QuickBooks Solutions for Multiple Company Files

More Construction Companies Than Ever - Have to rely on two or more incomes. We have met with contractors from several groups:

Group One - One person works for outside employer and the other person is self-employed. Today it is more common to see both partners are self-employed and own their business.

Businesses Owned By - Related business partners and business types may be merged into a single QuickBooks file and that can cause all kinds of trouble!

When The Individual Household Partners - File their annual tax return jointly the tax prepare who files the annual Income Tax Return looks at all the business and personal financials and is the final authority on what can and cannot be merged together on a single tax return.

Most Tax Returns Are About A “Zillion” - Pages long with much of the information duplicated on both the personal and business returns which is why we recommend you hire someone who specializes in preparing annual tax returns NOT Jack-Of-All-Accounting-Trades-Master-Of-None. We do not prepare annual tax returns; we do process Payroll and prepare Quarterly Tax Reports.

Why Do You Need Individual QuickBooks Company Files?

Even With Related Personal Partnerships - (married couples) each individual business types are not related and require they own Federal Tax ID Number (EIN). This creates the need for two or more QuickBooks files.

For Example -One partner is a Construction Contractor and the other partner has an Event’s Planning business.

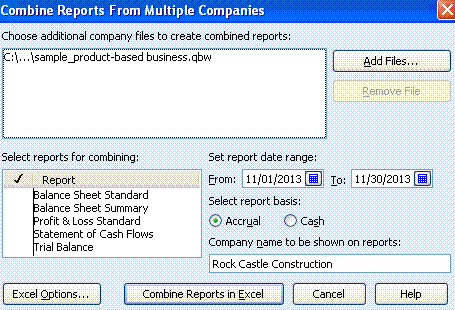

Multiple Companies In QuickBooks - QuickBooks will support multiple company files, Learn More... If one partner uses a Mac Computer and the other partner uses a PC you can both access QuickBooks windows version using our QuickBooks in the Cloud.

Individual Ownership - Of each company is not by the same parties.

Company Ownership Issues - Business partnerships between unrelated people makes the day to day accounting even more complex. Who handles the bookkeeping can range from “Everyone” is helping to write checks and “No One” is doing the actual bookkeeping. Which leads to a situation known as QuickBooks Out Of Control!

Common Practice - Money is coming / going between accounts of non-related companies and expenses are paid by a multiple of accounts either business / personal / or by others except the business checking account of the actual company.

When Company Funds Are Used - There is a need to track the flow of funds to / from each of the company QuickBooks files. Our focus is Contractors – we also focus on the business finances of our clients. Where did the money come from (Income / Personal funds / Money from others) – and where did it go? (Expenses / COGS / Taxes / Personal Draw) For this reason when the second / third / more company is “non-medical” we recommend that we handle the bookkeeping for all of the company files.

Common Practice - Money is coming / going between personal accounts to pay business expenses by family members or non-related household members.

Example - Contractor uses personal credit card and would like to be able to show the expense in QuickBooks file….Yes they should have used a company credit card; however, you were at the store, you needed some material to finish the job and did not have the company credit card with you or it may have been maxed out. So you did what you needed to do to get the job done!

Example - Girlfriend or Boyfriend pays from their personal account for expenses like vehicle insurance / bond / contractor’s license / etc. – because it was the fastest way to get it done. Someday she / he would like to be paid back.

How Do You Track All Of It - We have a Bookkeeping System to account for all business expenses. Without properly reflecting all the business expenses – Profit & Loss Statement is incorrect and equals higher taxes.

If The Business Owner Takes Money Out - Under the theme of “It’s Mine” without proper documentation then the Profit & Loss is incorrect again.

Sometimes Clients Want - To keep doing the QuickBooks file for “Their Tiny Little Company” and as time goes on they forget that the funds were handled on one side and missing on the other.

As Construction Bookkeepers - We know what standard and usual types of expenses are. If we see expenses have been paid with personal funds / funds by others – we track it in QuickBooks. If we see that normal expenses are missing – we ask about them…Maybe those expenses don’t exist….Most contactors want to have an idea of the individual profit by job and a variety of other reports

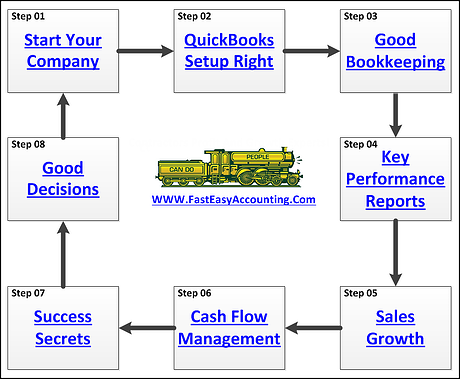

To Meet Construction Company Owners Needs For Specialized QuickBooks Reports – We have to think about What / Why / When / How and then develop the bookkeeping system and reports to provide the answers.

What Reports Do Most Contractors Want?

Why Do They Want To Know?

When Do They Want To Know?

How Do They Want To Know?

We Can Custom Tailor Reports To Fit Your Needs!

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

When You Become A Client reports hidden in your QuickBooks S.W.O.T. Analysis Strategic Roadmap

If You Are A Contractor You Deserve To Be Wealthy Because You Bring Value To Other People's Lives! This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services

Thinking About Outsourcing Your Contractors Bookkeeping Services? Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii <p>No Charge One-Hour Consultation for contractors like you to ask e<span style="font-size: 1em;">verything you always wanted to know about hiring a QuickBooks expert to help you with your contractor bookkeeping or perhaps do it all for you, but were afraid to ask because it might cost you a lot of money and you cannot afford it! The call is FREE!</span></p><p> </p><p>We are the small construction company owner's #1 Fan!</p><p> </p><p>You have one of the best support groups for small construction firms right here!</p><p> </p><p>If you are a brand new contractor trying to decide if QuickBooks is right for you or an established contractor who knows QuickBooks can do a lot more for you?</p><ul><li>Do you employ 1 - 10 people including yourself?</li><li><span style="font-size: 1em;">Are your yearly sales between $0 - $5 million?</span></li><li><span style="font-size: 1em;">Are your contracting projects between $50 and $100,000 each?</span></li></ul><p><span style="font-size: 1em;">Call Sharie 206-361-3950 or email her sharie@fasteasyaccounting.com</span></p><p> </p><p><span style="font-size: 1em;">Download your free guide to finding the right bookkeeping service for your contracting company </span><a href="http://www.fasteasyaccounting.com/contractors-bookkeeping-services-guide-for-quickbooks" style="font-size: 1em;" target="_blank">http://www.fasteasyaccounting.com/contractors-bookkeeping-services-guide-for-quickbooks</a&amp

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.