Marketing Headline Is Contractor Needs Accountant.

The Answer is Yes – Every Contractor needs a Construction Accountant.

The Question is Why Does the Contractor need an Accountant?

- Does the Contractor have an Accountant?

- Does the Contractor have Bookkeeper?

- Sometimes the Answer Is Yes.

No Charge One-Hour Consultation

We offer a Free One Hour Consulting

Definition of Free One Hour Consulting from the contractor side is:

- I am a General Contractor

- My life and accounting is in Chaos

- What does it cost to fix it?

- Will you invoice my clients?

- Will you pay all my bills?

- Will you pay all my taxes?

- Will you pay employees?

If you have any data that you can include relating to your list, include that in your introduction, too.

I received a call from a prospect a couple of years ago. She asked questions similar to the ones above.

When I started to ask questions about her business her immediate response was:

- “I am asking the Questions – Not answering any of yours;

- “Information About My Business Is None Of Your ”

- My response was that I could not be of assistance and Hung Up.

Unfortunately dealing with an accountant is a lot like going to the Doctor.

- We are unable to fix yesterday (clean up existing or previous bookkeeping) without knowing a little history.

- We are unable to determine the proper course going forward without knowing the following:

- What do you do?

- Handyman, General Contractor, Commercial TI Contractor, Remodel Contractor, Specialty Trade Contractor, Home Builder.

Each of these answers leads to more questions.

- Do you do Remodels or New Construction

- As a Builder is It High-End Remodels, Customs, Spec Building

- Do you have multiple companies you are running in a single QuickBooks file?

- Were you formerly a Large Contractor or worked for a Large Contractor used to all of the detail of a High-End Specialty Software and wanted a $300 program to provide the same results?

- How are currently handling your payroll if you have employees?

- If no, employees do you plan to have some in the near future?

We are in Washington State. It is fairly easy to become a Licensed General Contractor, Specialty Trade Contractor or Home Builder.

It starts with determining what type of Business Entity do you want to be and register with the Secretary of State.

- Sole Prop

- Partnership

- LLC

- S-Corp.

The Trick Is Do Everything In The Right Order Knowing It Is “Hurry Up and Wait.”

Once your name is registered with the Secretary of State you can get your Federal Tax ID Number from the IRS. Move on to applying for your Master Business License. Then finally the Contractor License with State of Washington’s Department of Labor and Industries.

Each state is a little different in it’s licensing rules. Some make it easier to become a Handyman and much harder to become a General Contractor. Your state may require State Exams.

Each state is a little different in how it deals with sales tax. Some states do not have any sales tax.

Others states charge tax on the material (which is paid to the supplier at the time of purchase).

Washington State is a sales tax driven state. Every contractor must charge sales tax on all customer invoices unless they have a resales certificate from a General Contractor that the project is wholesale.

Builder / Developer who is doing Spec Homes is the owners of the property. As the owner, the Builder / Developer must pay sales tax for all material, labor and to their contractors as they go.

Handyman is licensed as General Contractors as they do a little bit of everything. From installing closet rods to the full-scale kitchen and bath remodel or whole house remodels.

An additional twist is that Washington State Sales Tax is destination based. We need to keep track of where the sale is located. Every city has their own sales tax code (and individual local rate in addition to the state sales tax based). Luckily, we are able to file a combined return directly to the State for both State and Local sales tax. Depending on the company, the report and payment may be due Monthly, Quarterly, or Annually.

Payroll Is A Big Deal As Our Worker’s Comp Is Run By The State Of Washington.

- For all businesses, Workers Compensation is based on Hours worked, and the rate varies by trade and experience factor.

- It’s sound simple to say but adds the need for electronic time sheets for all employees including owners.

- In 2017, we are required to pay Personal Time Off for employees working inside the Seattle City Limits.

- This includes delivery drivers who on their route make stops inside the Seattle City Limits

- In 2018, a Washington State Rule is that employers are required to pay Personal Time Off for all employees including Part Time.

My Questions Help Me Understand Your Contracting Company.

- It is easier to do what I call “Playing Within The Lines.”

- The first Step is figuring where the Road is.

- What Do You Do?

- What Size Is Your Business?

- Do You Have Tools and Equipment?

- How Many Customers?

- How Much In Sales?

- Are you a Bigger Business with lots of Employees?

- We can talk – I will steer you to a Payroll Service and an In-House Bookkeeper.

- Do you have multiple companies?

- We can talk – We may be able to assist with the bookkeeping for some of them

- We are able to Setup, Cleanup, Enter Missing bookkeeping for most QuickBooks Desktop files

- Are you a Handyman, Specialty Trade Contractor, General Contractor with Zero to 5-7 employees

- We can talk – We may be able to assist with the bookkeeping

- We are able to Setup, Cleanup, Enter Missing bookkeeping for most QuickBooks Desktop files

- Are you a General Contractor, Custom and Spec Home Builder.

- We can talk – Accounting for each of these types of contacting is slightly different.

- Understanding exactly What You Do helps us Determine What Needs To Be Done.

We Understand Construction Accounting.

We know “What To Do” without additional supervision. Based on what you have “Told Us” we are able to do ongoing Bookkeeping. The issue happens with lack of paperwork, specialty projects where suddenly unseen Partners are involved; it appears to be a Custom Home but instead is a Spec Home or a variety of other factors where the “Bookkeeping Department” is the Last To Know.

I have heard stories from owners who are unhappy with their existing In-House bookkeepers. In many cases, the In-House Bookkeeper has tried to do a good job with too little information which did not arrive in a timely fashion.

It is impossible to enter into QuickBooks Desktop receipts they do not have and to keep up the checking account without information about customer payments and deposits.

Basics For All Accounting Is:

- Customer Invoices

- Customer Payments

- Bank Deposits slips with details of Customer payments

- Bank Statements

- Credit Card Statements.

Job Costing Is A Joint Effort Between Field And Office

The “In House Bookkeepers” are expected to know which job or which the phase of a project (code to an item or Schedule of Values) without any guidance from the Project Managers. A Load of lumber from the Lumber Supplier is material to the Bookkeeper.

It is unreasonable to expect an In-House Bookkeeper or us to know by looking at lumber receipts the material was used for Framing, Rough-In, Decking, or Trim for the House, Garage, Shed, Barn, Cabana, Gazebo, or Children’s Playhouse.

QuickBooks Job Costing Reports

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

These Reports - Can only be found in the Premier Contractors and Accountants editions of QuickBooks. Some of them are also available in the Professional Services edition.

We offer Job Costing Report Service click on button below to learn more

Costs to Complete by Job Summary - Once you enter an estimate for how far along each of your jobs are, this report will summarize the cost to complete each one of them that have active estimates. It also shows you how much you are over or under your estimate.

Costs to Complete by Job Detail - Report drills down to the detailed estimated cost by phase for whatever customer or job you select, and it shows you how you are doing in relation to your estimate.

Job Costs by Vendor and Job Summary - Report lists the job costs you have incurred for each job or project and it is subtotaled by vendor.

Job Costs by Vendor and Detail - Report shows a detailed list of all the job-related costs that you have incurred for each vendor, subtotaled by job.

Job Costs Job and Vendor Summary - Report lists the job-related costs you have incurred for each vendor, subtotaled by job.

Job Costs Job and Vendor Detail - Report shows a detailed list of the job-related costs you have incurred for each vendor, subtotaled by job.

Job Costs Detail - Report lists all the costs you have for each job. This report is useful if you need to separate all material supplier purchases, subcontractors bills, and labor costs for each job.

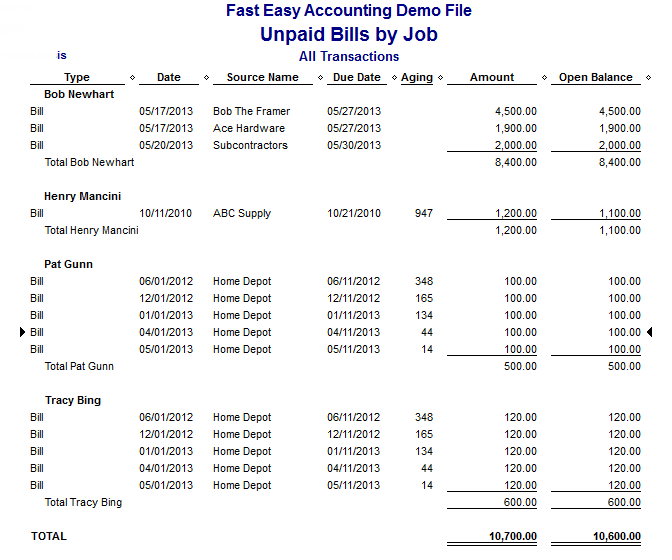

Unpaid Bills by Job - Report lists the bills you have not yet paid, separated by customers and jobs. It lists only bills with a customer or job associated with it. This report is useful if you wait to pay vendor bills for a specific job until you receive a payment from the customer; Pay-as-Paid.

Unpaid Job Bills by Vendor - Report shows all bills you have not yet paid, sorted by vendor or subcontractor, and lists customer or jobs associated with each line item on the bill.

Expenses Not Assigned to Jobs - Report lists costs that have not been assigned to a customer or job, totaled by vendor. This report helps you find costs that may not have been passed along to your customers.

Job Status - Report lists information for each active customer and job.

We Have Several Solutions Available For You

- Outsourced Accounting Services.

- We do the bookkeeping so you can focus on the parts that only you can do.

- Meet your customer, create an estimate, close the sale, oversee the work, invoice the customer and collect the money.

- Only you or your spouse should have direct access to the bank and pay the bills.

Call me old fashioned – if you chose your spouse as your “Life Partner” they should be your business partner. It gets down to a really basic fact. There is too much to do for One Person to do. If your spouse is your business partner (even a tiny percentage) they are a real person in the company and can collect the money, write checks and talk to the government, banks, etc.

If something happens to You, The Contractor, the house payment still needs to be made, the shop rent or mortgage payment still needs to be made, the truck or van payment needs to be made. Payroll still happens. Then, your spouse still has the asset you built and can decide to keep, run the business on their own or sell it. In the meantime, your spouse has the authority to do what needs to be done.

Most spouses do not want to be active in the business they want to do their part for a better life.

We use QuickBooks Desktop Version in a Cloud environment with Commercial Host approved by Intuit

Imagine Being Able To Push A Button And Have:

-

The Key Reports You Need:

-

Cash Report anytime YOU want it!

-

Receivables report anytime YOU want it!

-

Payables report anytime YOU want it!

-

Profit & Loss statement anytime YOU want it!

-

Balance Sheet report anytime YOU want it!

-

Job Costing report anytime YOU want it!

-

Estimates Vs. Actuals report anytime YOU want it!

-

Frequently Asked Questions And Answers Click Here

The Screenshots Below Were Taken In Our Lynnwood Washington Office

QuickBooks Is 1,000+ Miles Away Running On High-Speed Servers

Tucked Securely In A Building With Armed Guards

With Highly Skilled Technicians Maintaining It

All QuickBooks Files Are Backed Up Every Night On A Secured Server

Access Windows QuickBooks Desktop Version From PC or Mac

English Speaking, U.S. Based Technicians Maintain The Server

QuickBooks Software Updates Are Automatically Applied

We Provide Your QuickBooks Maintenance And Support

We recommend everyone have on a Cloud with his or her accounting. All of our Outsourced clients are in the cloud. Their access to the QuickBooks Desktop file is optional depending on their needs.

Assisted Do-It-Yourself Accounting

- We can set up QuickBooks file and return to you

- We can setup, cleanup existing QuickBooks file and return to you

- You can choose to stay in our Cloud environment and do your own Bookkeeping.

- Immediately be on the Server with their Existing QuickBooks Desktop File (current version)

We recommend Our Customized Setup of QuickBooks File it is not a requirement to be on the server

We are there if you need us; other than maintenance to your QuickBooks file we are not reviewing your QuickBooks data. You must request additional services for us to review your data.

Other Do-It-Yourself Accounting Services

- We understand Construction Accounting and have developed basic QuickBooks Desktop files and Chart of Accounts for the Do-It-Yourself Contractors who feel if they had the basics

- They could do the following on their own:

- Do their own bookkeeping going forward

- With a proper setup – clean up existing file.

- With missing items added to current setup – continue with their own bookkeeping.

- With limited Consulting and Training – can continue doing own bookkeeping easier.

Please visit our Fast Easy Accounting Store to for additional Self Service Solutions.

- QuickBooks Setup Files are based on US Version of QuickBooks Desktop.

- Chart of Accounts and Item lists should work for both our US and International Friends.

- We have recently added our Free Forms to the Fast Easy Accounting Store.

We Help A Little or A Lot Depending On Your Needs

- I appreciate your detailed emails about your business. They are very helpful.

- You can never be Too New or Too Small For Us To Help

- You can be a weekend warrior to an active contractor.

- We welcome new Outsourced Accounting Clients.

- We welcome new Do-It-Yourself Clients.

- We welcome new Consulting Clients

One Hour Free Consultation is available to everyone

The idea of digging a “Big Hole” in the backyard and filling it with everything in your contracting company that aggravates you up can be appealing. Not really a practical solution to cleaning and organizing your truck or shop. Equally throwing all you paperwork away isn’t really a practical solution either. Any missed deduction equals more taxes on your Local, State, Federal tax return. We try to make life easier for our clients, working together – It Works!

Thinking Happy Thoughts for 2017

Looking forward to chatting

Sharie DeHart

206-361-3950

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

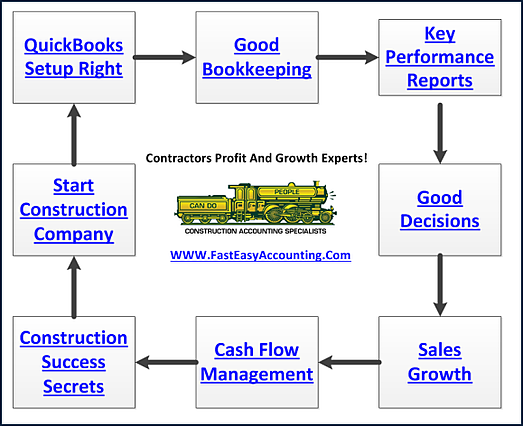

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar