customers to sign

-

Review contracts you will be asked to sign

-

Keep you out of trouble wherever possible

-

Keep you out of litigation if at all possible

-

Setup your partnership agreements

Two kinds of contractors: ones who have a commerical attorney and ones who will get a one after having locked horns with somebody else's commercial attorney. A good commercial attorney will draw up employment agreements, construction contracts, review insurance policies and more. A qualified commercial attorney is worth every dime they charge.

Action Step - 05: Ask your construction accounting services and your banker for referrals of construction attorneys in your area.

#5 Your Financial Planner

Eventually you will want to leave your business and pursue other interests so plan ahead now. You could start with Quicken software and play around with it. You can learn a lot about investing and run some scenarios that will show you how much income you will need to retire and develop an action plan.

Once you have some basic knowledge get a Certified Financial Planner. If you do not have a lot of money to ask your commercial banker to recommend someone at the bank and eventually when your reserves build up get a Certified Financial Planner.

Action Step - 06: Ask your construction accounting services and your banker for referrals of financial planners in your area.

Secret #03 Understanding Construction Pychology

It is one thing to be a carpenter, plumber, electrician, framer, drywaller, painter or any other master craftsperson and quite another thing to own a construction company that does those things.

When you are doing the work you have only one thing to worry about, getting things done. And things tend to do what you want them too most of the time. When they don't you simply use more brute force.

When you are the owner of the company you will find yourself dealing with people and people can appear to be illogical, unpredictable and until you understand them and learn how to lead them they will drive you crazy or you will degenerate into grouchy, irritable, mean, nasty troll with your face in a constant state of anger and frustration.

We Live In A World Of What Is, Not What Should Be - Randalisms and when we understand there is a "Hall of Justice" but not a "Hall of Fairness" we are better equipped to succeed.

Skip all of that and take full advantage of the FREE resources we have available here

Click On The Title Below To Read All About The Topic

Spouse Bookkeeping And Divorce

Construction Leadership Styles

Construction Company Board Of Advisors

Construction River of Commerece

Construction Project Manager PMP

Construction Project Manager Thinking Patterns

Construction Worker Thinking Patterns

Construction Apprentice Thinking Patterns

Construction Bookkeeping Personalities Review

Professional Bookkeeper Traits

Bad Bookkeepers Train Their Boss

Bad Bookkeepers Can Raise Your Taxes

Cheap Bookkeepers Are Very Expensive

Incompetent Bookkeepers Are More Expensive

Is Your Bookkeeper Training You

Why Bookkeepers Embezzle And Steal

Construction Business Operating Like Fire Fighters

Who Really Owns Your Construction Company

Three Types Of Construction Workers

Contractor's Business Round Table Reduces Profits

People Who Got You Where You Are Cannot Take You Where You Are Going

Contractors Who Adapt And Survive Continually Innovate

The Truth About Owning A Construction Company

Construction Workers Who Think Too Much Can Lead To Injuries

Contractors Need Results Not Advice

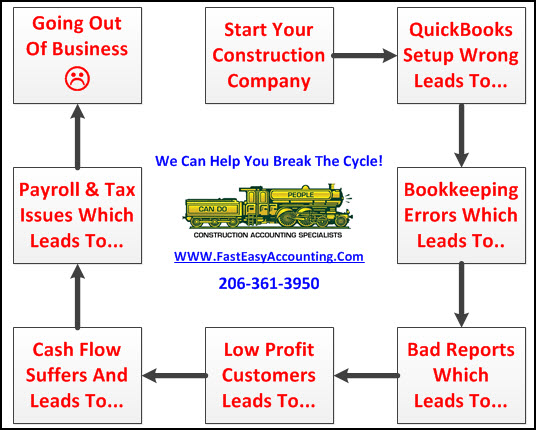

Secret #04 Avoid Typical Causes Of Construction Company Failure

-

Working for customers instead of clients and not charging enough (The 80-20 Rule)

-

Not using Additional Work Orders or Change Orders (Click For FREE Change Order Template)

-

Cash flow issues kill contractors even though they have profit

-

Changes in their operations due to contingencies beyond their control

-

Contractors are subject matter experts in a few areas then believe they know everything

-

Sales tax liens against contractors twenty two times higher than any other business

-

Poor document management and QuickBooks setup incorrectly results in overpaying taxes

-

Poor scheduling affects production and cash flow

-

Management skills are learned in the school of hard knocks

-

Lack of understanding of Construction Psychology

-

Creatures of habit performing the same mental scripts getting the same bad results

-

Contractors assimilate pictures faster and easier than numbers and words

-

General distrustful of their Board of Advisors until it is too late

-

Generally not able to construct BPM Strategy Tools to help them in decision-making

-

Generally do not plan from back (end goals) to front (current operations)

-

Look at financial data as time allows and in a historical context only, no forecasting

-

Operate in the manner that is their organic, natural instinct (it feels right)

-

Predominantly not financial managers and do not understand the value of outsourcing

-

Work primarily IN the business but not ON the business

-

Spend a good deal of time “putting out the same fires” over and over

-

Value production over planning

-

Want to work less and earn more money but not willing to learn how

-

Burn out is high after the tenth year of owning and operating a construction company

-

They would like problems solved for them without spending time or money

-

They want instant understanding, instant answers and instant results

-

Time and money are the commodities that are in the shortest supply

-

Work-In-Progress (WIP) report the ultimate gauge for cash flow and least understood

-

Working on stuff you are not skilled in by trying to save money

-

Ignoring Profit Centers and Key Performance Indicators (KPI)

-

Attending the business round table at the local bar which leads to Intellectual Incest

-

Contractors don’t plan, they recover

-

Do you have lots of “Squeaky Wheels” and do you carry a bucket of grease at all times?

-

Every contractor with cash flow problems works too hard, has too many clients and sells to much

-

Every contractor’s income is the average of their customers and client’s income

-

Good job pays $40K a year whereas a contractor with good financial reports earns $100K+ a year

-

Having ten dollar conversations instead of million dollar conversations

-

Lack of good accounting records causes 9 out of 10 contractor’s business failures

-

Not one contractor’s business failure had meaningful records in the Quarter preceding the failure

-

Poor contractors do their own accounting, payroll, and tax reports to save money; and yet they don’t

-

The more you know about bookkeeping the less successful you will be in your contracting business

-

Wealthy contractors work on building relationships and innovating (faster/better/cheaper)

-

Wealthy contractors outsource their Accounting and get timely financial and business coaching

-

Thinking you can only create wealth if you are doing the work

-

Thinking you can get rich with your head in a ditch

-

Working ten hours a day instead of focusing on marketing and innovation

There are simple answers to all complex problems and they are usually wrong. The last thing I leave you with is knowledge is power. You have what it takes to be successful and you deserve to be wealthy because contractors add value to other people's lives'. We stand ready to serve when you are ready to contact us.

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

We Scan Your Receipts And Invoices link them to QuickBooks transactions where it is appropriate and give you back a CPA-ready packet for your tax return and we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.