How To Get Started Right – TIPS

I = Income

We are not in business without Customers. Our New Customers become Existing Customers. Once the job is completed (last month / last year) they become our Previous Customers.

You may have started out being a “Hobby” – Something you liked to do that created a little spending money for the Little Extras / Vacation Fund / Christmas Fund / Special Purchases (TV / Boat / Car)

Reasons To Make A Change and Get More Serious About Your Business: It starts making a little More Income / The Reduction in hours or loss of a job may move the activities from the “Hobby” to “Business Stage” Gross Income (Sales Price) is the price set between Buyer / Seller as value of services performed. Net Income is the amount leftover after all the direct / indirect expenses are paid. Net Loss is what is on paper and in the checkbook after a job has costs above and beyond income.

From the Contractor’s View

- Who Am I?

Builder / General Contractor / Specialty Contractor / Service & Repair

- What Type Of Work Am I Doing?

New Construction / Commercial / Residential / Service & Repair

- Who Is My Customer?

What Now! I just want to go to work! Answer Is Yes

– Before You Get Started Let’s Answer Just A Couple Of Quick Questions

- Who Called and What Did You Tell Them?

This adventure has moved from a “Hobby” to a “Business” Did you start a folder for all those forms that are starting to come in the mail… One of them is from the Washington State Department of Revenue (TAXES)

As part of the Bidding / Estimating / Scheduling / Doing The Work / Collecting The Money you need to understand a few of the basic rules.

Paperwork

New Construction – Depending On The Type of New Construction the following may apply.

- Builder / General Contractor may issue a resale certificate

- Builder / General Contractor may be required to pay sales tax on each invoice

- Builder / General Contractor may hold retainage

- Builder / General Contractor may require complex pay application before paying

- Builder / General Contractor may require bill on 25th promise payment following 10th

- Builder / General Contractor may require conditional / unconditional lien release

- Builder / General Contractor may stay on schedule for the entire project

Commercial – Depending on the type of commercial, your individual trade and location

- City / County almost always will require additional review before issuing a permit

- City / County almost always will require the project be permitted by each trade

- City / County almost always will require mechanical trades to have higher certifications

- City / County almost always will require “something extra” to be done

- Owner / Property Manager will almost always require complex pay application

- Owner / Property Manager will almost always take their time about paying

- Owner / Property Manage may require retainage

Residential – Depending on the size of the project owner maybe actively involved

- Depending on the size / scope the number of permits that maybe required

- Depending on the size / scope on how the invoice and payments are structured

- Depending on the size / scope of project – When Do You Ask For A Customer Deposit?

- Depending on the size / scope of project – When Do You Ask For A Customer Draw?

- Depending on the size / scope of project – Do You Present a Formal Progress Billing?

- Depending on the size / scope of project – Do You Hire Specialty Contractor?

- Depending on the size / scope of project – When Do You Issue Lien Release?

Service & Repair – Usually emergency driven and price shopped “After The Work’s Done”

- Depending on the type of service city / county may require additional certifications

- Depending on the type of service it may lead to a larger remodel / repair project

- Depending on the type of services work is usually paid in full at the completion of the work

- Depending on the type of service it may lead to a reoccurring activity (maintenance)

- Depending on the person who shows up it may lead to additional new work to be done

- Depending on the skill level / efficiency / quality may limit warranty / call backs for “Fixes”

- Depending on the type of service provided / location on the property if it has sales tax.

Invoicing

Invoicing is all about presenting the agreed upon price in a format that the customer is able to easily understand and be willing to paid promptly. It’s all about getting a fair price for the work performed and payment in a timely fashion. The type of invoice presented varies from size of Job and Job Type.

In New Construction and Commercial the closer to the Owner / Property Manager / Direct Pays From The Bank the more detailed the invoicing requirement. Big Dollar Amount On Invoice = More Details

- New Construction Home – Formal Pay Application

- Commercial – Formal Pay Application

Large residential remodels owner / professional project managers acting on behalf of the owners

May nick / pick and ask for copies of all bills before authorizing payments on invoices presented.

- Residential Large Remodels – Formal Pay Application is preferred

- Residential Small / Mid-Sized Remodels – QuickBooks Invoice accepted

- Service and Repair – Carbonless Invoice presented for payment at time of service

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

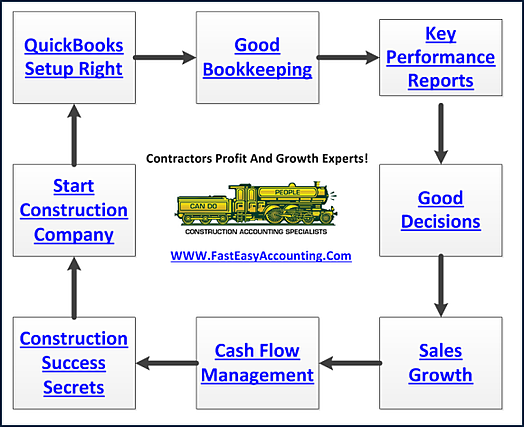

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/