Construction Accounting Services For Brand New Construction Company Owners

Brand New Construction Company Owners Have Unique Construction Accounting Needs

-

Not Just Any Construction Accounting Bookkeeper Will Do - Too often brand new construction company owners hire the wrong bookkeeper mistakenly believing all bookkeepers are the same. Nothing is further from the truth. Not all construction workers are the same. You would never hire a construction worker with a background in new construction commercial work to be part of your brand new construction company crew because they are trained to rip and tear, yell, get aggressive and bully everyone and everything in their way. The resulting destruction to you, your crew, your company and the poor family whose home you are working on would be extremely expensive.

-

Don't Hire The Wrong Construction Accounting Person - To handle your brand new construction company accounting needs. You need people trained in construction accounting.

-

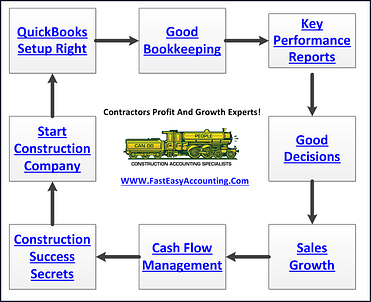

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your construction company and it will not matter who is doing the construction bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your construction business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

Brand New Construction Company Owners - Need people trained in construction accounting not someone with experience in regular bookkeeping. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost you tens of thousands of dollars a year or more on your bottom line profit.

-

We Know Construction Accounting - And we know what to do so you are not paying for guess work to get the QuickBooks reports you need to operate and grow your construction business.

-

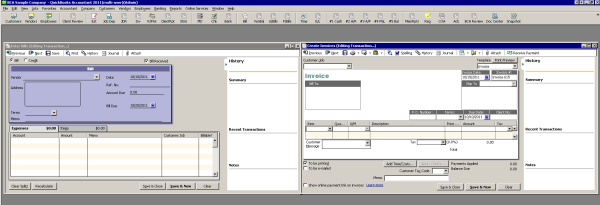

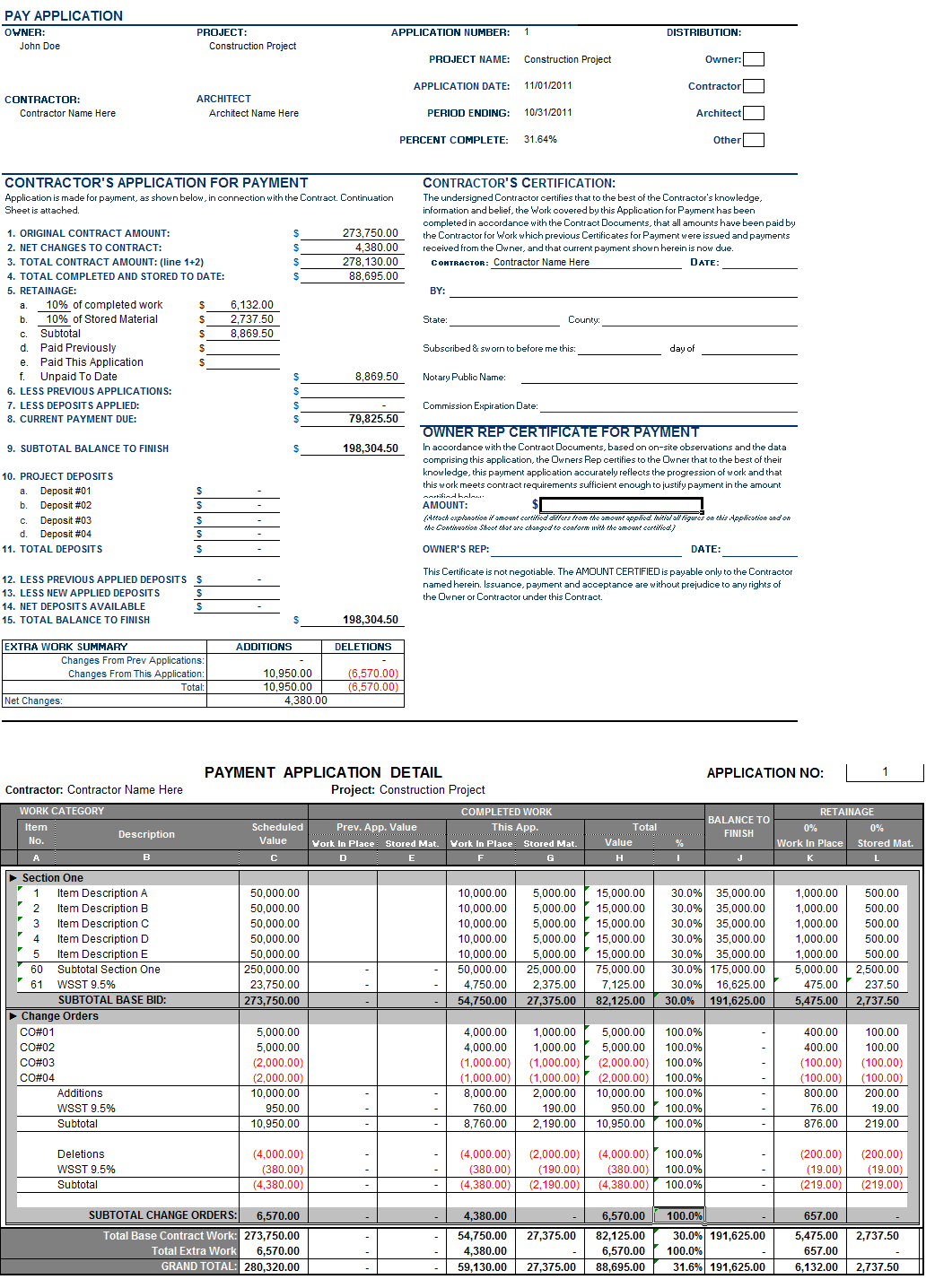

Invoicing And Statement Services - For brand new construction company owners no matter how you charge: Time and Material, Flat-Rate, Cost Plus, Not-To-Exceed, Underground, Rough-In, Trim, Milestones and several other methods.

-

Job Deposits - Customer down payments can be input several ways. There is only one method that will help manage cash flow and save money on taxes.

-

Complex Invoicing - With multiple deposits, payments, change orders, payment history and running totals your customer can follow. We prepare these and send them to you as often as you need them.

What You Can Expect From Our Construction Accounting And Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Are Less Expensive Cheap Bookkeeper

And We Offer Cloud Based Desktop QuickBooks

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com.