We Offer Contractors Liability Insurance Audit Support

Fill Out The Form And Get The Help You Need!

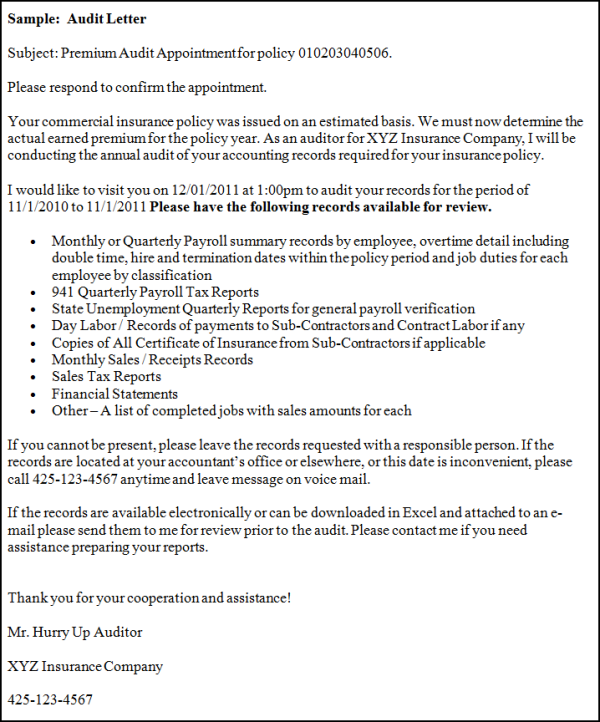

Your Audit Request May Come - By email or USPS letter

Your Annual Construction Liability Insurance Audit - Is part of the renewal process. Your Initial insurance premium is based on an estimate of your gross sales and your payroll to help your insurance company determine the amount of risk your company is exposed too.

We Have A Conference Room - You can use to meet with the auditor and we can have someone from out office present if you want it. Many times we meet with the auditor and can do most of the work without you needing to be there.

Your Insurance Audit Is - Similar to Estimates vs. Actuals report you generate for your Job Costing Reports. The audit will determine how much was under or over billed on the preceding year based on what your sales and payroll amounts. These numbers are also used to determine the amount of next year’s premium.

The Audit Process - Is an open book test because you have the list of questions ahead of time. It is just a matter of finding the answers in a timely manner (by the appointment date if a in person physical audit)

It Is A “What It Is” - Type of test as there is no wrong answer; however, if you have the answers without the proper supporting documents that could cost you a bundle of money.

Fill Out The Form And Get The Help You Need!

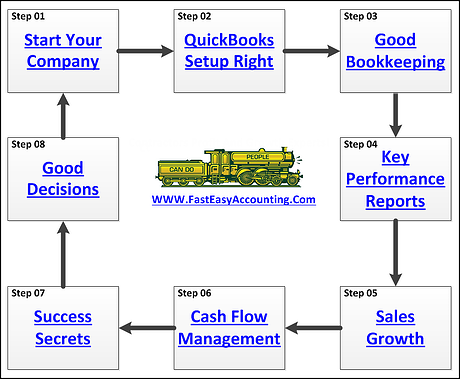

QuickBooks For Contractors - Can really help, if it is setup correctly, push a few buttons and have the printed reports in less than ten minutes.

The Insurance Auditor Can Require:

-

In Person Physical Audit - The auditor fills out the audit form

-

Auditor Will Require - Copies of your detailed reports

The Insurance Auditor May Require:

-

Voluntary By Mail Audit – Forms sent to your company for you, your bookkeeper or outsourced accounting company to fill out based on QuickBooks reports.

-

Auditor May Require - Copies of Detailed Reports

Sample Disclaimer:

*Premium auditing involves obtaining information from a policyholder’s financial records in order to adjust insurance premiums. Policyholder information is allocated among various classifications based on state and / or insurance jurisdictional rules and regulations. Results are submitted to insurance carriers for premium adjustment and statistical rate making. Premium Auditing is not the formal examination of financial records for accounting purposes.*

Your Insurance Company Wants To Know Early And Often What Jobs You Are Bidding - The names of other contractors are involved (sharing the risk). For Larger Projects many contractors liability insurance companies would like to see the Prime Documents before the bid is submitted.

Your Annual Insurance Audit - Report is touching sales / payroll / taxes. Insurance companies do not discuss how much access they have / do not have to a State / Local / Federal records to cross verify information given which is why many auditors require copies of actual payroll and sales tax reports filed.

Properly Setup QuickBooks Reports Will Have - Many of the answers needed to fill out the annual Insurance audit form. Having a clean set of books makes the process more efficient and less painful as the report is asking for information in multiple ways.

QuickBooks Makes It Easier - To fill out the forms and it is possible you may save money on premiums. Having an outside accountant is helpful because they deal with this stuff year round. It could save you more in time and money than you spend to have it taken care of by a professional because we know where and what information is needed to complete the report.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To Be Wealthy

Because You Bring Value To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Outsourced Construction Accounting Services

Outsourced Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.