Reports Tax Accountants Use Are Profit & Loss And Balance Sheet

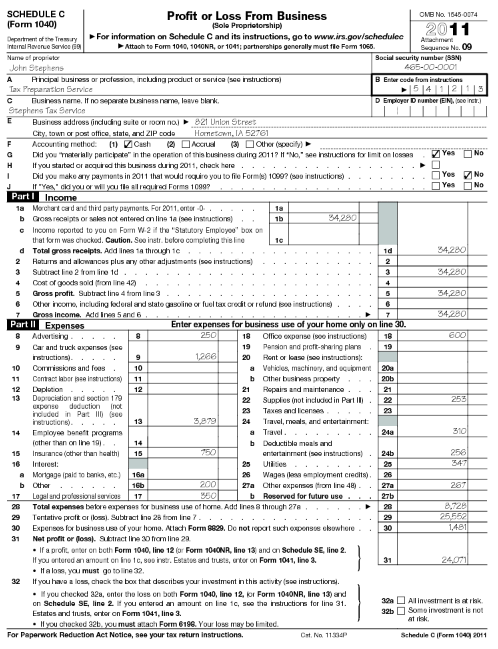

The Numbers On These Reports - Offer a summary snap shot of your business. They are referred to and reviewed over and over by banks and others. See a copy of the Schedule “C” it is the standardized format from the Internal Revenue Service.

Besides The Bottom Number – What does it tell you? I suspect very limited information. Why? Because the Internal Revenue Service has rules / regulations / restrictions about their forms and as much as they want to cram in more information. How many pages? What font size? The form becomes the “Bigger Bucket” theory.

The “Bigger Bucket” Theory - Is where data input installs as many transactions as possible are into a single line.

For Example - Income can be all of the deposits from bank statements which may have come from a single z-tape each day. Or Utilities, Office supplies, Marketing, Cost of Goods Sold (COGS) are classified as "Expenses". As the business owner you may want to know more specific information about your costs and your income in order to make intelligent decisions.

The business annual tax return - Doesn’t need to know which client if profitable – It’s all income.

It Doesn't Need To Know - Details about Costs of Goods Sold – it’s all material (or just an expense) because the annual tax return doesn’t need to know the details – it is not relevant to the tax accountant. Remember it’s the “Big Bucket” theory. Of course – most tax returns have gotten longer and longer saying the same thing over and over again.

If Your Construction Company - Files annual tax return as Sub-Chapter S you know that most of the numbers transfer over to your personal return and the numbers repeat again.

We Have All Heard - “Garbage In” and “Garbage Out”. It is becoming more common to do the bookkeeping “fast” after all it should only take about 10 minutes a day. One shortcut is downloading transactions directly from the bank.

Tax Accountants Typically - Set Up QuickBooks Chart of Accounts to map directly into their tax software which makes it easy to download from the bank “Big Bucket” theory again.

What Is The Purpose - Of your accounting system? To help you run your business more efficiently or just file your taxes? Neither choice is good or bad as long as you have made the Choice and understand the outcome.

Like Most People - I go to my bank website often and one of the things I have discovered is that all banks appear to treat each transaction in a unique fashion. How do you get money out of your checking account?

-

Do you write a paper check that is manually presented to the bank?

-

Do you write a paper check that is electronically presented to the bank?

-

Do you use your bank’s online bill pay that mails out a paper check you can present to the bank?

-

Does your bank’s online bill pay – use EFT to transfer your funds to the vendor?

-

Do you pay online using another bill pay service?

-

Do you pay online by going directly to your vendor’s website?

-

Do you pay online using pay pal bank?

From The Bank’s Transaction Report - It looks very easy. When the actual bank statement comes the transactions can look differently. Bank breaks transactions into Checks / Debit / ACH / EFT – Vendors may have a different name on the account that accepts each of these types of transactions.

Please Note - If you have had experience with downloading and synchronizing Outlook with a Customer Relationship Database like ACT, GoldMine or other CRM databases you understand the end result is NOT always what you expected.

Bank Downloads Appear To Love Quicken - QuickBooks is more complex and may create new surprises in your software.

Downloading Transactions Directly - From your bank can be a wonderful time saver if all goes well. I have heard stories of tax accountants without permission from their client, (they know everything they need to know to file your taxes) downloading a whole bunch of transactions into QuickBooks without properly mapping them.

Construction Companies - Have very complex Work In Progress (WIP), Job Costing and Job Profitability Reporting and Other QuickBooks Reporting needs which means some transactions must be coded to Items and some to Accounts in order for the reports to be accurate.

When In Doubt – Many times the Bad Bookkeeper or whoever is doing the bookkeeping will send the transaction to owner's draw, personal expenses, or some other wrong place.

The Reason Why Is Because - To often the business owner sees all accounting costs as “Overhead and a Waste Of Money” and they want the “Cheapest Option Possible” and the tax accountant is the only one who needs the information anyway why not let them do it.

Another Dirty Little Secret - You may not be aware of is some tax accountants send the bookkeeping to a cheap bookkeeper somewhere in the world. It is possible they will let the independent bookkeeper gather of your paperwork and take it to their home to work on it.

Identity Theft - Could be an issue for you to consider if your records are unsecured and floating around in a stranger's car or at their home with who knows coming and going. It really is a case you get what you pay for and if something is too good to be true there is a reason.

We Know Of Several Tax Accountants - That are a real pleasure to work with because they do not try to do bookkeeping in the off-season of tax preparation.

They Like “Clean and Tidy” QuickBooks - With reports and balances that make it is easy for them to review the Profit and Loss (P&L) and Balance Sheet, review their client’s entire financial picture, make decisions as needed and complete the annual tax return. And yes a good tax account takes more than 15 minutes to complete their client’s business return.

We Recommend Tax Accountant - To complete the annual tax return for several reasons:

-

They are a fresh set of eyes reviewing your QuickBooks and your business as a whole.

-

They are an important part of your Board of Advisors

-

It makes it easier to get bank loans because the bank knows you have more than one person in your accounting

-

We have used Tax Accountants for our business and personal annual returns for over thirty years

Congress Changes Tax Rules And Regulations - It appears to me the do it every time they meet! Who has time to focus on all those changes – It’s The Tax Accountant! After keeping on top of “The Big Stuff” they look for the simplest ways to prepare and file your annual tax return.

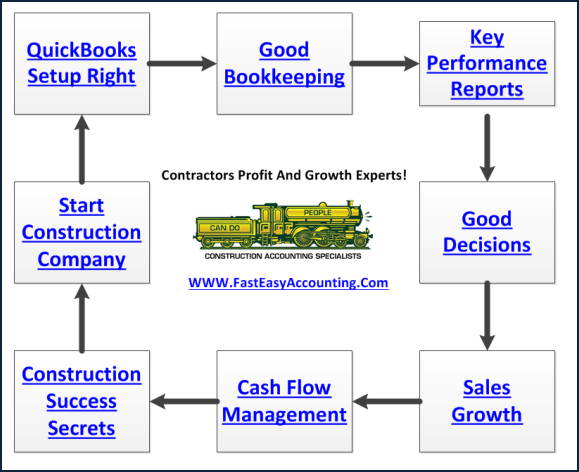

QuickBooks Provides A Common Language - We use QuickBooks Cloud Based Services which means we are able to work on your QuickBooks without sitting in your office and you can access it anytime 24/7/365 and anywhere you have internet service. We can both be in it at the same time, no fuss, no muss!

We Begin With Your - 1st sale / 1st deposit / 1st payment and put it away in QuickBooks in such a way that it creates easily understood reports for everyone who wants to review whether it is you the client / banker / tax accountant.

We Want Your Paper - In bags, boxes, cartons, crates, faxed, emailed, scanned with our 24 hour bookkeeper whatever is easiest for you! And you don't have to organize it or make it neat because we know what to do!

We Can Setup Your QuickBooks File - Clean-Up an existing QuickBooks file, customize construction invoices, you can download our FREE construction invoice template, we can help with Payroll, financial reports and the Five Key Performance Indicators (KPI Reports).

After The Initial Work Is Done - We can provide on-going services as needed.

Who Is Our Ideal Client?

New and Seasoned, Small Contractors in Service and Repair, Residential, Commercial, Remodel and Home Building Who Need Bookkeeping, Invoicing (Flat-Rate, NTE, T&M, Cost Plus), Sales Tax, Payroll, Payroll Reports, Job Deposits, WIP, Retention, Pay Applications, Insurance Audits or Business Processes. We know What to Do!

For the “Best Value” we practice “Flat Rate” pricing whenever possible.

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/