Why Getting The Leads And Doing The Work Are Still Not Good Enough

Posted by Sharie DeHart on Fri, Nov 26, 2021

Topics: Builders Bookkeeping Services, Accountant, Bookkeeping Services, Construction Accounting, Contractor, Contractor Tips, Contractor Operating Tips

Topics: Builders Bookkeeping Services, Accountant, Bookkeeping Services, Construction Accounting, Contractor, Contractor Tips, Contractor Operating Tips

How A Bookkeeper's Incompetence Can Ruin Your Construction Business

Posted by Sharie DeHart on Fri, Sep 17, 2021

Topics: Builders Bookkeeping Services, Accountant, Bookkeeping Services, Construction Accounting, Contractor, Contractor Tips, Contractor Operating Tips

Read More

Topics: Builders Bookkeeping Services, Accountant, Bookkeeping Services, Construction Accounting, Contractor, Contractor Tips, Contractor Operating Tips

Moreover, Construction Companies have unique bookkeeping needs. Some bookkeepers and bookkeeping systems may cost you more than they are worth in salary, fees, and loss profits because you cannot get QuickBooks reports and financial reports when you need them. Chances are, you are suffering from bookkeeping pain, and your bookkeeper or accountant is overwhelmed trying to figure out how to do construction accounting.

Good bookkeeping leads to informed decisions. Avoiding your bookkeeping is dangerous, however. For example, not knowing your construction company's financial situation can result in a series of missteps that could ultimately cost you your business.

Topics: Builders Bookkeeping Services, Accountant, Bookkeeping Services, Construction Accounting, Contractor, Contractor Tips, Contractor Operating Tips

Spec Home Builders Have Unique Bookkeeping Needs

-

Not Just Any Bookkeeper Will Do - Too often spec home builders hire a bookkeeper and end up with the wrong bookkeeper if they believe all bookkeepers are the same. Nothing is further from the truth. You would never hire a construction worker with a background as a handyman to be on your framing crew because they are trained to take their time, lay out tarps in the work area and think about every piece of lumber before cutting and installing it. They could do a fine job, the only question is how long would it take and would you be able to sell the house and make a profit?

-

QuickBooks Setup - And choosing the correct QuickBooks Version is the most critical part of all because it is the foundation upon which your entire financial system is built. Put the wrong foundation under your business and it will not matter who is doing the bookkeeping because it will always be a mess and you will never get the reports you really need in order to operate and grow your business profitably. Your Board of Advisors and especially your banker will be unhappy; however, they may not say it outright, just that your loans, lines of credit and referral opportunities may be limited.

-

Spec Home Builders - Need people trained in construction bookkeeping who understand how to put together a bank draw correctly, not someone with experience in regular bookkeeping. The difference between a Professional Bookkeeping Service and a Cheap Bookkeeper can cost you tens of thousands of dollars a year or more on your bottom line profit.

-

Spec Home Building - Is completely different from other construction accounting because the builder accumulates costs as assets until the HUD-1 statement is entered into QuickBooks. After the property is sold and closed the HUD-1 statement is entered into QuickBooks and that is the only time Cost of Goods Sold should ever appear as it relates to that house.

-

Professional Construction Accounting Firms - Have a Bookkeeping System to generate the same results every time. During construction there will be some expenses that should be properly allocated to Costs of Goods sold and some to Expenses and only a Skilled Professional Bookkeeping Service knows the difference.

-

Banks Sometimes Ask For - Updated Profit and Loss and Balance Sheet Reports in the middle of construction before releasing a big draw just to verify where the money is being spent and to make certain you have a firm grip on your business. It is critical that all the transactions are put in properly because if your financial reports show Cost of Goods Sold on houses under construction makes your banker think you may not be in control of your business. Perception is reality and you can "explain your situation to your banker" just know ahead of time it will fall on deaf ears because your banker has to justify every loan in their portfolio to their supervisor and a loan committee that don't know you and don't care one bit about you or "your situation".

-

I Have Seen Too Many - Spec builders lose money on a house under construction because the bank pulled the financing and demanded immediate payment on the outstanding loan balance due to shaky financial reports. Yelling at the Incompetent Bookkeeper made them feel better; however, the financial damage to them, their families and their businesses was catastrophic. All because they hired the wrong bookkeeper.

-

Many Bookkeepers Have Been Stumped - Trying to force QuickBooks to do the accounting for spec home building and I understand and empathize with their plight. We spent years and thousands of dollars developing a process that works with QuickBooks. And every year we continually innovate and add new features and benefits to it! We know what to do!

-

Spec Home Builders - Who also do some remodel work, buy houses for rental inventory and buy houses to fix up and sell, house flippers, create special problems for regular bookkeepers. There is only one method that works well and we have we have a system that allows all the bookkeeping to be done inside QuickBooks and it can save you time, manage cash flow and save money on taxes. We know what to do!

-

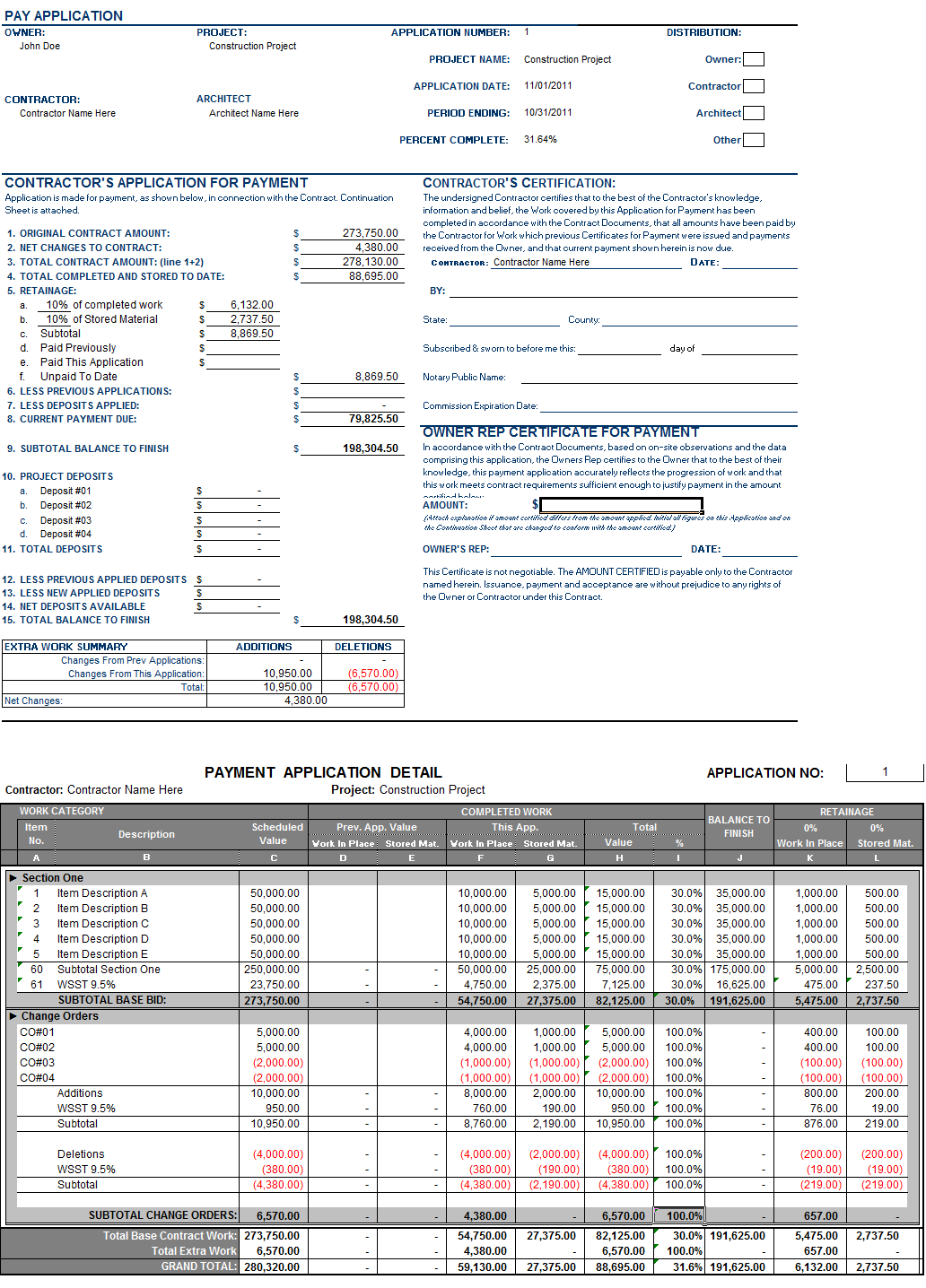

Complex Bank Draws - Using the lenders forms or ours with milestones, multiple deposits, payments, changes, payment history and running totals your bank inspector can follow is something we can prepare for you and send them to you as often as you need them.

What You Can Expect From Our Remodel Contractor Bookkeeping Services:

-

Professional Bookkeepers with over 10,000 hours of practice

-

Retention Tracking System

-

Optional scanner for sending paperwork to us with the touch of a button

-

Five Key Performance Indicator Reports for monitoring your business

-

Business Coaching - Someone who understands your business to talk with

-

Access to Meeting Space 24/7/365 - For training, meeting clients and vendors and quiet work place

-

Cloud based document storage

In The Long Run We Are Less Expensive Cheap Bookkeeper

And We Offer Cloud Based Desktop QuickBooks

-

Fully functioning QuickBooks desktop version

-

Export to Excel and Word which is part of the service

-

Print anything directly from QuickBooks, Word or Excel on your own printer

We Remove Spec Home Builder's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Topics: Bookkeeping Services For Spec Home Builders, Builders Bookkeeping Services