QuickBooks has over a hundred reports that can be viewed on a regular basis

![]()

![]() You could spend all of your time seeing a report in QuickBooks and trying to find the way to populate numbers in the report.

You could spend all of your time seeing a report in QuickBooks and trying to find the way to populate numbers in the report.

Many reports are designed for specific things. Take for example the view of the Home Page. Just because the feature is on the Home Page in QuickBooks does not mean it is useful for every contractor.

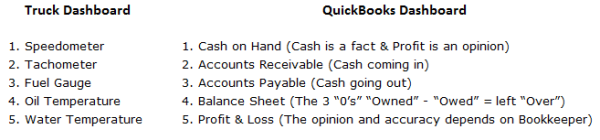

Five Key Performance Indicators Every Construction Company

Needs To Survive And Thrive!

![]()

![]() It is not practical or recommended for the Small Contractor or Handyman to track inventory. For most contractors, the material goes from the supplier directly to the job which is not the definition of inventory. Inventory is what goes into the warehouse and stays, and stays and stays.

It is not practical or recommended for the Small Contractor or Handyman to track inventory. For most contractors, the material goes from the supplier directly to the job which is not the definition of inventory. Inventory is what goes into the warehouse and stays, and stays and stays.

![]()

![]() Most contractors do not have the money to invest in inventory. Your supplier is just down the street. They have on-demand inventory – what you need when you need it.

Most contractors do not have the money to invest in inventory. Your supplier is just down the street. They have on-demand inventory – what you need when you need it.

Plumbers, Electricians, and HVAC Contractors tend to have a certain amount of inventory, and it is better to do a physical inventory a couple of times a year. (End of year and maybe mid-point of the year and enter as bulk numbers) There are specialty programs that are an add-on to QuickBooks for those larger companies who need to track inventory. Most inventory programs only work with QuickBooks Enterprise.

Trying to keep track of each item in the job can be overwhelming and not practical for smaller jobs. If it is a Cost+ or Time and Material job then be sure you only purchase what you need and assign that receipt to that specific job.

Five Key Performance Indicator Reports that are useful to every contractor regardless of their size.

![]()

![]() #1 Cash

#1 Cash

How much cash is in the bank. Why because you have bills to pay, material to purchase and upcoming expenses.

#2 Accounts Receivable

How much work have I completed and billed the customer? Contractors get confused and think that the signed contract is for “X Amount” and therefore they have that much coming before the job starts.

Accounts Receivable is for completed work that you bill your customer or client. In other words, how much can you expect to pick up a check for today?

![]()

![]() From someone doing their accounting, it seems simpler to create an invoice for the whole job and then takes payments on it. The problem is that the balance is aging nicely and give a false impression of the company’s financial position. Add the time it takes to determine what is owed to you.

From someone doing their accounting, it seems simpler to create an invoice for the whole job and then takes payments on it. The problem is that the balance is aging nicely and give a false impression of the company’s financial position. Add the time it takes to determine what is owed to you.

![]()

![]() After a short while, QuickBooks becomes a real MESS. Then your banker asks for financials, and you are trying to explain to the Banker that your Accounts Receivable includes work not started or completed. Bankers want to know How Much Money can you expect to collect today!

After a short while, QuickBooks becomes a real MESS. Then your banker asks for financials, and you are trying to explain to the Banker that your Accounts Receivable includes work not started or completed. Bankers want to know How Much Money can you expect to collect today!

#3 Accounts Payable

What bills do I have coming up? Accounts Payable is where you track all your supplier invoices, match against the month end statement and your subcontractor bills. It is not the place to track your monthly payments to your credit cards, your payroll or other tax payments to State and Federal Agencies. These items are in other places as liabilities in your QuickBooks file.

Please Note: All transactions on your credit cards need to be entered into QuickBooks (not just the month in balance with payment due).

#4 Profit and Loss

Profit and Loss are keeping track of your income and expenses and will reflect the Gross Profit and Net Profit of the business. This report is date specific.

Please Note: Expenses are broken down between the Cost of Goods Sold (direct costs to jobs) and Expenses (which tend to be overhead related). QuickBooks by default is on the accrual method. Reports are converted to the Cash Method for Sales Tax and Federal and State Income Tax Reports.

#5 Balance Sheet

The Balance Sheet is tracking the overall health of the company. Assets include Cash, Accounts Receivable, Undeposited Funds and Inventory. Yes – the Government treats those piles, boxes, and pallets of unsold material as an asset. (Which increases profit).

Unless you are have magical skills, it is impossible to trade that box of treasures for a tank of gas, lunch, bag of groceries. Having a good relationship with your suppliers is key. Good suppliers will encourage the return of material. Even with a restocking charge – Cash is more useful.

Liabilities is tracking the amount that is due to others. Short term is Accounts Payable and Credit Cards. Long-term is your Truck Loan, Equipment Loan, Loans to yourself or others.

Please Note: Track all money you lend to your company. You cannot get it back out without it being considered income unless you document you put it into the company. Startup costs by nature are funds lent to the business because unless a contractor has been doing “side work” the business did not have any income before it began to cover the initial costs of setting up your contracting company.

Equity is the value you have into the company. The net difference Assets – Liabilities = Equity. I recommend you take as little as possible out of the company. It is designed to grow and take care of your needs. Think company first. Many expenses are company expenses that as an individual you were paying personally.

It is much easier for the company to pay for all business expenses. Your tax accountant can easily review and assign a percentage that may be personal. (This is better than the mad scramble of finding missing receipts at tax time).

Contractors Favorite Job Costing Reports

Job Profitability Reports are the easiest and most practical to track. Contractors can see job by job; did these jobs make a profit? From this report, you can drill down to more specifics about the job.

Because of every small job, every remodel is different and knowing how much the plumber, the electrician, the framer charged is not always relevant.

It gets back to over tracking versus practical information you can see and process at a glance.

- Which jobs made money and which ones did not.

- Was it the material costs?

- What is the timing of the job?

- Time spent on the job?

- Lack of Signed Change Orders?

![]()

![]() Fuel costs have increased everywhere due to recent Hurricanes (if they didn’t work in your area – you are one of the lucky few).

Fuel costs have increased everywhere due to recent Hurricanes (if they didn’t work in your area – you are one of the lucky few).

Estimating Many contractors are finding it is helpful in bidding the jobs to use a detailed estimating program. Some Estimating Programs link to industry-specific cost codebooks.

Please Note: If your estimate is several pages long it is not practical to enter this type of estimate in QuickBooks line-by-line.

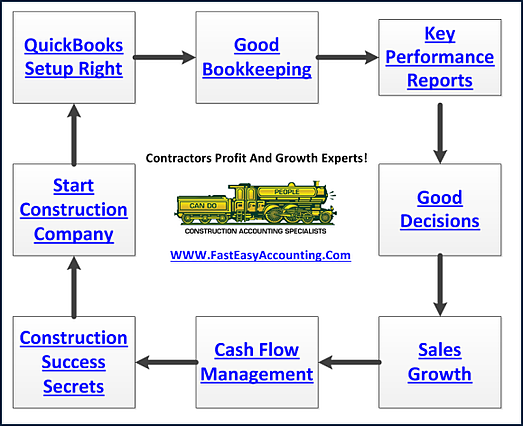

QuickBooks can be set up to do many things. QuickBooks can have as much detail or as little detail as the user wants or needs. Can be used as an electronic checkbook to a real accounting program with reports.

The object is to be able to see useful reports you can read and make decisions

![]()

![]() Making decisions and being adaptable happens every day when you are in business. We understand Contractors and Construction Accounting from your side; what you need and why you need it! Why, because we have been there. It is impossible for us to think from any position then from management.

Making decisions and being adaptable happens every day when you are in business. We understand Contractors and Construction Accounting from your side; what you need and why you need it! Why, because we have been there. It is impossible for us to think from any position then from management.

When you are ready – We are here to help.

Sharie

About The Author:

![]()

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

![]()

![]() When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

![]()

![]() For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

![]()

![]() This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

![]()

![]() Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

![]()

![]() Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

![]()

![]() We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]()

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company