Which QuickBooks Is Best For My Construction Company?

This question comes up a lot when a contractor asks us about our Outsourced Contractors Bookkeeping Services Program. In most cases we only invite construction companies with annual sales up to $10M and no more than 20 employees to become clients. The reason has to do with a principle from the study of economics known as expansion isoquants which describes the hidden dangers of growing any company to higher and lower production levels. Click here for more about this concept of Optimize Vs. Maximize.

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

We generally recommend the current version of QuickBooks Premier because it gives the most "Bang For Your Buck".

However, before making a definite recommendation to any construction contractor we like to get the answers to the following questions:

-

Who is doing the bookkeeping now and are the Professional Bookkeepers or Bad Bookkeepers?

-

Are you getting the reports you need to operate and grow your business?

-

What are the estimated gross sales for this year?

-

How many jobs / projects / homes are you expecting to finish this year?

-

Are you interested in knowing which jobs were most profitable?

-

How many jobs do you put together detailed estimates?

-

Are you interested in reports that show estimates vs. actuals?

With a rare few exceptions we only invite construction companies with sales volumes between $0 up to $10 million a year because after being in construction and construction accounting we know these folks can make a decent profit and we are best suited to help them.

Construction companies with sales between over $10 to $100 million a year are in a very difficult position and tend to suffer deeply and mightily before they fail.

Construction companies with sales over $100 million a year are in a class of their own and generally very well managed.

So this posting is focused on construction companies with annual sales up to $10M and as many as 20 employees

Remodel & Specialty Contractors

If you are a remodel or specialty contractor who do fewer jobs in a year at lower margins with a higher risk factor regarding profit you should consider QuickBooks Pro with some specialized add on software for customer relationship management, complex invoicing, project management and Estimating.

Service & Repair Contractors

If you are a plumbing, electrical, HVAC contractor, pest control, handyman or other related businesses with 1-5 trucks or vans then your accounting needs are simple and QuickBooks Premier with some simple add on software for dispatching and customer relationship management software will work just fine.

Home Builders Spec & Custom

If you are a spec builder your accounting needs are very complex because the costs to build your home are accumulated into specific asset accounts and you only show a profit or loss on the day the HUD-1 statement is entered into your accounting software.

It is interesting to note that a number of banks and private lenders who finance construction loans have a difficult time lending money to builders who treat their bookkeeping and accounting as an overhead expense instead of an investment.

It is glaringly obvious to the lender within a few minutes of reviewing their financial statements they may be very good builders but that skill set does not carry over to construction bookkeeping and accounting. Most lenders do not want to offend a customer so they will not tell you.

The builders who do this are the last ones to get financing and only if they have a long history in construction, deep pockets full of cash, titles to property or the demand for new homes is far greater than the existing inventory. In most cases I have seen they usually pay higher interest rates and have hidden fees.

Banks do this because they are not in the business of construction so they have to "pad the fees" to cover losses when and if they have to bring another builder in to finish building the home.

These builders are also the first ones to be hassled by the lenders when housing demand slows down.

If you are a custom home builder your accounting needs similar to remodel contractors with one added requirement if you are getting paid from the home owners bank you have to prepare bank draws.

Commercial Contractors

If you are a commercial contractor doing mostly T.I. or tenant improvement work your construction accounting needs are very detailed and the most complex of all because:

-

You have multiple people looking over each Pay Application

-

In most cases you have multiple pay applications

-

Change orders for adds and subtracts to be accounted for

-

Different retention % for completed work and stored material

-

Initial down payments in some cases

-

Additional deposits for custom fabrication work

-

Everything must be fast and easy to read and understand

To summarize for our commercial construction friends, if you want to maximize your bottom line profits then whomever prepares your pay applications needs to understand construction and be as skilled in construction accounting as Ginger Rodgers was when she danced with Fred Astaire in the movies. She did everything Fred Astaire did; only she did it backwards and in high heels!

Well that wraps up Episode2 of why our construction bookkeeping and accounting service is different and your comments are always welcome. I would like to read your thoughts and ideas on this subject or anything related to construction.

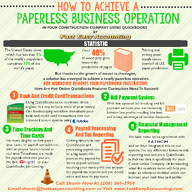

Business Process Management (BPM) For Contractors

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

QuickBooks Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+