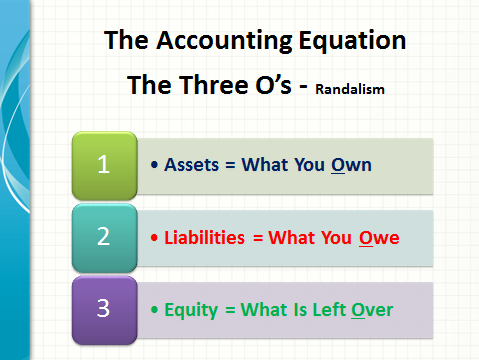

All Bookkeeping Methods Share The Same Accounting Equations

Business Owners - Need three basic reports, Cash, Profit and Equity

Cash On Hand................(Bank Balance - Un-cleared Checks) = Cash

Profit And Loss Report.........................(Sales - Expenses) = Profit

Balance Sheet Report..........................(Assets - Liabilities) = Equity

------------------------------------------------------------

Regular Bookkeeping - Is roughly 80% of all accounting and bookkeeping for businesses in the world. So it is practically the only thing taught in schools, colleges and universities.

This Type Of Bookkeeping Is Used - Where customers comes to the place of business or at most you ship or deliver a packaged product. In essence you are selling a product or a service from a fixed location.

Regular Bookkeeping Has These Things In Common:

-

Sales - With 1-4 categories

-

Cost of Goods Sold - If they sell products with 1-4 categories

-

Expenses - Overhead required to maintain business operations

-

Breakeven - Is fairly easy to calculate because there is a direct relationship between income and expenses on every item. It is easy to run reports to determine which items are profitable and unprofitable and make adjustments quickly as needed.

------------------------------------------------------------

Construction Bookkeeping - Is roughly 15% of all accounting and bookkeeping with manufacturing making up roughly 5%. So it is given very little attention in schools, colleges and universities. What little of it I have seen makes me very upset because I see the damage caused to contractors making management decisions on inaccurate reports.

This Type Of Bookkeeping Is Used - When the entire place of business is packed up and taken it to the customer. In essence you are selling, assembling, delivering and installing a customized product from a mobile shop on location. Think of it like shooting a movie on location without all the glamour, resources and money to go with it.

Construction Bookkeeping Has These Things In Common:

-

Sales - With 1-10 categories

-

Cost of Goods Sold - Has Direct and Indirect Job Costs with 25 - 200 categories with 1,000s of sub categories

-

Expenses - Overhead is extremely complex because some expenses in regular bookkeeping are actually Cost of Goods Sold in construction accounting

-

Breakeven - Very difficult to calculate because most projects are one-of-a-kind custom jobs. Proactive contractors have systems and cost libraries with pre-priced assemblies for bidding which works in conjunction with Strategic Construction Bookkeeping to provide management with progress invoicing, job costing and job profitability.

-

Job Costing and Job Profitability Reporting - Is similar to the Company Profit and Loss report except that it is specific to each particular job and has different expense codes. These reports in combination with the Five Key Performance Indicators are what help the contractor understand which projects to pursue and which ones to ignore. They form the foundation of a Business Process Improvement Plan and Construction Business Strategy.

We Never Cease Being Amazed - When we find someone who is doing the bookkeeping for a contractor and other unrelated industries and treats the construction business like any other business.

Example #1 - The contractor asks the bookkeeper "How much money did we make on the John and Mary Doe house remodel?" The bookkeeper generates a report showing $5,000 profit when in reality it was a ($15,000) loss! QuickBooks was setup like every other bookkeeping business and $20,000 worth of transactions was put in the wrong category. In this case some direct costs and some indirect costs were misallocated and not assigned to the job.

Example #2 - The contractor asks the bookkeeper "How much money did we make on the Bob and Sally house remodel?" The bookkeeper generates a report showing ($5,000) loss when in reality it earned $5,000 profit! QuickBooks was setup wrong and $10,000 worth of transactions was put into the wrong category. In this case some overhead costs were classified as direct costs and assigned to the job.

The Inevitable Result Is - The contractor makes bad decisions on what to bid and not to bid on and eventually runs out of time and money.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

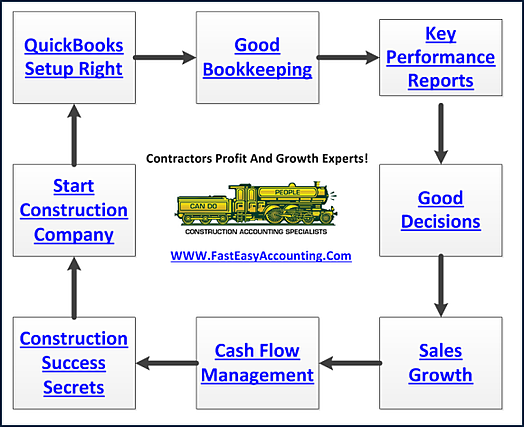

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+