Hot Time Card Issues

The most practical reason is that all employees want to get paid, early, often and on a regular basis and we recommend your employees fill out their own time cards.

For those of you that are parents do you remember when you brought home that brand new baby? They need food, water and diaper changed. You learned all about “Goldilocks and the Three Bears” Some children who are born on a HOT summer day seem to get “overheated” very easily and do not suffer quietly.

Employees are similar children because in many cases you the contractor take over where their parents left off. They want their paychecks (allowance) on a regular basis and had better not bounce at the bank due to insufficient funds.

Payday is the time when “It’s Results Driven”, yours not theirs and “No Excuses Allowed” if an employee does not get paid “On Time” they may call State Agencies for assistance.

Purpose Of Timecards:

-

Pay Employees

-

Fill out Government Forms

-

Job Costing for a better bottom line

As the Employer you need to have the Timecard as the foundation to making sure employees get paid. Employees need to fill-it-out their own timecard and total it, including anyone on salary. You can create your own timecard or you can download our FREE timecard form and modify it to fit your needs. Timecard needs to be something more than a few numbers scribbled on back of a paper bag or the nearest Home Depot receipt (those are already full of foot prints and coffee stains).

After all timecards (timesheets) are entered into QuickBooks save and file them. Do this even if you are using a 3rd party payroll processor. You may need to reference the information later.

Timecards Should Have The Following - More Detail Is Better:

-

Company Name

-

Time Period Payroll Covers

-

Employee Name

-

Days of Week worked

-

Hours Worked with Start / Stop and lunch breaks

-

Total Regular Hours

-

Total Overtime Hours

-

Special Hours

We have a FREE sample time card you can download by clicking here

Quarterly tax returns for Washington State Employment Security and Washington State Labor & Industries quarterly tax returns cross reference each other. Washington Employment Security and Labor & Industries compare what you put on your quarterly tax returns and communicate with each another to review the same employee wage data in different ways.

Quarterly tax returns for Washington State Employment Security Quarterly Reports want employee wage detail including:

Name

Social Security Numbers

Hours Worked

Gross Wages

Washington State Labor And Industries Wants Summary Data Including:

Labor code worked under

Total hours per classification

Total wages per classification

Washington State Labor And Industries sets the rate for each contractor based on their experience rating.

Example of Washington State L&I Contractor Rates

It is always optional to take the employee deduction from employees paycheck based on risk classification worked. Taking more than allowed is not acceptable.

We recommend all construction company owners deduct the maximum allowed from each employee and bring it up early and often in your safety meetings because it helps them focus more attention on safety which helps lower overhead costs and benefits everyone. It is important to understand the Psychology of Construction Field Employees. Click here for more

Whenever any employee is requesting unemployment benefits, their request is sent to the employer to verify they are or have been an employee. The Washington State Employment Security computer may auto fill the form and sends a letter to the first company on the list. It is very important that someone in your office double checks the accuracy of the request and notify the Washington State Employment Security if it is not your employee. Companies have similar names and each state wants to apply the risk to the proper company. They also want to verify if any employee is saying they have worked for a company which they were a 1099 contract employee or trying to submit a fraudulent claim.

Part Time Employees

What about an employee who is working part time and sometimes receiving unemployment benefits.

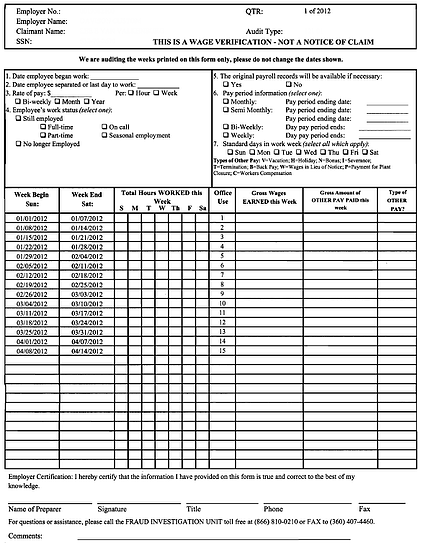

Washington State Employment Security will send a form for the employee to fill out breaking down the hours and gross pay week-by-week for a period that is in question.

Example of Washington State Employment Security Wage Verification

This can be for all the hours worked from a 12 to 52 week period including time worked during the previous year. Your source document is the timecards and paystubs and you may need it if you have to prove their hours and the more detail in their own handwriting the better!

Washington State Employment Security wants to know

Does the social security number match?

What is the rate of pay?

Is there any other type of benefits?

What is your pay cycle?

What is the last day of the pay period?

Are original timecards (sheets) available?

What are the daily hours with a weekly total?

What is the weekly total earned?

What day was the wages paid?

Dollar amount of wages paid?

All forms are easy to fill out if you have all the data in an easily usable format that accessible. What you do as a contractor is “Easy To Do” if it is something you do all of the time.

As QuickBooks experts in Contractors accounting and contractors bookkeeping paperwork is our special skill set. We know what to do! Let us help you so you can do what you do best!

Profitable Construction - Companies have known about and outsourced bookkeeping for a long time and now you know about it too!

Fill Out The Form And Get The Help You Need!

Business Process Management For Contractors

Click Here To Learn More

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Outsourced Construction Accounting Services

Outsourced Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+