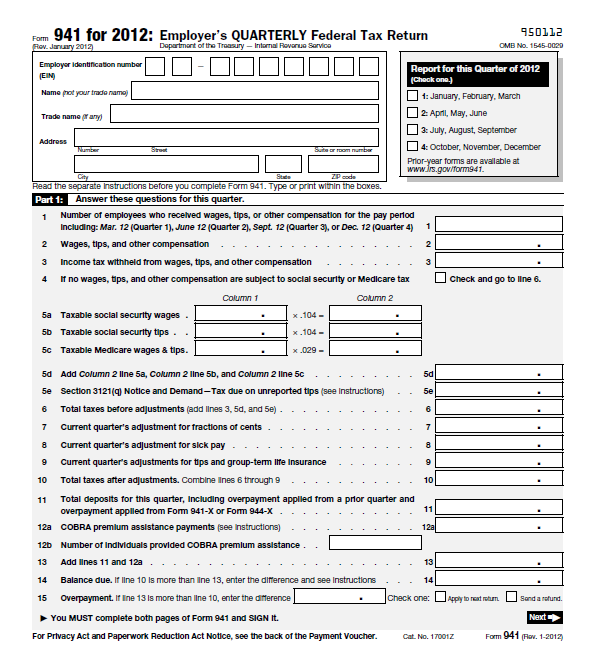

Quarterly 941 Tax Returns For Contractors

Contractors In Construction Businesses - With employees have to prepare, file and pay Federal 941 Payroll reports by the end of the month following the end of the previous quarter.

Payroll Taxes Are Calculated - On gross wages. Federal payroll taxes are paid based on the individual schedule set up by the Internal Revenue Service. It based on the total payroll liabilities schedule can be semi-weekly / monthly / quarterly. The 941 payroll tax reports are due on a quarterly basis (including no payroll) All outstanding payroll liabilities must be paid by the due date of the quarterly report.

Are You An Employee - Your contractor business? By that I mean do you take a formal payroll and receive a W-2 at the end of the year? Depending on your company structure you may or may not be an employee. Do you have any other employees? If you are anyone else in your company they need to an employee with regular payroll / taxes taken out of each check / W-2 at the end of the year and payroll taxes paid.

The Amounts Declared - On your quarterly 941 reports and your annual 940 (Federal Unemployment) and the year-end W-2’s all need to match each other. Otherwise you could send a red flag that may trigger an audit.

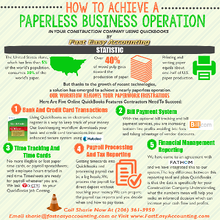

Things Have Changed - Now the IRS has can request a copy of your QuickBooks file for an intense review. Now more than ever you need to be sure your bookkeeping is clean and proper. This is one area where a Bad Bookkeeping can cost you and your company a lot of money in back taxes, fines and penalties.

Do Not Hire “1099 Employees” - Any non-employees need to be properly licensed as they are in business for themselves or should be an employee of another company. Casual construction labor needs can be met by using “temp service” like Madden Industrial Craftsman or Labor Ready and as part of their fees it covers the cost of their employee payroll taxes.

Most States Have Online Databases - To check on the status of a business by company name or owner’s name. You need to be aware that State and Federal government agencies talk to one another. Most states have employers fill out a “New Hire” form to notify the State of the location of new employees.

Most States Will Check - Their records for “Outstanding Child Support” liabilities. This database is linked to all 50 states and Tribal Agencies. It is important for business owners not to get into a position where they will be forced to assume the financial liability for some or all of your employee's children due to issues regarding payments due to the state agencies.

If You Are You Still Using the IRS Tax Guide – I recommend looking into our Payroll Processing Service because it could save you time and money.

Having Processed Construction Payroll In Washington State - For over thirty years we understand their guidelines very well and we know who and where to call when the things gets “wacky”.

With Our Cloud Based Bookkeeping Services - You have a wonderful alternative to having everything on your desktop or notebook computer. Electronic tax reporting forms can be quick and easy to fill out if you know what you are doing, if not we can help.

You May Still Need A Way To Prove - That you sent the quarterly tax forms to the appropriate tax agencies. In those cases you can print the reports on your printer as needed.

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Outsourced Construction Accounting Services

Outsourced Construction Bookkeeping Services

We Are QuickBooks Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

E-Mail Us Now! sharie@fasteasyaccounting.com

Business Consulting And Accounting

19909 64th Avenue West, Suite B, 2nd Floor

Lynnwood, Washington, 98036

206-361-3950

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com.