Virtual Bookkeepers Vs.Outsourced Bookkeeping

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

At networking events contractors have asked me about the risks of someone working in an undisclosed location handling their construction bookkeeping records.

I explain it this way virtual assistants can be a real asset to any business owner because they can handle a variety of mundane tasks better, faster than most business owners can. The time saved can be used to do things only the business owner can do. In short, do the $50 to $100 an hour work and outsourcing the $15 to $25 an hour work to a virtual assistant makes sense. In the end everyone makes more money and gets more enjoyment because they are doing what they love to do!

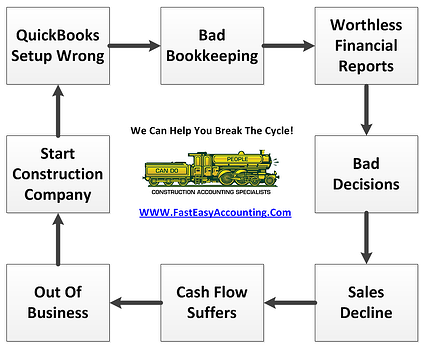

However, do not outsource important construction accounting services to a "virtual bookkeeper" because that is in my opinion foolish. The reason is simple; a virtual bookkeeper is usually a Bad Bookkeeper which is someone with enough skill to bluff their way into a construction accounting job but without the skillsets to keep it.

So what happens is they take a few online courses or attend a weekend seminar, setup a desk in their home and all of a sudden they are a low overhead, low price, virtual bookkeeper wrecking ball looking for a contractor to test out their new found skills on. Hiring one is like turning an apprentice loose on a job site with a set of plans and some power tools!

Since you have all your eggs in one basket and nobody to oversee that one bookkeeper you hope they never get sick, take a vacation, get distracted, get overloaded with clients or simply pass away. Because when, not if, any one of those things happen your contractors bookkeeping services needs will be way down the list of what is important.

In addition, most virtual bookkeepers operate in a vacuum; nobody to talk too, nowhere other than help screens for support and no incentive for continuing education. In most cases their ten years of experience is six months training repeated twenty times.

This is my opinion from reviewing hundreds of offers to subcontract to "Virtual Bookkeepers" on a regular basis. In all the interviews we have conducted sometime during the conversation most of the "Virtual Bookkeepers" relate stories to demonstrate how the "stupid contractors" they worked for went "bankrupt". I suspect part of it was due to the actions to the virtual bookkeeper.

newbie virtual bookkeepers give out their home address until they get a few angry contractors stopping by to express dissatisfaction about the condition of their QuickBooks Contractors financial reports anytime of the day or night. After a while they get a P.O. Box or a "Virtual Office" or the economy picks up and they get hired by a desperate contractor.

At the extreme end is the super-duper bargain basement, lower than low priced "virtual bookkeepers" working overseas in unfriendly environments with little or no skill in bookkeeping or accounting let alone construction accounting which is a whole different skill set.

The worst thing a contractor can do is enable a virtual bookkeeper remote access to their desktop computers, servers or other web enabled devices to have free unrestricted access to your company software and financial documents. See Bookkeeper Theft And Ways To Avoid It

The virtual bookkeeper can sign onto your company’s secure network from their home computer and accesses any documents just as they would if logged onto an on-site company computer and in many cases introduce viruses and wipe out many years' worth of work in QuickBooks and other sensitive data.

Outsourced Contractor Bookkeeping Services Providers

On the other side are the Outsourced Contractor Bookkeeping Services Providers like us. We work in a real office building with public access and normal business hours. We hire professional construction accountants and bookkeepers and have a comprehensive Construction Accounting System.

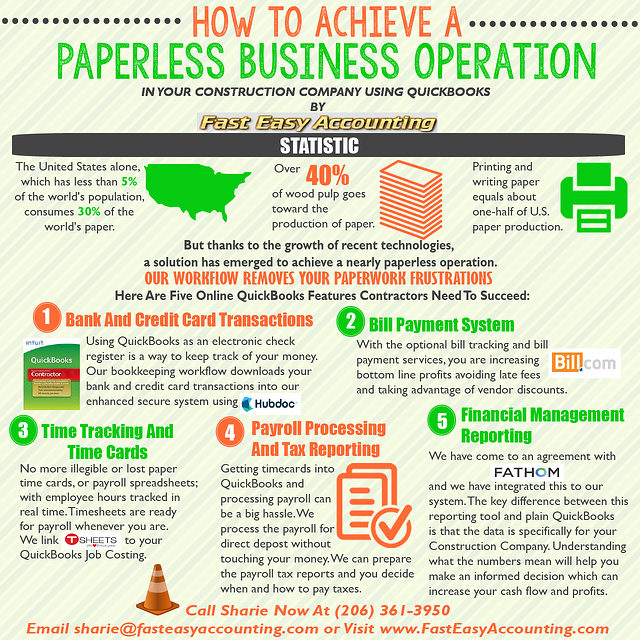

Outsourced Contractor Bookkeeping Services like ours do not rely on in-house servers; or your servers, instead we contract with an Intuit Approved Commercial Hosting company. What that means is Intuit the parent company of QuickBooks has set high standards and rigid requirements for any company wanting to host QuickBooks files. This gives contractors a layer of protection not available in privately held servers because everything is backed up and QuickBooks for Contractors software patches are installed automatically.

Very early in our search for a place to host, store, backup and maintain our own QuickBooks client files we "test drove" a lot of QuickBooks hosting providers before Intuit put their commercial Hosting Program in place and found most of them were offended when we asked detailed questions regarding safety, security and QuickBooks for Contractor backup procedures. In more than one case they hung up the phone and removed our access.

We have since found what we consider to be the best of the best Intuit Commercial Hosting Provider and we have our own private server. It is not cheap; however, quality is like oats...fresh clean oats cost more than oats that have been through the horse and we know What Ten Minutes Waste Costs.

Outsourced Contractor Bookkeeping Services have more than one person in the office so you do not have all your eggs in one basket. There are processes in place for checking and verifying the work. When a construction bookkeeper gets, take a vacation, get distracted, get overloaded with clients or simply passes away there is someone else to fill in because everyone is cross trained on everyone else's job wherever possible.

Work flow processes and job descriptions are documented in operations manuals so that when a new hire joins the firm they learn from videos, manuals and audio recordings. Not the old worn out method of following someone around and learning by watching. This means you get what you expect and read about in our Welcome Manual, very predictable, no surprises.

Qualified Outsourced Contractor Bookkeeping Services have specialists and for internal support for staff to talk with and get questions answered. We also provide continuing education. In most cases our staff ten years of experience really is ten years' experience.

Reduced Employee Costs

Both the virtual bookkeeper and Outsourced Contractor Bookkeeping Services may be appealing to a contractor because of the cost savings and flexibility associated with this arrangement. Neither one require office space, supplies, insurance, benefits or employment taxes which is a huge savings for the contractor. See What It Really Costs To Have A Bookkeeper In Your Office.

Both the virtual bookkeeper and Outsourced Contractor Bookkeeping Services offer flexible availability and can work as much or as little or the contractor needs; this can be especially beneficial for small contractors that do not need a full-time on-site bookkeeper or whose financial services needs fluctuate.

Save Yourself Some Grief

If you think you cannot afford Outsourced Contractor Bookkeeping Services you may be right. The question is can you afford not too? Many contractors have talked to us and felt that hiring a virtual bookkeeper would save money.

In the end they found that between having to explain how construction works, overpaying taxes, fines and penalties and having to pay extremely high interest on loans they contacted us and we welcomed them with open arms and got their situation back on track. Click on the button below to see for yourself

Need A Mentor? - Someone who has been were you want to go and can guide you. We would like to be that person for you. Fill out the form on the right or call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+