Warning This Article Is Tough On Bookkeepers Who Abuse Their Bosses!

It Was Started At 03:00AM As I Reflected On Bad Bookkeepers Who

Destroy Construction Company Owners Lives!

Proceed With Caution If You Dare!

How Do Bad Bookkeepers Train Their Boss?

Like An Organ Grinder Trains A Monkey!

Not all in house construction bookkeepers are rotten. It seems to me the 80-20 rule applies here and only 80% of them are rotten. Yes, I know that sounds a bit harsh please understand it comes from over thirty years of experience in the construction industry both as a contractor, a construction accountant and a profit and growth coach for a few select construction company owners. I have been there, done that, got the T-Shirt, the tattoo and sang a song about it.

Construction Bookkeeping is an unusual profession that seems to attract two groups. The bottom 80% wake up every morning hating life because they stumbled into being someone’s contractors bookkeeper all because they were at the wrong place at the wrong time. The top 20% best and the brightest that appear to have answered a "calling" like an Olympic athlete who dedicates a portion of themselves to lifelong learning and practice to be the best.

Even as a construction accountant operating a plumbing service and repair company with seven trucks and over twenty employees I never ceased to be amazed at how many so called "bookkeepers" would apply for a position and within a few short minutes of me asking some key questions I would usually get to the truth, which is four levels deep.

The Four Levels Of Bad Bookkeeper Truth

Number One - What bad bookkeepers want contractors to hear

Number Two - What bad bookkeepers want to contractors to believe

Number Three - Everything else

Number Four - Truth

All too often they would reveal themselves as rotten to the core. We are no longer in construction having decided to focus 100% on our construction accounting practice since early 2000.

I could easily identify several psychological issues that I knew we did not even want to deal with. The idea they would be bold enough to apply for a position knowing I would see right through them was astounding. After a while I noticed a pattern of phrases that kept being repeated and I have put a select few choice ones on the Bad Bookkeeper page.

There appears to be are a lot of Bad Bookkeepers in this world who in my opinion are looking to get even with contractors for some perceived wrong that happened to them, a friend or family member. Now I see bad bookkeepers as a train wrecks looking for places to happen!

In my opinion, and that is all I claim it to be, my opinion, the root cause of bad bookkeeper attitude is cognitive dissonance or "mental noise". They start out wanting to do a good job for the construction company owners and after a short while an idea creeps into their head and they start believing they are the most important person at the company and they should be respected and compensated accordingly. I put together a short overview of what I think may be some of the root causes of Bad Bookkeeper behavior which you can download and read and decide for yourself.

One of the biggest challenges construction company owners have with an in-house bookkeeper is training them to work for the construction company’s best interest which includes their best interest as well and not focus 100% on what is in it for them because construction company owners are desperate for answers and they reports they can trust day after day, year after year.

Having been involved with construction and construction accounting and bookkeeping for over thirty years I have seen a consistent pattern repeated over and over that will turn an ordinary decent, pleasant bookkeepers into a disheveled, broken, mean, nasty arrogant troll, and that's on a good day when the sun is shining and the birds are singing!

Here Is How It Happens:

-

Someone is assigned the construction bookkeeping duties because they are a nice person with a mild manner, shy and not able to say no. By the way it is the quiet people you need to worry about, not the loud assertive ones, just a quick hint and word to the wise.

-

The newly appointed "bookkeeper" opens the QuickBooks Pandora’s box and loads the CD in the computer believing it will be all setup and ready to go in ten minutes.

-

That's when the first of several unpleasant surprises happens and it starts with the pop quiz! QuickBooks screens start popping up and asking questions and since nobody said anything about a test or an exam, panic begins to take hold of the brand new bright and shiny construction bookkeeper. The kind of panic you get from driving down a twisting, turning, winding mountain road with sharp curves, a lot of open space with 1,000 foot drops and no guardrail at midnight after having just found out the car you're driving has no brakes and the headlights just went dim!

-

The bookkeeper thinks "don't screw this up because I can't afford to lose this job because if that happens I will be camping out in the urban environment and meeting interesting people!" The questions keep coming like a raging river so in an attempt to put the responsibility on someone else the bookkeeper asks the contractor for help and is told "I don't know, you're the bookkeeper you figure it out, I'm busy!"

-

The bookkeeper remembers a reference book with handwritten notes in the margins left by the previous bad bookkeeper about how unappreciated, overworked and underpaid they felt before taking revenge on the contractor by embezzling a substantial amount of money over a three year period and moving to a nice beach front condominium in Rio de Janeiro

-

The reference book did not help although there were some interesting notes written in the margins by the embezzler about how to get a little extra money each week out of the construction company and the bookkeeper thinks it could make for some good reading later, if needed.

-

Good news, QuickBooks has a built in guided tour for QuickBooks setup. Bad news, it was put together by a committee and as everyone knows a camel is a horse put together by a committee!

-

The bookkeeper charges forward taking all the default answers suggested by QuickBooks and in just over two hours QuickBooks is setup horribly wrong and so far it only cost the contractor of $25.29 per hour or $50.58 (click here for a sample fully burdened bookkeeper labor cost)

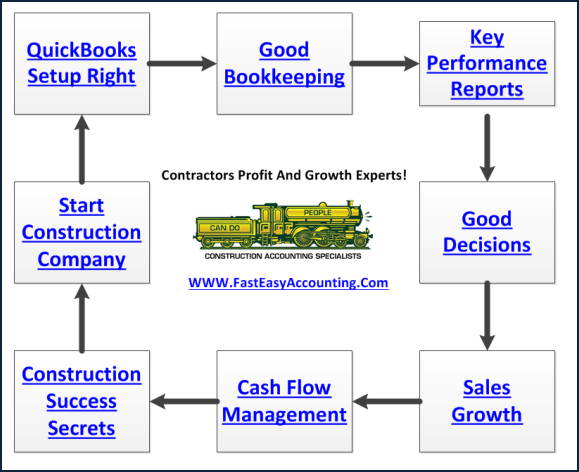

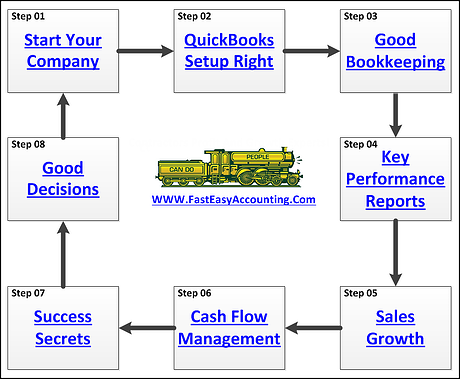

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which the construction company's entire financial system is built. Put the wrong foundation under a construction company and it will not matter who is doing the construction bookkeeping because it will always be a mess and the contractor will never get the reports they need to operate and grow their business profitably.

The Contractor's Board Of Advisors - Will be very unhappy with the financial reports and especially the lenders. However, they are not likely to say much other than "NO" when the contractor applies for a performance bond, loan or line of credit and any referral opportunities may be severely limited.

Contractors That Do Not Earn - A lot of money see bookkeeping as overhead which costs money and therefore is a drain on profits so they get a cheap computer, tiny monitor, garbage printer, tiny desk and broken down chair that even the dog would not sit in and tell the construction bookkeeper with the financial destiny of the company in their hands that is all the company can afford while the contractor drives off in a brand new F-350 pickup truck with all the bells and whistles!

-

In an effort to get their money's worth the contractor assigns all kinds of additional tasks to the bookkeeper like running business and personal errands, pickup and deliver material and paperwork to the jobsite, make coffee, answer the phones, take out the trash and clean the bathroom. Anything and everything to get "value" out of the time and money that is being wasted on bookkeeping.

-

Contractors can miss a lot of deadlines but miss a payroll and they are out of business. When that happens their staff is looking for a new job no matter what they say and the good construction workers will be the first to go.

-

As a result the contractor gets angry and makes deep noises from the chest sound like important messages from the brain and blames the bookkeeper for the missed payroll.

-

The mild mannered bookkeeper has now become The Incompetent Bookkeeper and will respond with something like: "The timecards never arrived so I could not process payroll!"

-

The contractor responds with something like: "You should have figured out how to get them even if it meant using your car, your gas, your personal time to go to the jobsite and get them! It's all your fault! I depended on you to do your job and you let me down!"

-

This is where the ordinary decent, pleasant bookkeeper starts growing a bad attitude thinking the contractors doesn't understand how difficult construction bookkeeping is with a program like QuickBooks that is all screwed up and won't work right!

-

Getting anything done in QuickBooks is a pain, a big fat royal pain, let alone all the other stuff the contractor wants done.

-

The construction bookkeeper begins to understand the construction company owner does not have a clue what is going on in QuickBooks and doesn't care because the bookkeeper was assigned to take care of the paperwork.

-

In defense of the construction company owner it is tough to run a construction company second only to a restaurant because in construction they produce reasons or results and reasons don't count.

-

Now the construction bookkeeper begins testing their new powers by letting vendors and suppliers not get paid on time and missing the 2% discount if paid by the 10th which in effect means the construction company is paying 36% annual interest rate penalty

-

When the contractor asks the construction bookkeeper why it happened they standard reply for training construction company owner's is to deflect and turn it around by saying they didn't have enough time to get the bills into QuickBooks with all the other pressing duties they have been assigned.

-

This starts another round of talks about how the contractor work 10 to 12 hours a day if that what it takes to get the job done and if the construction bookkeeper really cared they would do the same and only clock in for 8 hours.

-

Now your bookkeeper gets angry and begins to think the contractor is trying to get unpaid volunteer work that is when they cross over into full blown Bad Bookkeeper because they suddenly realize how very little the contractor knows about construction bookkeeping compared to what they know.

-

Now the construction bookkeeper understands the old saying: "The one-eyed man is king on the island of the blind!"

-

Next the bad bookkeeper begins testing the limits of how far behind the payroll tax returns, sales tax returns, labor and industries tax returns, business and occupation tax returns, city licenses and liability insurance audits can slip and how many fines and penalties can be added up like the high score on a pin ball machine or computer game.

-

And then the bad bookkeeper starts testing the limits of the contractors tolerance by coming in a few minutes late and leaving a few minutes early, talking on their cell phone whenever they please and when the contractor asks for a QuickBooks report they say: "I will get to it later" or "QuickBooks will not do that" or one of my favorites: "Can't you see I'm busy?"

-

The contractor gets more and more frustrated because they are paying penalties and interest on late quarterly tax returns and up to 136% annual interest rate for late sales tax returns.

-

Eventually the contractor goes bankrupt from cash flow issues or is faced with three responses; fight, flight or replacement.

-

If the contractor chooses to fight and demand the QuickBooks report the bad bookkeeper may work a little harder to get it done or they may do what the cook in some restaurants do when you send a meal back to be "fixed", they get even. Instead of spitting in your food the bad bookkeeper start taking shortcuts like using Journal Entries to input credit card charges which totally destroys Job Costing Reports.

-

If the contractor chooses flight the bad bookkeeper will take full control of the construction company and run it into the ground at hyper-speed.

-

If the contractor chooses replacement the bad bookkeeper will know it before the contractor does because they have learned all the contractor's "Hot Buttons" that cause them to confess anything and everything and at that point the bad bookkeeper will begin to read the reference book with the handwritten notes in the margins left by the previous bad bookkeeper who left the company after embezzling a substantial amount of money.

-

There is a fourth option. Instead of hiring another in-house bookkeeper and repeating the process the contractor could possibly save time, money and aggravation by outsourcing to a competent Construction Bookkeeping Service. Hopefully the contractor will at least consider the outsource option before allowing bad bookkeepers to drive them insane or worse!

Let's look at an example of what the incompetent bookkeeper is costing that is known and knowable in the first year.

-

QuickBooks Setup horribly wrong = $50.58

-

Payroll for bookkeeping should have been two hours a day = $6,828.30

-

Overpaying by two hours a day for bookkeeping = $6,828.30

-

Lost productivity from bad QuickBooks setup 30 minutes a day = $3,410.10

-

(click here for sample of what is 10 minutes costing your construction company)

-

2% on lost discounts X $100,000 in purchases = $2,000.00

-

Late Quarterly Tax Reports $25,000 X 25% Penalty = $6,250.00

-

Estimated Total = $25,367.28

-

Estimated Savings 40% By Outsourcing Bookkeeping = $10,146.91

-

Does not include overpaying income tax, lost productivity due to stress and a number of other unknowns.

Outsourcing doesn't cost, it pays that is why the oil change stores are so popular

Outsourcing construction bookkeeping to us is even better because all construction bookkeeping services are done in our office in Lynnwood Washington by skilled construction bookkeepers and construction accountants.

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in you QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To

Be Wealthy Because You Bring Value

To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

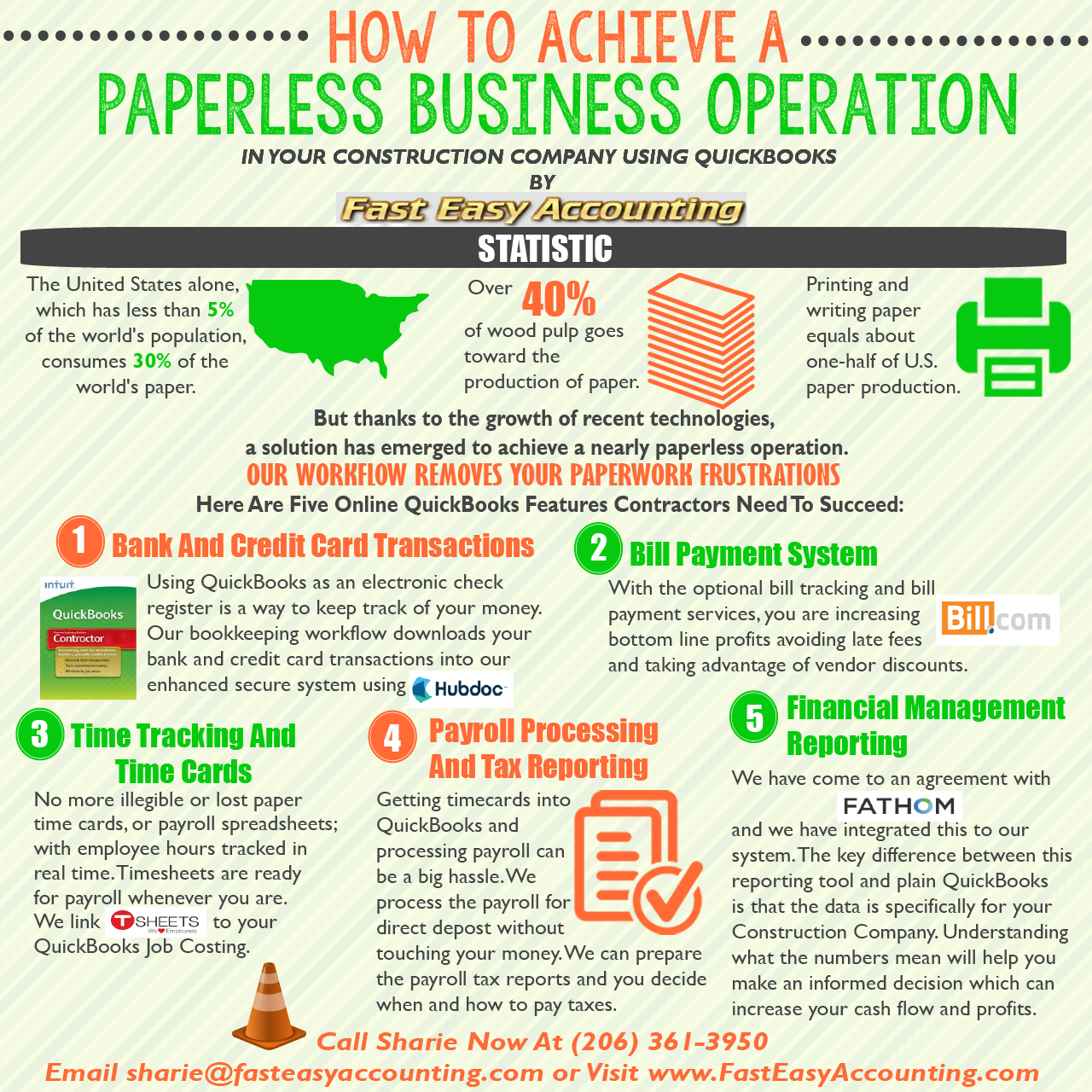

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your

Contractors Bookkeeping Services?

Click On The Button Below To

Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+