QuickBooks Expenses Not Assigned to Jobs

Expenses Not Assigned to Jobs - Report lists costs that have not been assigned to a customer or job, totaled by vendor. This report helps you find costs that may not have been passed along to your customers.

This QuickBooks Report - Is a list of the costs and expenses that are not assigned to any customer project or job, totaled by vendor.

This QuickBooks Report - Includes only the last fiscal year by default. If you want a different reporting period to show simply click on the Dates drop-down list and choose a different date range.

This QuickBooks Report - Can help construction business owners find costs that may not have been invoiced to your customers.

To Optimize Profits The 80 /20 Rule all job costs must be invoiced to your customer job project.

If Your Bookkeeping System - Fails to do this properly it could cause your job costing reports to be horribly inaccurate and make it appear that your jobs are more profitable than they are in the real world.

Finally If You Invoice Customers - Using the Time and Materials, (T&M) basis, you could be missing some costs that were not assigned to the customer project / job.

We offer a Job Costing Service Where We Do It All For You!

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

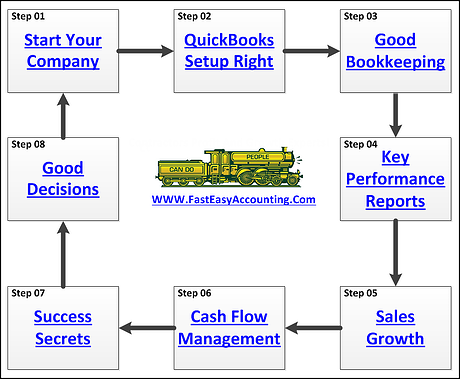

You went into business for yourself for a variety of reasons and in most cases you thought all you had to do was get good jobs, do the work and you would make a lot of money. In a very short while you got a rude wake-up-call and your reality check bounced. You found out getting the jobs and doing the work was only a small part of being a contractor. What started out as an adventure turned into something not as fun as you thought it would be and then it degenerated into a nightmare as you discovered the three accounting nightmares all contractors face. #1 Calculating And Processing Payroll #2 Calculating And Filing A Slew Of Tax Returns #3 Figuring Out Which Customers And Jobs Are Profitable And Which Ones To Avoid Like The Plague

When You Become A Client reports hidden in your QuickBooks S.W.O.T. Analysis Strategic Roadmap

If You Are A Contractor You Deserve To Be Wealthy Because You Bring Value To Other People's Lives! This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services

Thinking About Outsourcing Your Contractors Bookkeeping Services? Click On The Button Below To Download A Free Guide

Need Help Now? Call Sharie 206-361-3950

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

Cloud Based QuickBooks Outsourced Bookkeeping Services For Contractors All Across The U.S.A. We are headquartered in Lynnwood, Washington State, USA. We work remotely to meet your accounting and bookkeeping needs with QuickBooks and Xero Accounting Online whichever is most appropriate for your situation. We can perform a QuickBooks Setup,QuickBooks cleanup, customize your invoices, process payroll and generate QuickBooks financial reports. We Help “A Little or A Lot” depending on your needs including on-going bookkeeping services. Remote web based QuickBooks for contractors bookkeeping, accounting & quarterly tax reports. We specialize in contractors including general, specialty and trade contractors, home builders and commercial tenant improvement contractors. If you need help please call Sharie <span class="baec5a81-e4d6-4674-97f3-e9220f0136c1" style="white-space: nowrap;">206-361-3950<a title="Call: 206-361-3950" style="margin: 0px; border: currentColor; left: 0px; top: 0px; width: 16px; height: 16px; right: 0px; bottom: 0px; overflow: hidden; vertical-align: middle; float: none; display: inline; white-space: nowrap; position: static !important;" href="#"><img title="Call: 206-361-3950" style="margin: 0px; border: currentColor; left: 0px; top: 0px; width: 16px; height: 16px; right: 0px; bottom: 0px; overflow: hidden; vertical-align: middle; float: none; display: inline; white-space: nowrap; position: static !important;" src="data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAABAAAAAQCAYAAAAf8/9hAAAACXBIWXMAAA7EAAAOxAGVKw4bAAAAIGNIUk0AAHolAACAgwAA+f8AAIDpAAB1MAAA6mAAADqYAAAXb5JfxUYAAAKLSURBVHjadJPfS5NhFMe/21xvuhXRyJAZroiSrJnbRdT7vrAf5HBaK5RABmEEwQIvkpZ/QRcWXdSFw5soKaF0F7qZeLO13mGBDpQsf5CoxVKHOt0Pctp2uvEdrzG/V+c553w/54HnPDIiQiGpPMETABoB2AAYd9MRAMMAvGmX+RcAyAoBVJ7gZQDtABworH4AHWmX+bOMZdkjCoXiUzabvcAwzPSsob5p/VTNY9GcdpnxdmYZ9wJThSCtCr1e/4XjuNPd3d1KjUZzaGbI27ysqzGQoggAsLa1A7ehArrDxfDNr0oBlQB+wmKxbJFEL968SxoamsjkHaPU9l9piUo6A0RE1DG2QCWdASrpDAzJM5kMI8XecdjVxfEl+K9dxFgsgUvvR6HyBKHyBAEATyKLeGSsENuNcqk5kUjEGm7fzcYqr0ClVODl99+YXEvl6+c1amjVe+ahiGGYaUEQKnmeh91uL43rqheixjpdmzCL11er0PcjhrTLvMfUJsyKYUSeyWQ6enp6tgCgrKxsfbP8bB8AdE1G89cOReMAgOv+Cag8QXRNRkXAsDwcDr+am5tLCYKA3t7eo2dG+1vVK/MfpRPtA+MIReMYaKj+/xm9MiICx3EmpVL5wefzFavValis1u1vvHMkdfykCQC0kSGUTo+Ajmnx1dSC7IGD+UUCEYGIwLKsyWazrSeTSSIiMpnNf7Ttz5+ec96fr7/VnE0mk+QfHMzV3WjcKH/4rEr05QGFIA6HY4llWRLPRER+v3/HYrFMFQSIkNra2tVQKJSlfcSyLO0LECFWq3XF6XRGA4HAptTsdrsXeZ6fEHtl+31nAOA4rkUulz/I5XL63dQGgHEAN8Ph8AYA/BsAt4ube4GblQIAAAAASUVORK5CYII="></a></span> or sharie@FastEasyAccounting.com If you are considering hiring a contractors bookkeeping service go to http://www.fasteasyaccounting.com/contractors-bookkeeping-services-guide-for-quickbooks

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System Randal on Google+

This QuickBooks Report - Is a list of the costs and expenses that are not assigned to any customer project or job, totaled by vendor.

This QuickBooks Report - Is a list of the costs and expenses that are not assigned to any customer project or job, totaled by vendor.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.