When You Hire A 1099 Contractor They May

Actually Be Your Unplanned Employee!

Having a contractor’s license is not proof enough you are a business versus an employee. If you hire a 1099 Contractor (Specialty or Trade Contractor), they just become your employee in the eyes of the tax agencies.

When you hire 1099 contractors, you need to know that their state contractor’s license, bond, and insurance are active. If you are doing construction work in Washington State You can start here https://fortress.wa.gov/lni/bbip/Search.aspx - mobile app is coming

When a being a licensed contractor is just not enough!

During audits state agencies are now looking to check about the bond and insurance. Anytime a contractor’s license is suspended the state may reclassify that person as an employee on your jobs.

Contractor's License Suspensions Are Computer Generated

-

Did you mail your renewal to the wrong mailing address?

-

Did you send your liability insurance payment in late?

-

Did you forget to renew your bond?

Suddenly just like any other employee you owe Worker’s Compensation, State and Federal Unemployment. Depending on your state’s (wage & hour law) that may not be a big deal and you may only incur nominal fines, penalties, and interest. Some states are more friendly and easier to work with than others. The common factor is they are all concerned about tax revenues and unlicensed construction contractors.

Ask Yourself These Questions Regarding Your Subcontractors

-

Are they bringing employees to the job?

-

Are they bringing heavy equipment?

-

Why do you if you are just going to 1099 them?

Because all fifty states are working with other agencies looking to be sure employee rights are covered and the state, local and federal payroll taxes are paid. As an employer among your responsibilities are these:

-

Pay workers’ compensation

-

Meet wage and hour requirements

-

Pay unemployment tax

-

Maintain a safe workplace

Washington State Labor & Industries has several definitions to decide whether or not the contractor you hire is really a contractor or an employee and here are a few:

-

Supervision Do they perform the work free of your direction and control?

-

Separate Business Do they offer services that are different from what you provide?

-

Do They Maintain and pay for a place of business that is separate from yours?

-

DO They Perform services in a location that is separate from your business or job sites?

-

Previously Established Business Do they have an established, independent business that existed before you hired?

-

Required Documentation May includes other customers or advertising.

-

IRS Taxes: When you entered into the contract, was this person responsible for filing a tax return with the IRS for his or her business?

-

Required registrations: Are they up-to-date on their required local, county, State, and Federal business registrations?

Ask your State's Department of Revenue if their business license is active. If they are a construction contractor, check their contractor registration or electrical contractor’s license. If they have employees check their workers’ compensation account and claim history. In Washington State, you can do it through The Department of Labor And Industries.

Do They Maintain A Useful Contractors Bookkeeping System: Do they maintain their own set of bookkeeping records dedicated to the expenses and earnings of their business? Note: If you plan to treat your worker/subcontractor as an independent, make sure you can prove they are. For your protection, you should always ask the person you are hiring to show you proof otherwise you could be liable for all of their employee taxes and all of the employer taxes plus fines and penalties.

Steps We Recommend For Construction Contractors Who Do Not Want To Have Employees.

-

Keep your business licenses and registrations up to date.

-

Washington State Licenses http://www.sos.wa.gov/corps/corps_search.aspx

-

Washington State Department of Revenue https://fortress.wa.gov/lni/bbip/Search.aspx -

-

Washington State Labor & Industries https://fortress.wa.gov/lni/bbip/Search.aspx

-

Washington State Resellers Permit saves money and increases cash flow: http://www.fasteasyaccounting.com/blog/?Tag=Resale+Certificate

Marketing To Prove you are actively engaged in acquiring new customers. Be Proactive and market your business. Join a Trade Organization, Chamber of Commerce, set up a Facebook page. Add your business listing to other social media sites and add your business contact to the bottom of your emails. You must have more than one customer to not be considered an employee.

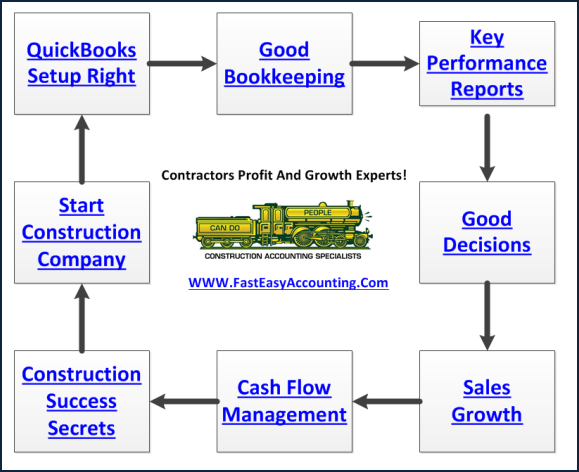

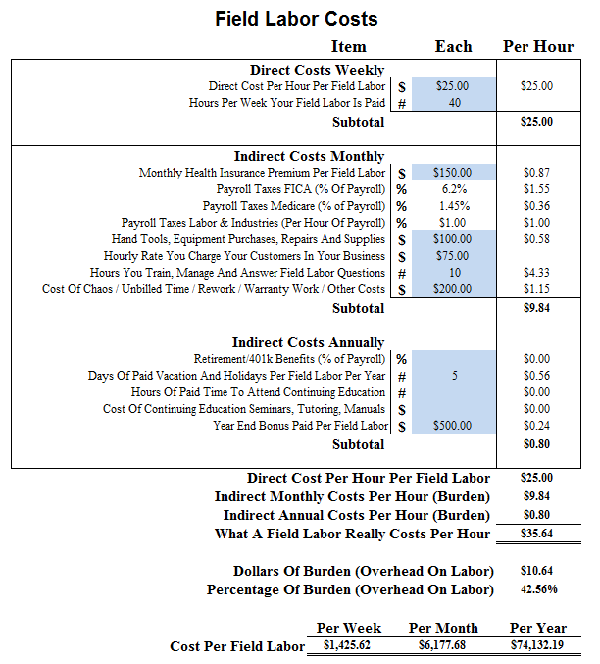

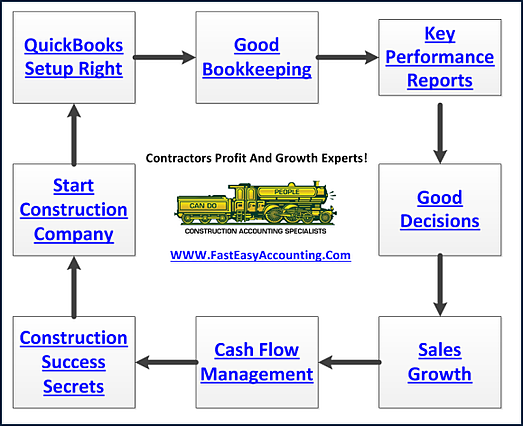

Maintain Contractors Bookkeeping System which means do they or someone else maintain their contractor's bookkeeping system dedicated to the expenses and earnings? Today more than ever, it is necessary to have a properly setup QuickBooks file and maintain it. Someone with the knowledge and training combined with an understanding of construction to perform a QuickBooks Set-Up for construction, Clean-Up, Tidy-Up and Update QuickBooks. Do you have 941 or Sales Tax Issues? If so we can help.

As The Contractor You Are The Most Important Employee http://www.fasteasyaccounting.com/blog/bid/168849/You-Are-The-Most-Important-Employee-In-Your-Construction-Company

Please Note: We work with the following company types: Sole Prop, Partnerships, LLC's and S-Corps. No matter which company structure you choose to be, we are here to support your contractors bookkeeping services needs. As Part Of Best Practices: It is in our Opinion the best company structure for active contractors is an S-Corp. Making "A Profit" and Having Real "Money Left Over" is how you are able to the things you want to do in life.

In Construction, having good bookkeeping is more than entering the receipts into QuickBooks For Contractors.

Starting where you are: We help “A Little” or “A Lot” depending on the individual needs. We take a shoebox, file box and all the receipts hidden under the seat, & turn them into useable data.

When we are done, your QuickBooks will create easy to understand year end reports for your tax preparer to complete the annual tax return.

We also provide on-going services - www.fasteasyaccounting.com/bookkeeping-services-more-detail/

Customized reports hold many answers to the WHO Questions – Who Owes Money To Whom? Who is your Best Customer? Is your #1 Favorite Customer adding / taking profits or cash flow?

What does that mean? We handle the paperwork, and you handle your money. We help with the details so that you can focus on the management tasks that only you can do. What should you do? Generate Estimates / Create Billings / Collect From Your Customers / Deposit The Money / Pay The Bills

Along the way – we help with item lists, detailed customer invoicing (pay apps) and job costing.

Summary: We work from the first dollar in on January 1st to the last dollar spent on December 31st and all of the transactions in between from Customer Invoices, The Bills Paid, Reconciling Bank Statements, Credit Card Statements and knowing what to look for on your Vendor Statements. Client access to QuickBooks is optional.

Thanks For Reading - The Next Step Let’s Chat! http://www.fasteasyaccounting.com/chat-with-sharie/

Looking forward to helping you...(even if it’s just listening) I can be reached at 206-361-3950 (9-6 PST)

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com