Practical Tax Season Tips For Construction Business Owners

Posted by Sharie DeHart on Fri, Jan 12, 2024

Topics: How To Lower Your Tax Bill, Save Money On Income Taxes, Sales Tax, Tax Accountants, Reduce Taxes, Taxes, Contractor Tips

Contractors Reflect On This Year's Results As The Last Quarter Begins

Going into the last Quarter of the year. Time for some basic reflection about taxes. Officers in S-Corps tend to take payroll later in the year. Now is the time if you have not already been taking payroll. Don't wait until it is time to prepare your Construction Company tax return.

Next review your Estimated personal Taxes paid to the IRS. How much did you pay in taxes for the current year? Internal Revenue expects that you have paid a percentage Federal Taxes before the end of the year.

Reviewing Federal Withholding for yourself and your employees to avoid surprises when your annual taxes are filed. Contractors who file as a Sole Prop or as an LLC fining as a Sole Prop tend to forget that payroll taxes on their net income is due. I call this “Chef’s Surprise” as it is based on Net Income. Everyone wants the last few jobs to pay before the end of the year.

Topics: Save Money On Income Taxes, Checklist For Income Tax Preparation

Your Income Tax Preparer - Is paid to fill out the tax forms and could not care less if you are paying too much in taxes because your QuickBooks file is a mess.

Sometimes They Will - Say something to you about how much easier it would be for them if your bookkeeping was in order and all the entries were in the right accounts where they belong.

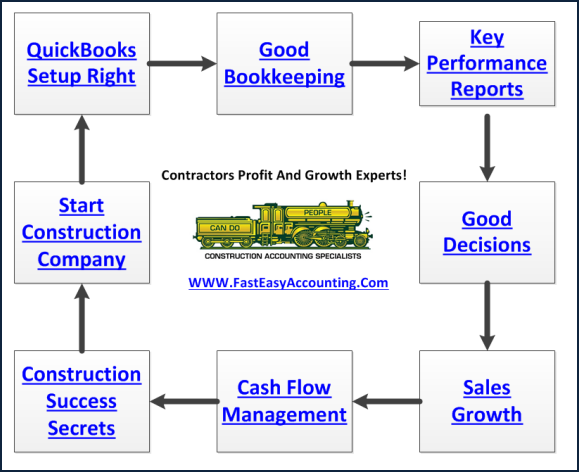

Topics: QuickBooks Tune-Up, Save Money On Income Taxes, QuickBooks For Contractors, QuickBooks, QuickBooks Clean-Up, QuickBooks For Contractors Setup