In Construction Hiring Independent Contractors - Can get very expensive very fast!

Most Construction Company Owners - Are doing whatever they can to survive and thrive in tough economic times and we here to support and hopefully help you stay out of trouble where we can.

The Misguided Idea - That you can save roughly thirty percent (30%) on your payroll costs in payroll taxes by hiring construction workers as independent contractors is one of the worst ideas every conceived.

A Lot Of Bad Ideas - Are circulated at the Business Round Table, the little round table at the tavern with a pitcher of beer and several glasses being held by contractors, curbstone lawyers and Bad Bookkeepers who like to hold "Kings Court" and pass out bad advice on how to run construction businesses.

Unfortunately Nobody In Attendance - Seems to realize that opinions from experts cost money which is why there is rarely anyone with real knowledge at these meetings.

In Most Cases Free Advice - Is worth what you pay for it, nothing. Except in the case of the Business Round Table, this is the one place where the advice carries a heavy and painful price.

One Common Method - Discussed at the Business Round Table is for the contractor to require that anyone who wants to work at their construction company to get a business license in the city or county where the contractor’s business headquarters is located. The contractor tells the worker "Since you will not have any taxes taken out I can pay you less and you will still make more money than anywhere else"

Leverage Is Great - Until the stick breaks!

In Washington State - There have been a number of cases where this practice has cost the contractor in fines, penalties, legal fees and lost time from work many times what they saved in payroll taxes. It is the same in all states, it simply does not pay!

One Way Contractors Are Found Out - In Washington State is by accident, literally, when the "independent contractor" sustains a job related injury and requires medical attention, and it does not matter if the need is immediate and life threatening or something that can wait and be checked out after work.

When The “Independent Contractor" - Is faced with having to pay for their own medical expenses out of pocket they are often encouraged by the clinics and hospitals to contact The Department of Labor and Industries and "suddenly discover" the Big Bad Contractor forced them into becoming an “Independent Contractor”.

Medical Clinics And Hospitals - Prefer to deal with government agencies because they know there is a better chance of being paid. So naturally it is in their best interest to shift the burden of medical costs to the contractor and ultimately to the Department of Labor and Industries wherever possible.

And So It Begins - The contractor has a lot of explaining to do, there are potential fines, penalties, back taxes, interest and possible investigations by The Department of Labor and Industries, The Employment Security Department, U.S. Department of Labor, local and state agencies and The IRS. This is because everybody smells blood in the water and they are all looking for back taxes and your money, bank accounts, homes, trucks, cars and equipment if that is what is deemed appropriate.

In Addition - It could eventually trigger an IRS audit where the IRS demands a copy of your QuickBooks file! And then things could get Un-Bear-Able!

In Some Cases - The IRS has made business owners have been forced to pay ALL OF THE EMPLOYEE AND EMPLOYER PAYROLL TAXES PLUS PENALTIES AND INTEREST!

The Answer Is Simple - Play it straight in everything you do! Play the construction game to win! Play by the rules, pay your taxes, give to Caesar what is Caesar's (Tax Agencies), live easy and breathe the air of freedom.

For The Contractors That - May have fallen into the trap of hiring Independent Contractors there is an answer:

-

Make a decision to set thing straight and get on the winning side of the construction game.

-

Contact Sharie 206-361-3950 email sharie@fasteasyaccounting.com

-

It will be clearly understood that our job is to help you come clean with the tax agencies and get your business turned around. In most cases the tax agencies are very workable in these situations and they want to help.

-

We will do everything we can to help you get straightened out and we will start with reviewing and cleaning up your bookkeeping files no matter what you have, QuickBooks, Peachtree, Excel, Shoeboxes, File Boxes, Dashboard of your truck or any other software.

-

You will be kept fully informed every step of the way.

You May Want To View - This short video from the IRS regarding their The Voluntary Classification Settlement Program (VCSP)

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

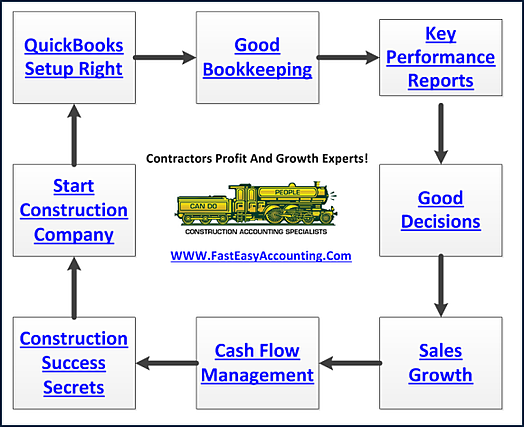

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+