Washington State Department of Revenue is sending emails to all construction Contractors and other business owners

A new message regarding a change to the Department of Revenue's banking information is waiting in your Secure Messaging Inbox regarding your account.

To read the message, visit the WA State Department of Revenue website and login to My Account by clicking the link below.

https://fortress.wa.gov/dor/efile/MyAccount/SecureMail/

Subject: Important Change to the Electronic Funds Transfer Program

|

Why you are |

The Department of Revenue is changing financial institutions. On July 1, 2014, the Department's bank account will move from Bank of America to US Bank. |

|

What is |

You may see a change in the payment description on your bank statement. |

|

When payments |

In order for your payment to be timely, your return and payment must be submitted no later than 11:59 p.m. Pacific Time on the tax return due date. The payment effective date will default to the next business day after the return due date. |

|

Questions? |

For general information on the EFT program, please go to our website at http://dor.wa.gov/eft. If you have questions, you may also contact us at 1-877-345-3353 or (360) 902-7079. |

Many banks will process payments and then any pending deposits. This can cause some of your checks, debit payments and other payments to be returned and you could be charged a Non-Sufficient Funds (NSF) from your bank and possibly by the merchants that accepted the payment.

When you choose Electronic Funds Transfer (EFT) Debit Program just know the funds are immediately withdrawn from your bank account. It is nice that you can go online and see the payment posting immediately to your bank account if you have cash flow.

I recommend you choose e-check over (EFT) when paying your Washington State Department of Revenue Sales Tax Payment. The benefit of using an E-Check to pay Washington State Department of Revenue is they create an e-check and submits the payment request to your bank.

Tip: You can schedule your Sales Tax Payments. Just be certain you verify the date you want it to be submitted because it will default to due date of return.

We Can Prepare Your Sales Tax Returns

Contact sharie@fasteasyaccounting.com or 206-361-3950

Stop struggling with DOR Sales Tax Returns!

-

Are you behind on filing your construction company Washington state sales tax returns?

-

Are you getting Washington State Department of Revenue notices in the mail?

-

Are they calling you about your construction company unfiled sales tax returns?

-

Do you need a little help to get your construction company sales tax returns right?

-

Did you know Washington State Department of Revenue can levy fines and penalties for sales tax returns that have right information in the wrong boxes and the wrong information in the right boxes?

We can prepare your Payroll and Sales Tax returns

Contact sharie@fasteasyaccounting.com or 206-361-3950

Complete the form to watch the how-to video and instantly download the Washington State Business Tax Guide.

If you need help right away contact sharie@fasteasyaccounting.com or 206-361-3950

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

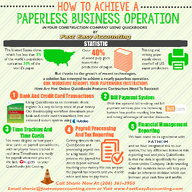

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/