Taking steps to create a good foundation in the early days of your business is essential for a sustainable and profitable future.

It's rare these days that your prospective leads happen to find your construction business and become a client with no work. Your company has to grab people's attention, turn curious visitors into leads and then convert those leads into sales.

Keep in mind: Marketing-Accounting-Production

Read More

Topics:

Construction Marketing,

Construction Bookkeeping And Accounting,

MAP vs. PAM,

Contractor Tips,

Construction Productivity,

Construction Organizational Change

How often have you hired someone with the expectation that they know how construction works, and then you found out they did not know about it? You are a master in the construction industry, so you recognize what to look for in your particular field and quickly observe if someone has the skillsets, and you proceed accordingly.

You know what happens when you send your best Rough Carpenter that you pay piece work for framing spec from the ground up in all kinds of weather and working conditions to install some custom-made cherry wood cabinets with gold plated pulls and knobs in the home of your best client (who happens to be in the wealthiest neighborhood in your town). It is not a pretty sight.

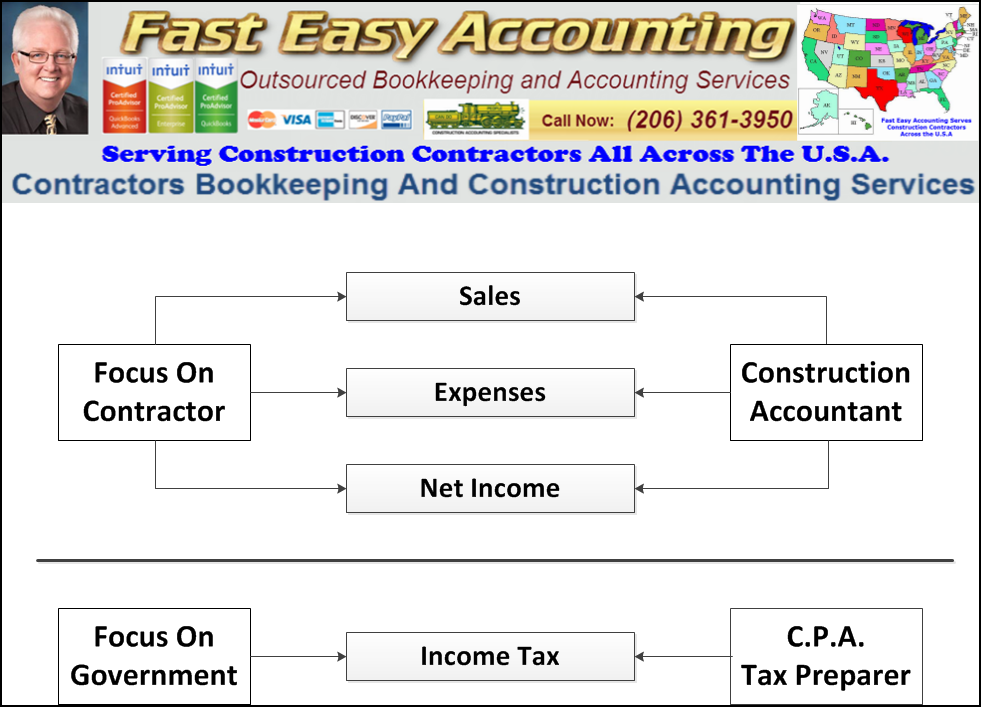

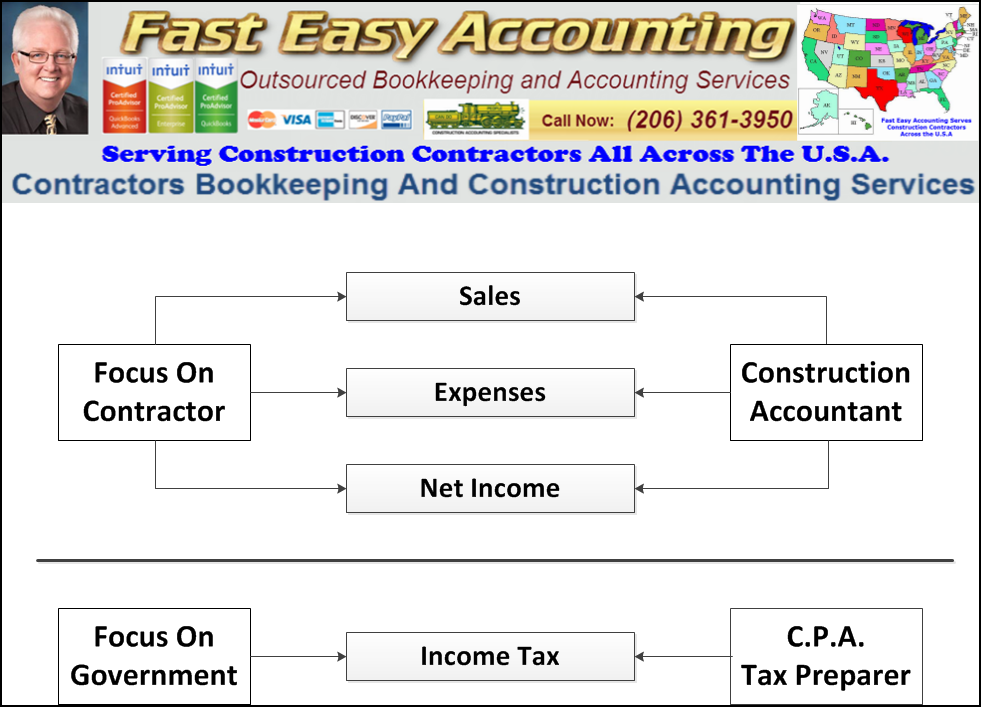

Have you pictured a crew with muddy work gear and boots stepping onto your client's pristine floors? The dirty secret is that Tax Accountants operate like Rough Carpenters because they work fast and furious, and they are paid piece work. The main difference is that they earn the bulk of their annual income in three and a half months. This means they do not waste any time going through your receipts to ensure you get all the deductions you are entitled to.

Read More

Topics:

CPA Vs Construction Accountant,

When Contractors Need A CPA,

Construction Bookkeeping,

Construction Bookkeeping And Accounting,

Construction Accountant Who Listens,

CPA,

Contractor Tips

Operating and growing your construction business requires more than functional and skilled employees, but it's an excellent start. You need a steady stream of quality, paying clients to keep your company afloat. Likewise, deciding on an online marketing plan can be overwhelming for company owners like you who are looking for affordable ways to nurture consistent, sustainable growth. With time in short supply, the key is to find one or two growth strategies that will get results at a minimal cost.

Building a construction business requires collaboration and partnership. The deployment of employees in a way that allows them to work together to problem-solve and act with a shared sense of urgency; and increasing brand awareness through an alliance with people in the industry are simple, cost-effective ideas for building your company within, in the office or job site, or externally through referral and online connections.

Read More

Topics:

Profit and Growth Strategies For Contractors,

Construction Bookkeeping And Accounting,

construction business partnership,

Boost Construction Profitability,

Construction Collaboration

Inflation has ballooned worldwide in recent months, and there's no question that small construction businesses are feeling the pinch. Supplies cost more, employees are hard to find, and your profits are shrinking.

This can lead to operating at a loss - spending more money than you make. Otherwise, you will eventually run out of cash reserves and be out of business. And while it's not uncommon, especially for new companies, it's still not ideal and shouldn't continue in the long term.

Be aware of what's going on in your industry and adjust. Customers judge a business based on perceived value. If you're at the bottom of the pack price-wise, they're likely to skip over you to get a good deal. Price yourself accordingly to attract quality clients.

Read More

Topics:

Construction Bookkeeping And Accounting,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability,

Inflation,

Construction Business Inflation

So you have a great business idea and are convinced you can make it work, but you don't have much capital to get your business off the ground. Juggling existing financial commitments such as a mortgage or bank loan could put a squeeze on your business plans. Many entrepreneurs use creative thinking and shrewd planning to get businesses off the ground with the smallest budgets.

Freelancers in all industries deal with the same problems due to the nature of their work. Most of you came from the skilled craftsman trades; some worked as construction company managers and have now started or thought of starting your business.

If you just did, congratulations, you have decided to own and operate a construction company. Practically, solo contractors manage every aspect of their business, but we are here to help you navigate it. Here are the things you need to consider (especially when you are on a limited budget) to keep it running.

Read More

Topics:

New Contractors,

Construction Cash Flow,

New Business Startup,

Construction Bookkeeping And Accounting,

Construction Company Startup Tips,

Contractor Tips

When you think of payroll, you might still envision paperwork and envelopes given to employees by hand. Even with direct deposit being the norm for years, there is still a significant paper component to manage.

You won't find a contractor using inefficient tools on the job site these days. The hammer or the nail gun? No question. While every contractor recognizes the flaws of using ineffective tools, they may still be losing money due to inefficient payroll tools and processes.

As with most things, payroll is going digital – for a good reason. There are many benefits to digital payroll for construction business owners and staff alike. Read on to learn why switching to paperless payroll could be right for you.

Read More

Topics:

Construction Cash Flow,

Construction Bookkeeping And Accounting,

Key Performance Indicators,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability

The new year is a natural time to decide what you want to achieve and how. Businesses tend to progress more consistently if the owner sets financial goals and makes a plan to achieve them.

Your construction business (and personal) budget is one area where you should keep your resolutions from slipping. While it’s true that there’s also next year when it comes to your financial goals, putting it off has real consequences that equal less money and more work. So here are seven steps you should take in January to start your 2023 budget.

Read More

Topics:

Construction Cash Flow,

Construction Bookkeeping And Accounting,

Key Performance Indicators,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability

The end of the year is typically a reflective time. Something about that lull between holiday festivities and New Year's Eve sets the stage for introspection and review. While you're busy reflecting on the year ending and making plans for the new one about to begin, make sure you take some time to consider your finances.

Preparing your End of Financial Year (EOFY) information often feels stressful—there are receipts to sort out and reports to review. You must ensure you have all the necessary information about your income and expenses. It can be overwhelming, and it can make the EOFY feel daunting.

The end of the financial year isn't just a time to collect receipts and find invoices. It's also a time to reflect on how your past year went, what went well and what didn't, and what you can change for next year.

Read More

Topics:

Construction Cash Flow,

Construction Bookkeeping And Accounting,

Key Performance Indicators,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability

Small construction company owners like you already have a time-consuming and challenging job running your business. If you're working on weekdays, you usually need the weekend to catch up on paperwork, pay bills, and manage any tasks you didn't get to during the week.

But this weekend is Christmas, and with it comes time to relax, focus on family and friends and take stock of what is essential in life. Phone calls from employees dealing with a minor crisis will pull your focus from your family, or your Christmas dinner will be taken over by business talk. Like the merry bells of Christmas, your cell phone will constantly chime with the sounds of urgent text messages and emails that must be dealt with. Clients will need your attention.

So, if you've been waiting for a sign or permission to pause, this post could be the one you're waiting for. It's easy to let the construction company take over your personal life, but as a small business owner, it's vital that you get some time away from work.

Read More

Topics:

Construction Cash Flow,

Outsourced Accounting For Contractors,

Construction Bookkeeping And Accounting,

Do What You Do Best And Outsource The Rest,

Contractor Tips,

contractor delegation,

Switching Off During The Holidays

The year is almost over. Fourth-quarter and year-end deadlines are approaching. Most construction business owners who reach out to us describe this as their "Year End Madness" to prepare their documents for the tax accountant.

The end of the year tends to be chaotic for construction company owners, but it's an excellent time to get some extra housekeeping done for your business. If you're on QuickBooks, you can click the Help Menu; depending on the year and version you're using, you can access the Year-End Guide, which will show you how to wrap up your business year. It's not an easy process, but it's all worth it.

Why? Because tax preparers will take what you give them - they don't have the time, and it's much work that you've paid for, but a good tax preparer will know how much you can save if you can track your money. Bottomline - pay your taxes right, but it doesn't have to be more than what you owe.

Read More

Topics:

QuickBooks Year End Closing Tips For Contractors,

Construction Bookkeeping And Accounting,

QuickBooks Year End Closeout,

Contractor Tips,

Reducing costs,

Year End Tips For Construction Contractors