How To Get Your Construction Business Started Right – TIPS

T = Taxes

The last thing we want to think about is TAXES when in reality it the First thing we should be thinking about. Our office is in Lynnwood, Washington so this blog is directed to Washington State residents.

Think /Research / Choose

Your Business Name: Who Are You?

Is That Your Trade Name? Are They The Same Name?

What Is Your Domain Name?

First Stop: Secretary Of State

What Type of company entity am I. What is my ownership structure for the Federal / State Agencies?

Who we are determines what type of taxes we pay as a part of our personal 1040 tax return

To prevent duplicate identification numbers (UBI) it is recommended to file your company identity the Secretary of State

Choices:

Sole Prop – No Registration Necessary

S-Corporation – Registration

C-Corporation – Registration

LLC (Limited Liability Corporation) – Registration

In Our Opinion: Never ever do a partnership. We recommend setting up as an S-Corporation.

Call Sharie 206-361-3950 and discuss why she thinks it will do everything you want it to do!

Wait until your documents arrive from the Secretary of State

Washington State will issue a UBI (unified business identification number) which will be requested on multiple forms as long as this company is in business. Use this packet of documents to fill your Business License Application. (It is much easier than the process of cancelling a second UBI number)

Second Stop: Federal Employer Identification Number

Apply for a Federal Employer Identification Number (FEIN) Whenever you have employees this number is required no matter what type of ownership structure. Many years ago a personal social security number was used. Government will request both the personal social security and FEIN on some forms.

Third Stop: State of Washington Business License Application

Washington State Business License Application (commonly known as the Master Business License)

This is what registers the business. Depending on your type of business whether you need to collect sales tax, pay business and occupation tax to the State of Washington.

The agency that receives tax revenue from businesses is the Washington State Department of Revenue. This department also determines the frequency a business must pay their state sales taxes. Frequency is based on sales volume and previous filing history. Sales Volume = tax liability. Frequency is broken into (3) categories:

Monthly Quarterly Annually

Business License Application:

Read the entire form before you begin as it will ask multiple questions about Trade Names, Employees, Business Ownership. Click Here For The Application

1. Purpose of Application

Register Trade Name:

Company can have many trade names; Trade names can be added at anytime

Recommend having a Trade Name that is different from your “Ownership”

Call Sharie 206-361-3950 and discuss why!

NOTE THE PHRASE: Business Has or Will Have Employees

New business owners sometime get excited and check this box.

I recommend waiting until you have hired your First employee.

2. Licenses and Fees

Industrial Insurance (Labor & Industries, L&I, Workers’ Compensation) – Required if you will have employees.

Unemployment Insurance – Required if you will have employees.

There is No Fee to set for employees at this stage. Note: Quarterly reports are required to be filed even if you have no employees and / or no payroll. There may be a PENALTY if reports are not filed on time.

3. Owner Information

Select ONE ownership structure: - Enter the information you obtained from the Secretary of State

4. Location / Business Information

Where you are located / how much sales do you expect for the year.

Remember Sales Volume = Sales Tax Liability. Higher tax liability = more frequency of payment to Department of Revenue. Delinquent filer may automatically be converted to monthly to help them better manage their Sales Tax Liability

NOTE: City Business License Registration: Just as you can select the box to add employees you can be over enthusiastic on which cities and how many you will be working in. Each city selected may send an application for a City Business License.

5. Employment / Elective Coverage

Required if you have employees other than yourself. Elective coverage for yourself.

6. Signature

As a construction contractor you may be required to have a Contractor's License.

This is issued by Labor and Industries (it’s another department that oversees this license) As a former contractor – I know it well

Note: Enforcement officers are in the field on job sites looking for unlicensed contractors.

We are here to help you get started………

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

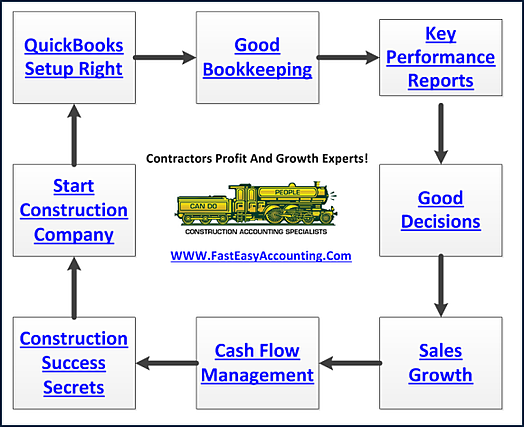

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/