QuickBooks Setup For Contractors Done Here

Let us do your QuickBooks setup for your contracting company because accurate QuickBooks contractor reports are what profitable contractors use to help them steer their construction company through the ups and downs of the business cycle.

We Do QuickBooks Setup For Construction Beginning With Year 2000 And Up

- QuickBooks Pro 2000 And Up

- QuickBooks Premier 2000 And Up

- QuickBooks Premier Contractor 2000 And Up

- QuickBooks Premier Accountant 2000 And Up

- QuickBooks Contractors 2000 And Up

- QuickBooks For Contractors 2000 And Up

- QuickBooks Enterprise Contractors 2000 And Up

- QuickBooks Enterprise For Contractors 2000 And Up

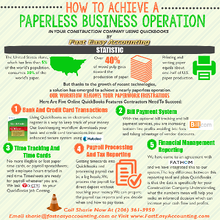

Let us do your QuickBooks setup for your contracting company because today more than ever owning and operating your construction company is a rough and tumble game because everyone has access to so much information and now more than ever you need clear and concise actionable information to survive and thrive.

The same QuickBooks contractor reports the profitable contractors use are available to every all four types of contractors from the one-person “Dog and Pickup Truck” to the "Enterprise" level contractor. For more on this click here.

Incidentally the size of your construction company is not as important as how much money you earn from it. Our internal research has shown that a properly run construction company with annual sales of $250,000 to $5,000,000 can generate more hard dollars for the owners and employees than a company with annual sales between $5,000,000 and $20,000,000. It has to do with understanding the Expansion Isoquant and knowing the difference between maximize and optimize. For more on this click here.

The QuickBooks reports number that are available number in the thousands and with any one of the hundreds of add-on software you could generate millions reports. If you are a construction accountant like me you would love it. I love learning about construction reports and I invest a certain amount of time testing and reviewing add-on software to find more BBCR (Bigger Better Construction Reports). That's all fine and nice; however you want to know:

Which QuickBooks Reports Will Help Me Increase Sales And Profits?

The reports that stand the test of time are:

-

The Five Key Performance Reports, (KPI) Reports. Cash Report, Receivables, Parables, Profit and Loss and Balance Sheet. For more on this click here

-

Job Cost Reports, Job Profitability Reports. For more on this click here

What Makes QuickBooks Contractor Reports Valuable?

Understanding and using the information they provide to make strategic and tactical decisions to increase sales and profits in your construction company. What if I told you there is buried treasure in your backyard and all you need is a treasure map to find it and dig it up, would you be interested? Of course you are!

Proper QuickBooks Setup Is Your Treasure Map

If your QuickBooks setup was done by a QuickBooks Expert in construction accounting and maintained correctly you are riding high and living well! If not, we can fix just about any QuickBooks setup by performing a QuickBooks cleanup and importing all of the transactions. The Chart of Accounts is the foundation and if your Chart of Accounts is not setup right you will not have anywhere to put the transactions.

The Short List Of Essentials In Our QuickBooks Setup

-

User Permissions

-

Company Information Window

-

Chart of Accounts Direct Construction Costs

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Work-In-Progress For Land Developers

-

Chart of Accounts Work-In-Progress For Land Development Into Lots

-

Chart of Accounts Work-In-Progress For Spec Builders

-

Chart of Accounts Work-In-Progress For Spec Home Into Rentals

-

Chart of Accounts Over Billings For Earned Value Reports

-

Chart of Accounts Under Billings For Earned Value Reports

-

Chart of Accounts Retention From Your Customers

-

Chart of Accounts Retention For Your Subcontractors

-

Chart of Accounts Job Deposits From Your Customers

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Prepaid Expenses

-

Chart of Accounts Job Deposits

-

Chart of Accounts Fixed Assets

-

Chart of Accounts Depreciation

-

Chart of Accounts Intercompany Transfers

-

Chart of Accounts Payroll

-

Chart of Accounts Payroll Taxes

-

Chart of Accounts Payroll Tax Liabilities

-

Chart of Accounts Customer Discounts

-

Chart of Accounts Bad Debts

-

Chart of Accounts Customer Checks Returned From Bank

-

Chart of Accounts Employee Loans And Repayments

-

Chart of Accounts Jobsite Costs

-

Chart of Accounts Warranty Work

-

Chart of Accounts Sales Tax Errors

-

Chart of Accounts Mobilization

-

Chart of Accounts De-Mobilization

-

Chart of Accounts Leases

-

Chart of Accounts Purchases

-

Chart of Accounts Marketing

-

Chart of Accounts Advertising

-

Chart of Accounts Owner Loans And Repayments

-

Chart of Accounts Special Accounts For Sole Proprietors

-

Chart of Accounts Special Accounts For LLC Corporations

-

Chart of Accounts Special Accounts For Sub-S Corporations

-

Chart of Accounts Special Accounts For Partnerships

-

Chart of Accounts Special Accounts For LLP Limited Partnerships

-

Chart of Accounts Special Accounts Flipper Houses

-

Chart of Accounts Credit Cards

-

Chart of Accounts Lines Of Credit

-

Chart of Accounts Short Term Loans

-

Chart of Accounts Long Term Loans

-

Chart of Accounts Spec House Construction Loans

-

Chart of Accounts Land Development Construction Loans

-

Chart of Accounts General And Administrative

-

Chart of Accounts Occupancy Costs

-

Chart of Accounts Triple Net Leasing Costs

-

Chart of Accounts Technology

-

Chart of Accounts Professional Fees

-

Chart of Accounts Taxes

-

Chart of Accounts Licenses

-

Chart of Accounts Insurance Builders Risk.

-

Chart of Accounts Insurance Vehicles

-

Chart of Accounts Insurance Liability

-

Chart of Accounts Insurance Health And Dental

-

Chart of Accounts Financing Costs

-

Chart of Accounts Interest Earned

-

Chart of Accounts Gain And Loss On Fixed Assets

-

Chart of Accounts Estimates

-

Chart of Accounts Sales Orders

-

Chart of Accounts Purchase Orders

-

Item List Direct Construction Costs

-

Item List Indirect Construction Costs

-

Item List Construction Job Deposit

-

Item List Construction Labor Costs

-

Item List Construction Material Costs

-

Item List Construction Other Costs

-

Item List Construction Subcontractors Costs

-

Item List CSI Codes For Commercial Construction

-

Item List Bid Bond Deposits

-

Item List Sales Tax For Cities (Updated When It Changes)

-

Item List Sales Tax For Counties (Updated When It Changes)

-

Item List Sales Tax For State (Updated When It Changes)

-

Item List Land Developers Direct Costs

-

Item List Land Developers Indirect Costs

-

Item List Spec Home Builders Direct Costs

-

Item List Spec Home Builders Indirect Costs

-

Item List Retention Held By Customers

-

Item List Retention Holding For Subcontractors

-

Item List Work-In-Progress Costs For Land Developers

-

Item List Work-In-Progress Transfer Costs For Land Developers

-

Item List HUD-1 Statement Transfer Costs For Land Developers

-

Item List Work-In-Progress Costs For Spec Home Builders

-

Item List Work-In-Progress Transfer Costs For Spec Home Builders

-

Item List HUD-1 Statement Transfer Costs For Spec Home Builders

-

Item List Work-In-Process Transfer Costs For Spec Home Builders

-

Retention Tracking For Your Customers And Trade / Subcontractors

-

Payroll For Your Employees

-

Payroll Sick Days

-

Payroll Vacation Days

-

Payroll Loans Setup And Tracking

-

Payroll Loan Repayment Setup And Tracking

-

Payroll Reimbursement Setup And Tracking

-

Payroll Garnishment Setup And Tracking

-

Payroll Child Support Setup And Tracking

-

Payroll Tax Table

-

Owners Time To Job For Job Costing Without Affecting Financial Report

-

Preferences In 23 Categories Each One With Multiple Decision Points

-

Price Level List

-

Billing Rate List

-

Sales Tax Code List

-

Other Names List

-

Customer Profile List

-

Vendor Profile List

-

Templates List

-

Memorized Transaction List

-

Memorized Reports List

We offer the most comprehensive contractors bookkeeping services system in the world. Your Letter of Engagement includes some or all of the options listed below. If there are options, you would be interested in knowing more about please contact Sharie at 206-361-3950 or email sharie@fasteasyaccounting.com and she will be happy to review them with you.

QuickBooks Setup For Construction Options

-

QuickBooks Automatic Backup On Remote ServerAll Expenses And Costs Recorded In Chart of Accounts, Not Items

-

All Work In Process Recorded in Chart of Accounts, Not Items

-

Retention Hold By Your Customers

-

Retention Hold For Subcontractors

-

Job Deposits From Customers

-

Employee Type Tracking - Field

-

Employee Type Tracking - Admin

-

Employee Type Tracking - Sales

-

Employee Type Tracking - Operations

-

Employee Type Tracking - Officers

-

Employee Loans - Field

-

Employee Loans - Admin

-

Employee Loans - Sales

-

Employee Loans - Operations

-

Employee Reimbursements - Field

-

Employee Reimbursements - Admin

-

Employee Reimbursements - Operations

-

Employee Reimbursements - Sales

-

Employee Reimbursements - Officers

-

Payroll Preperation - Field

-

Payroll Preperation - Admin

-

Payroll Preperation - Sales

-

Payroll Preperation - Operations

-

Payroll Preperation - Officers

-

Payroll Tax Reporting – 941

-

Payroll Tax Reporting - 940

-

Payroll Tax Reporting - 940

-

Payroll Tax Reporting - W-2

-

Payroll Tax Reporting - W-3

-

Insurance Audit Reporting

-

Insurance Audit Support (Business Consulting And Accounting Office)

-

Bank Reconciliations

-

Credit Card Reconciliations

-

Washington State Cities Business And Occupation Tax Reporting - Monthly

-

Washington State Cities Business And Occupation Tax Reporting - Quarterly

-

Washington State Cities Business And Occupation Tax Reporting - Annually

-

Washington State Business And Occupation Tax Reporting - Monthly

-

Washington State Business And Occupation Tax Reporting - Quarterly

-

Washington State Business And Occupation Tax Reporting - Annually

-

Washington State Sales Tax Reporting - Monthly

-

Washington State Sales Tax Reporting - Quarterly

-

Washington State Sales Tax Reporting - Annually

-

Petty Cash Register

-

Fixed Asset Tracking

-

Monthly Depreciation Transactions

-

Intercompany Transfers

-

Security Deposits Tracking

-

Loan To Shareholders / LLC Members / Partners

-

Cost of Goods Sold - Direct Costs

-

Cost of Goods Sold - Indirect Costs

-

Your company Schedule of Values

-

Prevailing Wage Reports

-

Work-In-Process Reporting

-

Tool Lease Tracking

-

Vehicle Lease Tracking

-

Equipment Lease Tracking

-

Schedule of Values For Job Costing

-

QuickBooks Default Schedule of Values

-

Fixed List Of Your company Schedule of Values

-

Your company Schedule of Values For Each Project

-

Construction Specification Institute 16 Basic Cost Codes

-

Heavy Equipment Allocation

-

Occupancy Expense - Office

-

Occupancy Expense - Shop

-

Marketing Cost Tracking By Chart of Accounts

-

Vehicle Costs – Admin / Sales / Operations / Officer

-

Other Income Tracking

-

Other Expense Tracking

-

Investment Property Tracking

-

Upload Documents To Inbox

-

Read, Print And E-Mail Documents

-

24/7 Access To Web Based Online Financial Reports

-

Paperless Server Vault Options

-

Web Based Reports

-

Excel Based Payment Applications

Our process for QuickBooks setup of a new client is a whole lot longer than what I am showing here and for some of you this was TMI (Too Much Information).

Our construction company clients offer a lot of feedback regarding what they would like their QuickBooks contractor to do and we listen to each and every request and look for ways to add those enhancements and more.

On average the QuickBooks setup template will have 50 enhancements a year. We test them on our server and when they are proven to work we manually update each and every client that has their QuickBooks contractor file on our server. And then we test each update on every client QuickBooks contractor file to make certain it will work.

Most of the time our clients do not even know when a template update happened, they just know it works a little bit better and something that was a problem no longer is a problem.

The one BIG PROBLEM we caution you about is be careful when you tell another contractor about all the reports and how Fast And Easy your QuickBooks contractor works because in most cases they will not believe you. It is the difference between QuickBooks setup the easy way and QuickBooks setup the hard way!

QuickBooks Setup - By a QuickBooks expert in construction accounting to work specifically for contractors on whatever year and version of QuickBooks you own because we have worked with QuickBooks since it first arrived in the early 1990's in DOS.

Which QuickBooks Edition - Is right for you? It depends on your annual sales volume and what QuickBooks Reports you want to have.

QuickBooks Pro - Works well for all contractors with less than $250,000 annual volume because your QuickBooks Reporting needs are not great.

QuickBooks Premier Contractor - Is what we recommend for contractors with more than $250,000 annual volume currently or projected in the next 12 months. The difference in cost is very small compared to the potential value.

The Most Important - Part of QuickBooks Setup for contractors is having a QuickBooks expert with a deep background in construction accounting who understands what your particular construction company needs. Among other things you need a fast and easy way to monitor the financial health of your construction company. QuickBooks Premier Contractors Edition provides a running scorecard of Key Performance Reports and when used with Business Process Management Tools like what 10 minutes of waste costs their company.

Five Types Of Construction Firms Need QuickBooks Setup On Premier Contractor Edition:

New Construction Speculative - Land developers, home builders and light commercial builders. These are the contractors who build something in hopes a buyer will emerge during or shortly after the building is built and they need QuickBooks setup so that it will:

-

Your QuickBooks setup is put together so you can track all your construction and overhead costs and generate Bank Draws and Work-In-Progress (WIP) reports against budgeted estimates to monitor progress.

-

Your QuickBooks setup for your Chart of Accounts needs to be focused WIP Assets with a few Cost of Goods Sold Accounts (COGS) to allocate the sale of the building

-

Your QuickBooks expert can setup the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

You need between 200 and 6,000 Items setup to track all the costs of the construction process from the ground up through the roof and final cleanup

-

This is the most difficult QuickBooks Premier Contractor Edition to setup because there is a mix of Direct, Indirect, WIP and COGS accounts

-

The day to day input is also the most difficult and needs to be handled by accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Your income can be sporadic and extremely sensitive to the ups and downs of the new construction market which is why you need a strategy with an external focus on the global housing market.

-

In order for your Spec Builder Company to reach its full potential you will need an overall strategy including a Business Plan for Contractors

-

We believe a lot of speculative builders go bankrupt because they do not have accurate reports to base decisions on and that is as direct result of trying to save money with Cheap Bookkeeping

New Construction Custom - Builders of residential and light commercial buildings have special QuickBooks setup needs:

-

You use QuickBooks to track all the costs and generate Complex Payment Applications, Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress

-

Your QuickBooks setup for the Chart of Accounts has a lot of Goods Sold Accounts (COGS) to allocate project costs

-

Your QuickBooks expert can setup the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

You will have between 500 to 2,500 Items setup to track all the costs of the construction process from the ground up through the roof and final cleanup

-

This is the second most difficult QuickBooks setup is Premier Contractor Edition because there is a mix of Direct, Indirect, COGS and only a few WIP accounts

-

The day to day accounting and bookkeeping input is the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your group generates a relatively unstable income and is somewhat sensitive to the ups and downs of the new construction custom built market

-

In order for your Custom Home Building Company to reach its full potential you need a Construction Business Strategy including a Business Plan for Contractors

-

We believe a lot of custom builders go bankrupt because they do not have accurate reports to base decisions on and that is as direct result of trying to save money with Cheap Bookkeeping

Remodel - Residential And Light Commercial Tenant Improvement Contractors QuickBooks Setup:

-

You use QuickBooks to track all the costs and generate Complex Payment Applications Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress

-

Your Chart of Accounts is focused Goods Sold Accounts (COGS) to allocate project costs

-

You need the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

Your QuickBooks setup will need 1,000 to 5,000 Items setup to track all the costs of the construction process from beginning to end in order to get the reports you need

-

This is the third most difficult QuickBooks setup in Premier Contractor Edition because there is a mix of Direct, Indirect, COGS and only a few WIP accounts

-

The day to day input is also the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your group generates a stable income and is not as sensitive to the ups and downs of the new construction market

-

In order for you to reach their full potential of your business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Trade contractors - QuickBooks Setup For Plumbers, Electricians, HVAC, Flooring, Sheetrock, Painters, Landscapers and others:

-

You use QuickBooks to track all the costs and generate Simple Invoices which can then be input into QuickBooks Premier Contractor Edition

-

Your QuickBooks setup for the Chart of Accounts is usually focused Goods Sold Accounts (COGS) to allocate project costs

-

You will need to pay close attention to the Five Key Performance Indicators (KPI) to monitor the financial health of the business because your sales cycle is so short

-

You will need 500 to 2,500 Items in your QuickBooks setup to track all the costs of the construction process from beginning to end

-

This is the fourth most difficult QuickBooks setup is the Premier Contractor Edition because there is a mix of Direct, Indirect, COGS accounts

-

You day to day input is also the third most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your group generates the most stable income and you are not as sensitive to the ups and downs of the new construction market

-

In order to reach their full potential of your Trade Construction Business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Service and Repair - QuickBooks setup for companies like drain cleaners, emergency service electricians and others:

-

You use QuickBooks setup needs to be able to track all the costs and generate Simple Invoices which can then be input into QuickBooks Premier Contractor Edition

-

Your QuickBooks setup for the Chart of Accounts is usually focused Goods Sold Accounts (COGS) to allocate project costs

-

You will need to closely monitor the daily changes in the Five Key Performance Indicators (KPI) to understand the financial health of your business

-

Your QuickBooks setup will need between 500 to 2,500 Items setup to track all the costs of the construction process from beginning to end

-

This is the fourth most difficult QuickBooks setup for Premier Contractor Edition because there is a mix of Direct, Indirect, COGS accounts

-

The day to day input is also the third most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your generates a very stable income because you are not as sensitive to the ups and downs of the new construction market

-

In order to reach your full business potential you need an strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

QuickBooks Setup - By a QuickBooks expert in construction accounting to work specifically for contractors on whatever year and version of QuickBooks you own because we have worked with QuickBooks since it first arrived in the early 1990's in DOS.

Having Used - A number of accounting programs over the years we believe when your QuickBooks setup is done correctly is the best, hands down, no contest! For the construction trades the tiny amount of money difference between QuickBooks Pro and QuickBooks Premier Contractor Edition is worth the investment for the additional a Contractor Reports alone. Upgrading every year is a “no brainer” because of all the new features and if a contractor’s construction accounting staff only saves only 10 minutes a day the savings will more than pay for the program.

Our mission is to “Help Contractors Achieve Their Definition Of Success”. Which means we work with them and support them no matter what version of QuickBooks they use? We have observed contractors who use QuickBooks Premier Contractor Edition simply make more money.

We Contract - With An Intuit Authorized Commercial Host company that allows us to access QuickBooks Desktop Version Online. The good news is they are great at providing 24/7 access to client QuickBooks files and nightly backup. The other news is that we need staff that is skilled in construction bookkeeping and accounting and other staff that is very experienced with Microsoft Windows Explorer File Structure because we have to upload, setup, monitor and maintain the QuickBooks data, paperless documents and internal file folders for each client. The great news is that from our client’s point of view everything just works fast and easy so they love it!

It Is Like - Having a red carpet lease for your car. The manufacturer (Intuit) makes and sells the product and the contractor buys it (QuickBooks) parks it in our garage (Hosting Service) where our mechanics keep it tuned up and running smoothly (Microsoft Windows Explorer Specialists) and the chauffeurs (construction bookkeepers and accountants) drive the transactions and paperwork into it so the contractor can enjoy the ride (passenger) and generate useful KPI Reports anytime day or night and we help them understand and use the KPI Reports

Click Here To Start Your Business Process Management Strategy

Outsourced Construction Accounting Services

Outsourced Construction Bookkeeping Services

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com.