Bookkeeping Services For Contractors

Owning A Construction Business - Means you understand that Bookkeeping is just one of those mundane, nasty, dirty, aggravating, grubby little chores you get stuck with along with its rotten scoundrel cousin the Monthly / Quarterly Tax Reports.

If You Have Employees - Whoa! Look out! On top of everything else you have payroll to process, in some cases you may decide to provide cash advances to your employees to keep them focused on the job and not on personal issues and finally there are all the Payroll Taxes you need to keep track of and file the reports for on a regular basis.

Smart Contractors - Know their time is more valuable spent meeting prospective clients, putting together bids, managing jobsites and a whole lot of other things other than bookkeeping. So they find someone else to do it and that is the subject of this article.

Just Like There Are - Skilled construction workers and clowns trying to pass themselves off as skilled workers there are Professional Bookkeepers and Bad Bookkeepers.

You Know How To - Tell if someone knows what they are doing in construction because you have been doing it a while.

You May Not Know - How to tell if someone is going to do right by you in your bookkeeping so here are the top ten things to watch out for:

Most Contractors Don't Need - An office. Why should they? The majority of your clients hardly ever come to your place of business. And if you do need a place to meet someone you can use our meeting room.

Red Flag #1 Professionals Do Need An Office - Professionals in any field, doctors, lawyers, consultants and bookkeepers that cannot afford to maintain an office, even a small one room office, outside their home is in my opinion dangerous, dangerous, dangerous!

The Ones Who Say - "I keep my overhead low" may as well be saying "Your records are available to any of my family, friends and neighbors to rummage through them because I am not the least bit concerned about your exposure to Identity theft or you competition getting a peek at what your business is all about."

Red Flag #2 Professionals Do Not Work Alone - Because it is too easy to get sloppy and lazy when there is nobody else looking over their work. After a while they develop a severe case of the stupids! Just like a hermit living in the mountains in a cabin they go stir crazy.

Red Flag #3 Professionals Accept Credit Cards - Wanna Bees don't and in a lot of cases it is because of bad credit score, business location, business setup, criminal record, (Perhaps involving embezzlement) and a whole lot of other reasons including the fact that it cost money to take credit and debit cards.

The Ones Who Say - "It costs money to accept credit cards" ask them if they use credit cards ask yourself, "What are they really saying?"Business Consulting And Accounting - Accepts all major credit and debit cards including Visa, MasterCard, Novus, Discover, American Express, Check Cards, Cash, Checks and Wire Transfer. And it does not cost you anything extra!

Red Flag #4 Bad Bookkeeper - For a short list of Bad Bookkeeper Traits Click Here

Red Flag #5 Time Billing Only - Professional Bookkeeping Services charge a flat monthly fee for services. Only someone who does not know what they are doing still charges by the hour. Professionals have a contractor bookkeeping system and they continually improve on it.

We Are Accountants For Goodness Sake - Any bookkeeping and accounting firm that does not know how to calculate complex algorithms that take into account fluctuations in the workload and generate a monthly fee that is fair to you and them they need to go back to school and take those courses on Decision Modeling, Statistical Analysis and Business Process Management.

All Professional Bookkeeping Services - Have formulas for calculating fee structures. It is not rocket science but it does take a deep understanding of accounting:

-

How many employees do you have? From that we know how much time and effort will be required to process payroll and do the tax reports

-

What type of construction do you do? New, remodel, service, residential, commercial? From the number of employees and the type of work you do we know how much time and effort will be required to do all the bookkeeping, bank and vendor reconciliations and the rest. Because we have a System. Click Here To Learn About Our System

Red Flag #6 All Businesses Welcome - Gone is the day of the person sitting at the desk with green eyeshades handling the books for a variety of businesses.

You Are Facing Fierce Competition - And it is getting worse. You need someone who specializes in your industry. If you are in the construction industry we can help. If you are in the restaurant industry, sorry, we cannot help you.

Red Flag #7 Your QuickBooks Is Hidden - Today more than ever you need to have access to your QuickBooks. Any bookkeeping service that cannot or will not allow you 24/7 access to your QuickBooks Desktop Version in a cloud based environment is doing you a disservice. Now if you do not want or need it that is O.K. too!

Red Flag #8 Annual Tax Return And Bookkeeping - Bad, Bad, Bad....I have written several articles on this subject and you can Click Here For The Best One

Red Flag #9 Unwilling To Collaborate - When your bookkeeper gets a bit uncomfortable about other people being involved and overseeing your financial records you have a BIG PROBLEM.

We Advocate Trust-But-Verify - There are five people you need on your Board of Advisors and you are paying for their services anyway so you may as well take full advantage of them. They are there to help you.

Red Flag #10 They Do Not Understand KPI - KPI is short for Key Performance Indicators also known as the Five Key Reports every contractor needs.

Here Are The Key Performance Indicators:

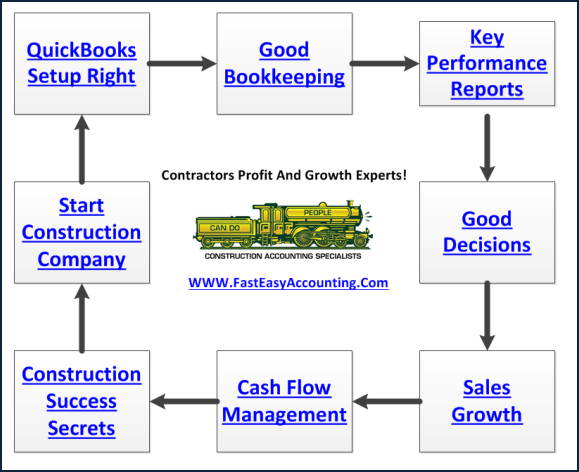

There Is A Better Way To Run Your Construction Business And You Found It!

Click Here To Start Your Business Process Management Strategy

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Outsourced Construction Accounting Services

Outsourced Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.